Mo Form 5060

What is the Mo Form 5060

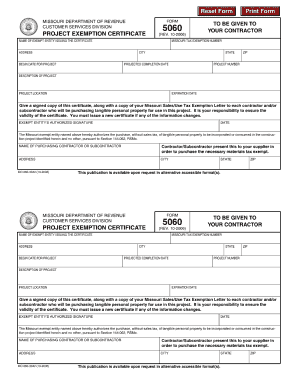

The Missouri Form 5060 is a tax-exempt certificate used by organizations to claim exemption from sales tax in the state of Missouri. This form is essential for qualifying entities, such as non-profits, educational institutions, and government bodies, allowing them to make purchases without incurring sales tax. The form must be presented to vendors at the time of purchase to validate the tax-exempt status of the organization.

How to use the Mo Form 5060

To use the Missouri Form 5060 effectively, organizations must complete the form accurately and provide it to vendors during transactions. The form requires specific details, including the name of the organization, address, and the reason for claiming tax exemption. It is important to ensure that the information is current and matches the organization's records to prevent any issues during purchases.

Steps to complete the Mo Form 5060

Completing the Missouri Form 5060 involves several straightforward steps:

- Obtain the form from the Missouri Department of Revenue or authorized sources.

- Fill in the organization’s name, address, and contact information.

- Specify the type of organization and provide the reason for tax exemption.

- Sign and date the form to certify that the information provided is accurate.

- Present the completed form to vendors at the time of purchase.

Legal use of the Mo Form 5060

The Missouri Form 5060 is legally binding when completed correctly and used in accordance with state laws. Organizations must ensure they meet the eligibility criteria for tax exemption and use the form solely for qualifying purchases. Misuse of the form can lead to penalties, including back taxes owed and potential fines, so it is crucial to adhere to the guidelines set forth by the Missouri Department of Revenue.

Key elements of the Mo Form 5060

Several key elements must be included in the Missouri Form 5060 to ensure its validity:

- Organization Name: The legal name of the entity claiming exemption.

- Address: The physical address of the organization.

- Type of Organization: Classification of the entity (e.g., non-profit, government).

- Reason for Exemption: A clear explanation of why the organization qualifies for tax exemption.

- Signature: An authorized representative must sign the form to certify its accuracy.

Form Submission Methods

The Missouri Form 5060 can be submitted in various ways, depending on the vendor's requirements. Organizations typically present the completed form directly to vendors during purchases. Some vendors may accept electronic copies, while others may require a physical document. It is advisable to check with individual vendors regarding their preferred submission method to ensure compliance.

Quick guide on how to complete mo form 5060

Complete Mo Form 5060 seamlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Handle Mo Form 5060 on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

How to modify and electronically sign Mo Form 5060 effortlessly

- Obtain Mo Form 5060 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to share your form, via email, text message (SMS), or link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device of your choice. Modify and electronically sign Mo Form 5060 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mo form 5060

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 5060 and how can I use it with airSlate SignNow?

Form 5060 is a crucial document that can be easily managed and signed using airSlate SignNow. Our platform enables you to upload, edit, and securely eSign form 5060, ensuring compliance and efficiency in your operations.

-

Is airSlate SignNow compliant with regulations for form 5060?

Yes, airSlate SignNow is compliant with relevant regulations for form 5060, ensuring your documents meet legal standards. Our eSigning solution incorporates advanced security features that protect your data and maintain compliance.

-

What are the pricing options for using airSlate SignNow with form 5060?

airSlate SignNow offers flexible pricing plans tailored to your business needs for managing form 5060. We provide various subscription options, allowing you to choose a plan that fits your budget and volume of document handling.

-

What features does airSlate SignNow offer for managing form 5060?

Our platform provides essential features for managing form 5060, including customizable templates, automated workflows, and real-time tracking of eSignatures. These tools enhance productivity and streamline your document management process.

-

Can I integrate airSlate SignNow with other applications for form 5060?

Yes, airSlate SignNow seamlessly integrates with various applications, making it easy to manage form 5060 alongside your existing workflows. You can connect with CRM systems, cloud storage, and more, ensuring a cohesive experience.

-

What are the benefits of using airSlate SignNow for form 5060?

Using airSlate SignNow for form 5060 offers numerous benefits, including increased efficiency, reduced turnaround times, and enhanced document security. Our user-friendly interface ensures that both you and your clients can easily navigate the signing process.

-

How secure is my data when signing form 5060 with airSlate SignNow?

Data security is a top priority at airSlate SignNow. We employ robust encryption and multi-factor authentication to protect your information when signing form 5060, ensuring that your documents remain confidential.

Get more for Mo Form 5060

- Arizona order to attend parental education classes form

- Maricopa county self help divorce flow chart fill online form

- Maintenance feescharges decorating and repair charges advertisements form

- Personal guaranty of residential lease agreement form

- Your neighbors have complained to landlord about your form

- Apartment rulesus legal forms

- This agreement shall be governed and construed in accordance with applicable law form

- Your new address will be form

Find out other Mo Form 5060

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online