C101 Form

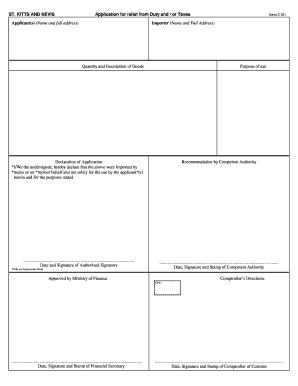

What is the C101 Form

The C101 form, also known as the C101 customs form, is a crucial document used in the United States for the declaration of goods being imported or exported. This form is essential for customs clearance and helps ensure compliance with federal regulations. It provides detailed information about the nature of the goods, their value, and the intended use, allowing customs officials to assess duties and taxes accurately.

How to Use the C101 Form

Using the C101 form involves several steps to ensure proper completion and submission. First, gather all necessary information about the goods being imported or exported, including descriptions, quantities, and values. Next, fill out the form accurately, ensuring that all fields are completed to avoid delays. Once completed, the form should be submitted to the appropriate customs authority along with any required supporting documents. It is advisable to keep a copy of the submitted form for your records.

Steps to Complete the C101 Form

Completing the C101 form requires attention to detail. Follow these steps:

- Obtain the latest version of the C101 form from the appropriate customs authority.

- Fill in your personal information, including name, address, and contact details.

- Provide detailed descriptions of the goods, including their quantity, value, and country of origin.

- Indicate the purpose of the import or export, such as personal use or commercial sale.

- Review the form for accuracy and completeness before submission.

Legal Use of the C101 Form

The C101 form is legally binding when completed and submitted in accordance with U.S. customs regulations. It is essential to provide truthful and accurate information, as any discrepancies can lead to penalties or delays in processing. Compliance with relevant laws, such as the Tariff Act and customs regulations, is crucial for the legal use of this form.

Key Elements of the C101 Form

Several key elements must be included in the C101 form to ensure its validity:

- Importer/Exporter Information: Name, address, and contact details.

- Description of Goods: Detailed information about the items being imported or exported.

- Value Declaration: The monetary value of the goods, which is essential for duty assessment.

- Country of Origin: Where the goods are manufactured or produced.

- Intended Use: Explanation of how the goods will be used once imported or exported.

Form Submission Methods

The C101 form can be submitted through various methods, depending on the customs authority's requirements. Common submission methods include:

- Online Submission: Many customs authorities allow electronic submission of the C101 form through their websites.

- Mail: The form can be printed and sent via postal service to the designated customs office.

- In-Person: Some individuals may choose to submit the form directly at a customs office.

Quick guide on how to complete c101 form

Finalize C101 Form effortlessly on any device

Online document management has become prevalent among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without delays. Manage C101 Form on any platform using airSlate SignNow Android or iOS applications and simplify any document-centric task today.

The easiest way to modify and eSign C101 Form without hassle

- Locate C101 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that necessitate reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign C101 Form and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the c101 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the c101 form and why is it important?

The c101 form is a crucial document used for various business transactions and agreements. Understanding its significance helps streamline workflows and ensure compliance in documentation. With airSlate SignNow, you can easily create, send, and eSign c101 forms, enhancing your efficiency.

-

How does airSlate SignNow facilitate the eSigning of a c101 form?

airSlate SignNow allows users to electronically sign the c101 form securely and conveniently. The platform provides a user-friendly interface that guides you through the signing process, ensuring that your documents are executed quickly and legally accepted. This simplifies your document management signNowly.

-

What are the pricing options for using airSlate SignNow for c101 form management?

airSlate SignNow offers various pricing plans designed to fit different business needs, including options for managing c101 forms efficiently. Each plan provides access to essential features that facilitate document signing and management. You can choose a plan that best matches your usage frequency and budget.

-

Can I integrate airSlate SignNow with other software for c101 form processing?

Yes, airSlate SignNow offers a range of integrations with popular software tools which can streamline your c101 form processing. These integrations help automate workflows by connecting with CRM systems, project management tools, and more. This enhances collaboration and ensures that your documents are managed seamlessly.

-

What features does airSlate SignNow include for managing the c101 form?

The platform includes features like customizable templates, advanced authentication, and audit trails for c101 forms. These tools ensure that your documents remain secure and compliant while allowing for easy tracking of changes and signatures. Utilizing these features enhances the overall document management experience.

-

Are there any benefits to using airSlate SignNow for electronic c101 forms over traditional methods?

Using airSlate SignNow for electronic c101 forms offers signNow advantages over traditional methods, such as faster turnaround times and reduced paper waste. The electronic process is more efficient and allows for real-time updates, ensuring that all stakeholders can view the current version of the document. This keeps everyone on the same page and speeds up decision-making.

-

Is it secure to use airSlate SignNow for sensitive c101 form documents?

Absolutely, airSlate SignNow prioritizes security and employs advanced encryption to protect your sensitive c101 form documents. Additionally, features like secure access controls and comprehensive audit reports ensure that your documents remain confidential and tamper-proof. You can confidently manage important business documents with peace of mind.

Get more for C101 Form

- Fillable online jsunaa attendee information school

- Public works california department of industrial relations form

- Free dwc ca form 10214 a reset form findformscom

- Internal use only united states court of appeals for the form

- Name address of party or attorney us legal forms

- California attorneys fees cases retainer agreements form

- Complaint for rescission form

- Attorney or party without attorney nicolaserosdefiori form

Find out other C101 Form

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation