Sblc Lease Agreement Form

What is the SBLC Lease Agreement

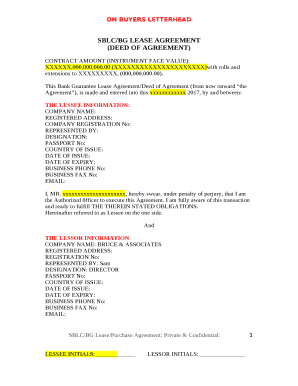

The SBLC lease agreement is a financial document that outlines the terms under which a Standby Letter of Credit (SBLC) is leased. This agreement serves as a guarantee from a bank or financial institution that a specified amount will be paid to a beneficiary if certain conditions are met. It is commonly used in various financial transactions, including trade finance and project financing, to provide assurance to parties involved in a deal.

The agreement typically includes details such as the duration of the lease, the fees associated with it, and the obligations of both the lessor and the lessee. Understanding the components of this agreement is crucial for businesses looking to leverage SBLCs for their financial needs.

How to Obtain the SBLC Lease Agreement

Obtaining an SBLC lease agreement involves several steps. First, businesses should identify a reputable financial institution or bank that offers SBLC leasing services. It is essential to conduct thorough research to find an institution that aligns with your specific needs and requirements.

Once a suitable bank is identified, the next step is to initiate contact and discuss the terms of the lease. This conversation will typically cover the purpose of the SBLC, the amount required, and the duration of the lease. After agreeing on the terms, the bank will provide the necessary documentation to formalize the agreement.

Steps to Complete the SBLC Lease Agreement

Completing an SBLC lease agreement involves several key steps to ensure that the document is filled out accurately and meets all legal requirements. Begin by carefully reviewing the agreement provided by the financial institution. Pay attention to details such as the amount of credit, the duration of the lease, and the parties involved.

Next, provide all required information, including your business details and the purpose of the SBLC. Make sure to include any additional documentation requested by the bank, such as financial statements or proof of identity. Once the form is completed, review it for accuracy before submitting it to the bank for processing.

Key Elements of the SBLC Lease Agreement

Understanding the key elements of the SBLC lease agreement is essential for ensuring compliance and protecting your interests. Important components include:

- Parties Involved: Clearly identify the lessor (the bank) and the lessee (the business leasing the SBLC).

- Amount: Specify the exact amount of the standby letter of credit being leased.

- Duration: Outline the lease period, including start and end dates.

- Fees and Charges: Detail any costs associated with the lease, including interest rates and service fees.

- Conditions for Activation: Define the circumstances under which the SBLC can be drawn upon by the beneficiary.

Legal Use of the SBLC Lease Agreement

The legal use of the SBLC lease agreement is governed by various regulations and laws that ensure its validity and enforceability. In the United States, it is crucial to comply with the Uniform Commercial Code (UCC), which provides a framework for commercial transactions, including letters of credit.

Additionally, the agreement must adhere to the specific requirements set forth by the issuing bank and any relevant state laws. Ensuring that the agreement is legally sound protects all parties involved and minimizes the risk of disputes in the future.

Examples of Using the SBLC Lease Agreement

SBLC lease agreements can be utilized in various scenarios, providing flexibility and security in financial transactions. Common examples include:

- International Trade: Businesses often use SBLCs to guarantee payment to suppliers in different countries, ensuring that transactions are secure.

- Real Estate Transactions: Developers may lease SBLCs to secure financing for construction projects, providing assurance to investors.

- Project Financing: Companies can leverage SBLCs to secure funding for large projects, demonstrating financial credibility to potential investors.

Quick guide on how to complete sblc lease agreement

Complete sblc lease agreement effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle lease sblc monetization on any platform using airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and electronically sign sblc monetization agreement pdf without hassle

- Locate lease sblc and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Select your preferred method to submit your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Edit and electronically sign leased sblc monetization and maintain excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to lease sblc monetization

Create this form in 5 minutes!

How to create an eSignature for the sblc monetization agreement pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask leased sblc monetization

-

What is a lease sblc and how can it benefit my business?

A lease sblc, or Standby Letter of Credit, is a financial instrument that can provide assurance to your vendors that payments will be made. By utilizing a lease sblc, businesses can enhance their credibility and secure better terms from suppliers. This service helps in strengthening business relationships while minimizing risks.

-

How much does a lease sblc cost?

The cost of a lease sblc varies depending on the financial institution and the specific terms of the lease. Generally, banks charge a percentage of the total credit amount as a fee. It’s advisable to compare different providers to find the most cost-effective lease sblc that suits your business needs.

-

What features should I look for in a lease sblc provider?

When choosing a lease sblc provider, look for features such as flexibility in terms, quick processing times, and strong customer support. Additionally, consider providers that offer transparent fee structures and reliable online management tools. These features can enhance your experience and efficiency with a lease sblc.

-

Are there any risks associated with using a lease sblc?

While a lease sblc can provide signNow benefits, there are associated risks such as fees and potential restrictions set by the provider. It's important to thoroughly review the terms and conditions before entering into a lease sblc agreement. Consulting with a financial advisor can also help mitigate these risks.

-

Can I use a lease sblc for different types of transactions?

Yes, a lease sblc can be utilized for various transactions, including imports, exports, and real estate leases. This flexibility allows businesses to leverage the lease sblc in many scenarios, providing financial security across diverse operations. Always ensure that the terms meet your specific transactional needs.

-

How does airSlate SignNow streamline the process of obtaining a lease sblc?

airSlate SignNow simplifies the process of managing documentation required for obtaining a lease sblc by enabling you to easily eSign and send necessary forms. This user-friendly system reduces delays and ensures that your requests are processed more efficiently. The platform's integration capabilities further enhance operational workflow.

-

What industries commonly use lease sblc?

Various industries utilize lease sblc, including real estate, manufacturing, and international trade. Businesses within these sectors benefit from the assurance provided by a lease sblc when entering into contracts. This financial tool is particularly essential for companies looking to strengthen their market position.

Get more for sblc lease agreement

Find out other sblc lease

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy