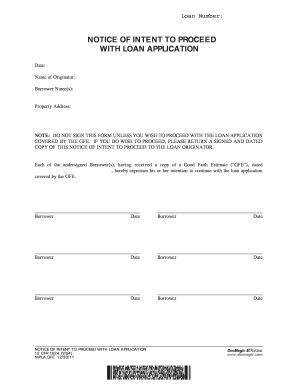

Intent to Proceed Letter Form

What is the Intent to Proceed Letter?

The Intent to Proceed Letter is a formal document that indicates a borrower's intention to move forward with a mortgage application after receiving a loan estimate from a lender. This letter serves as a crucial step in the mortgage process, signaling to the lender that the borrower is ready to proceed with the loan under the terms outlined in the loan estimate. It is important for both parties as it establishes a mutual understanding of the loan terms and conditions, helping to streamline the application process.

Key Elements of the Intent to Proceed Letter

When drafting an Intent to Proceed Letter, several key elements should be included to ensure clarity and compliance. These elements typically consist of:

- Borrower's Information: Full name, address, and contact details of the borrower.

- Lender's Information: Name and contact details of the lender or mortgage broker.

- Loan Details: Specifics about the loan, including the loan amount, interest rate, and any pertinent terms.

- Signature: The borrower's signature, which confirms their intent to proceed with the loan application.

- Date: The date on which the letter is signed, marking the official start of the loan process.

Steps to Complete the Intent to Proceed Letter

Completing the Intent to Proceed Letter involves several straightforward steps. Here’s a simple guide to assist borrowers:

- Review the Loan Estimate: Carefully examine the loan estimate provided by the lender to understand the terms and conditions.

- Gather Information: Collect all necessary personal and loan-related information required for the letter.

- Draft the Letter: Use a clear and professional format to draft the letter, ensuring all key elements are included.

- Sign the Document: Add your signature to the letter to indicate your intent to proceed.

- Submit the Letter: Send the completed letter to the lender through the preferred submission method, whether electronically or via mail.

Legal Use of the Intent to Proceed Letter

The Intent to Proceed Letter is legally significant in the mortgage process. It not only signifies the borrower's commitment to the loan application but also helps protect both parties by outlining expectations. For the letter to be legally binding, it must comply with relevant regulations, including the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA). Ensuring that the letter is properly executed and submitted can prevent misunderstandings and potential legal issues later in the process.

How to Obtain the Intent to Proceed Letter

Obtaining the Intent to Proceed Letter is typically a straightforward process. Borrowers can request this letter directly from their lender or mortgage broker. Many lenders provide templates or forms that can be easily filled out. Additionally, borrowers can create their own letter by following the key elements and structure outlined previously. It is essential to ensure that the letter meets the lender's requirements and includes all necessary information.

Examples of Using the Intent to Proceed Letter

Examples of the Intent to Proceed Letter can vary based on the lender's requirements and the specific details of the mortgage application. A typical example would include the borrower's intent to proceed with a conventional loan, outlining the loan amount and interest rate. Another example could be a borrower indicating their intent to proceed with a government-backed loan, such as an FHA or VA loan. Each example should reflect the unique circumstances of the borrower's situation while adhering to the standard format and key elements.

Quick guide on how to complete intent to proceed letter

Prepare Intent To Proceed Letter effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and safely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage Intent To Proceed Letter on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Intent To Proceed Letter effortlessly

- Obtain Intent To Proceed Letter and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Intent To Proceed Letter to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the intent to proceed letter

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a sample letter of intent for mortgage loan?

A sample letter of intent for mortgage loan is a document that outlines your intention to apply for a mortgage. It typically includes your personal information, the terms you wish to propose, and the context of your financial situation. Using a template can help ensure that all necessary details are included, making it easier for lenders to process your application.

-

How do I create a sample letter of intent for mortgage loan using airSlate SignNow?

Creating a sample letter of intent for mortgage loan with airSlate SignNow is simple. Start by selecting a template that fits your needs, customize the fields with your information, and then add your eSignature. This process streamlines your document preparation, making it quick and efficient.

-

Is there a cost associated with using airSlate SignNow to prepare my sample letter of intent for mortgage loan?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Pricing typically includes features like eSigning, document storage, and access to templates. Check our website for the latest pricing details and choose a plan that works for you.

-

What features does airSlate SignNow offer for managing my sample letter of intent for mortgage loan?

airSlate SignNow provides robust features for managing your sample letter of intent for mortgage loan. These include eSigning, custom templates, real-time tracking, and secure document storage. Such features ensure that your documents are handled efficiently and securely.

-

What are the benefits of using airSlate SignNow for my sample letter of intent for mortgage loan?

Using airSlate SignNow for your sample letter of intent for mortgage loan offers several benefits. It enhances the speed of document processing, reduces paperwork, and provides an easy-to-use platform that supports anytime, anywhere access. This efficiency helps you focus on securing your mortgage.

-

Can I integrate airSlate SignNow with other tools for managing my mortgage application?

Yes, airSlate SignNow offers integrations with a variety of tools and platforms, which can enhance your mortgage application process. Integration options include CRM systems and email platforms, allowing you to streamline workflows and keep track of your sample letter of intent for mortgage loan seamlessly.

-

Is my data safe when using airSlate SignNow for my sample letter of intent for mortgage loan?

Absolutely. airSlate SignNow prioritizes data security and complies with industry-standard security measures. Your sample letter of intent for mortgage loan is protected through encryption, secure storage, and access controls, ensuring your information is safe throughout the process.

Get more for Intent To Proceed Letter

- Notice of landlord to tenant for nonresidential or form

- Real estate law unit fifteen landlord tenant law form

- Percent per annum from the date hereof until paid payable as follows form

- Facilities use agreement congresodesantidadorg form

- Landlordlessor or authorized agent form

- In hisher capacity as form

- Specific lease provision notice page 1 form

- By posting prominently on the front door of the leased premises form

Find out other Intent To Proceed Letter

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast