Ohio Stec B Form

What is the Ohio Stec B

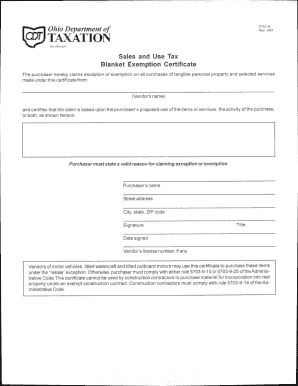

The Ohio Stec B form is a specific document used for tax purposes within the state of Ohio. It is primarily utilized by businesses and individuals to report certain financial information to the state tax authorities. This form is essential for compliance with Ohio tax regulations and helps ensure that taxpayers fulfill their obligations accurately and timely.

How to use the Ohio Stec B

Using the Ohio Stec B form involves several key steps. First, gather all necessary financial documents that pertain to the reporting period. This may include income statements, expense reports, and any relevant tax documents. Next, fill out the form accurately, ensuring that all information is complete and correct. After completing the form, review it for any errors before submission. Finally, submit the form according to the specified methods, whether online, by mail, or in person.

Steps to complete the Ohio Stec B

Completing the Ohio Stec B form requires a systematic approach:

- Gather required financial documents, including previous tax returns and supporting documentation.

- Access the Ohio Stec B form through the appropriate state tax website or office.

- Fill in the form with accurate information, ensuring all fields are completed.

- Double-check all entries for accuracy, including calculations and personal information.

- Submit the form using the preferred method, ensuring it is sent before the deadline.

Legal use of the Ohio Stec B

The legal use of the Ohio Stec B form is governed by state tax laws. To ensure that the form is legally valid, it must be filled out accurately and submitted on time. Compliance with all relevant tax regulations is crucial. Additionally, e-signatures are recognized under U.S. law, making electronic submission a viable option, provided that the necessary legal standards are met.

Key elements of the Ohio Stec B

Key elements of the Ohio Stec B form include:

- Taxpayer identification information, such as name and address.

- Details regarding income sources and amounts.

- Deduction and credit claims relevant to the reporting period.

- Signature and date fields to confirm the accuracy of the information provided.

Form Submission Methods

The Ohio Stec B form can be submitted through various methods to accommodate different preferences:

- Online: Many taxpayers choose to submit electronically through the Ohio Department of Taxation's website.

- Mail: The form can be printed and mailed to the appropriate tax office.

- In-Person: Taxpayers may also deliver the form directly to local tax offices.

Quick guide on how to complete ohio stec b

Complete Ohio Stec B seamlessly on any device

Online document management has grown in popularity among businesses and individuals. It offers a superb eco-friendly substitute for traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents swiftly without interruptions. Handle Ohio Stec B on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Ohio Stec B effortlessly

- Find Ohio Stec B and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional ink signature.

- Verify the details and click on the Done button to store your modifications.

- Choose how you want to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tiresome form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Ohio Stec B and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ohio stec b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a stec b form?

A stec b form is a specific document used for various business transactions that require a signature. With airSlate SignNow, you can easily create, send, and eSign the stec b form, ensuring a streamlined workflow without the hassle of paperwork.

-

How does airSlate SignNow help with the stec b form?

AirSlate SignNow offers an intuitive platform that allows users to manage their stec b form efficiently. You can customize the template, add signers, and track the progress of the document in real time, making it simple to maintain organization and compliance.

-

Is there a cost associated with using airSlate SignNow for the stec b form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan that fits your budget and enjoy the convenience of managing your stec b form and other documents without unexpected costs.

-

What features does airSlate SignNow provide for the stec b form?

AirSlate SignNow comes with several features designed to enhance your experience with the stec b form. Features include customizable templates, automated reminders, secure storage, and integration with other software tools to streamline your document management.

-

Can I integrate airSlate SignNow with other applications for the stec b form?

Absolutely! AirSlate SignNow offers integrations with various applications such as CRM systems, cloud storage, and productivity tools. This allows you to seamlessly manage your stec b form alongside other business processes.

-

What are the benefits of using airSlate SignNow for the stec b form?

Using airSlate SignNow for the stec b form simplifies the signing process, increases operational efficiency, and reduces turnaround time. With its user-friendly interface and robust security measures, you can trust that your documents are handled safely and efficiently.

-

How secure is airSlate SignNow when handling the stec b form?

AirSlate SignNow prioritizes security, implementing robust encryption and authentication protocols to protect your stec b form. You can rest assured that your documents are safeguarded against unauthorized access while in transit and at rest.

Get more for Ohio Stec B

- Severe physical abuse child under five300e form

- Caused another childs death through form

- Juvenile california judicial council forms california legal

- Jv 133 recommendation regarding ability to repay cost of legal services judicial council forms

- Jv 134 response to recommendation regarding ability to repay cost oflegal services judicial council forms

- Jv 136 jv 136 juvenile dependencycost of appointed counsel judicial council forms

- Jv 140 notification of mailing address california courts form

- Supplemental petition for more restrictive placement attachment form

Find out other Ohio Stec B

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT