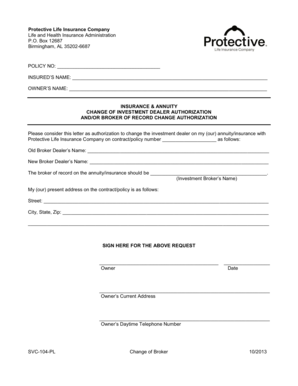

Protective Life Insurance Company Life and Health Form

What is the Protective Life Insurance Company Life And Health

The Protective Life Insurance Company specializes in life and health insurance products designed to provide financial security and peace of mind. Founded in 1907, this company offers various policies, including term life, whole life, and universal life insurance, as well as health-related products. Their offerings aim to meet the diverse needs of individuals and families, ensuring that they are protected against unforeseen circumstances. The company is known for its commitment to customer service and financial stability, making it a trusted choice for many Americans seeking insurance solutions.

How to use the Protective Life Insurance Company Life And Health

Using the Protective Life Insurance Company life and health products involves several straightforward steps. First, individuals should assess their insurance needs, considering factors such as family size, income, and long-term financial goals. Next, they can explore the various policies available through the company’s website or by contacting a licensed agent. After selecting a suitable policy, applicants will need to complete a life and health form, providing necessary personal information and health history. Once submitted, the company will review the application and provide feedback regarding coverage options and premiums.

Steps to complete the Protective Life Insurance Company Life And Health

Completing the Protective Life Insurance Company life and health form requires careful attention to detail. Here are the essential steps:

- Gather necessary documents, including identification and financial information.

- Visit the Protective Life Insurance Company website or contact an agent to access the form.

- Fill out the form thoroughly, ensuring all personal and health-related questions are answered accurately.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail, depending on your preference.

Legal use of the Protective Life Insurance Company Life And Health

The legal use of the Protective Life Insurance Company life and health form is governed by various regulations that ensure the validity of the application process. Electronic signatures are recognized under the ESIGN Act and UETA, allowing applicants to sign documents digitally. It is crucial for individuals to understand their rights and responsibilities when completing these forms, as inaccuracies or omissions can lead to delays or denial of coverage. Maintaining compliance with applicable laws helps protect both the applicant and the insurance provider.

Eligibility Criteria

Eligibility for policies offered by the Protective Life Insurance Company varies based on the type of insurance being sought. Generally, applicants must meet specific age requirements, provide accurate health information, and demonstrate insurable interest. For life insurance, individuals typically need to be between the ages of eighteen and seventy-five, while health insurance eligibility may depend on factors such as employment status and existing medical conditions. Understanding these criteria is essential for a successful application process.

Application Process & Approval Time

The application process for the Protective Life Insurance Company life and health products involves several stages. After submitting the completed form, the company will review the application, which may take anywhere from a few days to several weeks, depending on the complexity of the case. Factors influencing approval time include the thoroughness of the application, the need for additional medical information, and the volume of applications being processed. Keeping track of your application status can help ensure a smooth experience.

Quick guide on how to complete protective life insurance company life and health

Complete Protective Life Insurance Company Life And Health effortlessly on any device

Online document handling has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to acquire the necessary form and securely manage it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without interruptions. Manage Protective Life Insurance Company Life And Health on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to alter and eSign Protective Life Insurance Company Life And Health with ease

- Find Protective Life Insurance Company Life And Health and then click Get Form to initiate the process.

- Make use of the tools we provide to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Select how you want to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate the hassle of missing or lost files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Protective Life Insurance Company Life And Health and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the protective life insurance company life and health

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What types of life insurance products does Protective Life Insurance Company Life And Health offer?

Protective Life Insurance Company Life And Health provides a variety of life insurance products, including term life, whole life, and universal life insurance. Each product is designed to meet different financial needs and preferences, ensuring that customers find a suitable option. Their comprehensive offerings incorporate flexibility and various riders to enhance policy benefits, making them ideal for diverse consumer needs.

-

How does pricing work for Protective Life Insurance Company Life And Health's plans?

Pricing for Protective Life Insurance Company Life And Health's insurance plans varies based on several factors, including age, health status, and coverage amount. Customers can request quotes online for a personalized estimate that considers their specific circumstances. This allows for transparent pricing and ensures that customers understand the cost implications of their chosen policy.

-

What are the key benefits of choosing Protective Life Insurance Company Life And Health?

Choosing Protective Life Insurance Company Life And Health means opting for a reliable provider with a strong financial standing and a history of excellent customer service. Their policies often include features such as flexible payment options and customizable coverage to suit individual needs. These benefits ensure that customers have access to supportive services that can evolve with their life stages.

-

Can I integrate Protective Life Insurance Company Life And Health products with other financial services?

Yes, Protective Life Insurance Company Life And Health offers integration options with various financial services, making it easier for clients to manage their insurance alongside other investments. This connectivity helps streamline financial planning and management. Customers can consult with their financial advisors to identify the best integration strategies.

-

What is the claims process for Protective Life Insurance Company Life And Health?

The claims process at Protective Life Insurance Company Life And Health is straightforward and designed to provide support during difficult times. Customers can initiate claims online, where they can submit necessary documentation and receive status updates. The company emphasizes efficient processing to ensure families receive their benefits promptly.

-

Does Protective Life Insurance Company Life And Health offer any riders or additional features?

Yes, Protective Life Insurance Company Life And Health provides various riders that customers can add to their policies for enhanced protection. Common options include accidental death benefits, waiver of premium, and accelerated death benefits. These additional features tailor the insurance coverage to meet unique personal and family needs.

-

Are there any discounts available for Protective Life Insurance Company Life And Health policies?

Protective Life Insurance Company Life And Health offers discounts that may apply depending on the type of policy and individual circumstances. Customers can inquire about multi-policy discounts or favorable rates for healthy lifestyle habits during the application process. These potential savings can make essential coverage more affordable.

Get more for Protective Life Insurance Company Life And Health

- State of minnesota district court county of carver form

- Motion to enforce domestic orders order to show cause utah courts form

- Cdocuments and settingswegnermy documentsmedtronicco2wpd form

- Court formsunited states district court district of minnesota

- The client the contractor contract for painting services form

- Control number mo 14 09 form

- Business entity owner form

- Judgment of the full order of protection adult this missouri courts form

Find out other Protective Life Insurance Company Life And Health

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form