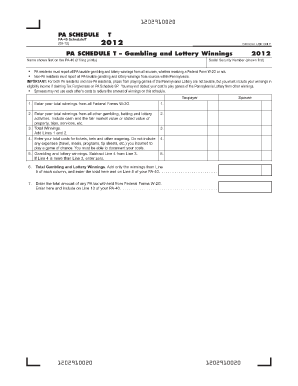

Pa Schedule T Form

What is the Pa Schedule T Form

The Pa Schedule T Form is a tax document used by residents of Pennsylvania to report certain types of income. This form is specifically designed for taxpayers who need to declare income from various sources, including but not limited to, business income, rental income, and other earnings that may not be reported on standard tax forms. Understanding the purpose of the Pa Schedule T Form is essential for accurate tax reporting and compliance with state tax laws.

How to use the Pa Schedule T Form

Using the Pa Schedule T Form involves several steps to ensure proper completion and submission. Taxpayers must first gather all necessary financial documents that detail their income sources. Once the required information is collected, individuals can fill out the form by entering their income figures in the appropriate sections. It is important to review the form for accuracy before submission to avoid potential penalties or delays in processing.

Steps to complete the Pa Schedule T Form

Completing the Pa Schedule T Form requires a systematic approach. Here are the steps to follow:

- Gather all relevant financial documents, including income statements and receipts.

- Download the Pa Schedule T Form from the Pennsylvania Department of Revenue website.

- Fill out the form by entering your income details in the designated fields.

- Double-check all entries for accuracy and completeness.

- Sign and date the form to validate your submission.

- Submit the form either electronically or by mail, depending on your preference.

Legal use of the Pa Schedule T Form

The legal use of the Pa Schedule T Form is governed by Pennsylvania tax laws. This form must be filled out accurately to reflect all applicable income, as misreporting can lead to legal repercussions. It is crucial to adhere to the guidelines set forth by the Pennsylvania Department of Revenue to ensure that the form is recognized as valid during audits or reviews.

Filing Deadlines / Important Dates

Filing deadlines for the Pa Schedule T Form are critical for compliance. Typically, the form must be submitted by April 15 of the tax year, aligning with federal tax deadlines. However, taxpayers should verify specific dates each year, as changes in legislation or state policies may affect filing timelines. Staying informed about these deadlines helps avoid penalties and ensures timely processing of tax returns.

Examples of using the Pa Schedule T Form

There are various scenarios in which the Pa Schedule T Form may be utilized. For instance, a self-employed individual reporting income from freelance work would need to complete this form to accurately declare their earnings. Additionally, a landlord receiving rental income must also use the Pa Schedule T Form to report that income. Each situation requires careful documentation to support the reported figures, ensuring compliance with tax regulations.

Quick guide on how to complete pa schedule t form

Prepare Pa Schedule T Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents promptly without interruption. Manage Pa Schedule T Form on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Pa Schedule T Form seamlessly

- Find Pa Schedule T Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate reprinting new copies of documents. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choosing. Modify and eSign Pa Schedule T Form to ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa schedule t form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Pa Schedule T Form?

The Pa Schedule T Form is a specific tax form used by individuals and businesses in Pennsylvania to report certain types of income and expenses. It is crucial for accurate tax reporting and can affect your overall tax liability. Understanding the Pa Schedule T Form helps ensure compliance with state tax regulations.

-

How can airSlate SignNow assist with the Pa Schedule T Form?

airSlate SignNow provides an efficient platform for electronically signing and sending documents, including the Pa Schedule T Form. With our easy-to-use interface, you can quickly prepare your tax documents, ensuring they are signed and sent securely. This streamlines your tax filing process, saving you time and effort.

-

Is airSlate SignNow a cost-effective solution for managing the Pa Schedule T Form?

Yes, airSlate SignNow offers a cost-effective solution for managing the Pa Schedule T Form. Our pricing plans are designed to accommodate various business sizes and needs, ensuring you get the best value for your money. By using our service, you can minimize costs associated with paper documentation and manual signatures.

-

What features does airSlate SignNow offer for the Pa Schedule T Form?

airSlate SignNow includes features such as templates, customizable fields, and an intuitive dashboard for managing documents like the Pa Schedule T Form. The platform allows you to set signing orders and reminders to keep your tax filing organized. Additionally, real-time tracking provides updates on the status of your documents.

-

Are there any integrations available for the Pa Schedule T Form in airSlate SignNow?

AirSlate SignNow integrates seamlessly with various third-party applications, enhancing your experience with the Pa Schedule T Form. These integrations streamline workflows by connecting with CRMs, cloud storage solutions, and other productivity tools. This interconnectedness allows for efficient management of all your documents.

-

How secure is airSlate SignNow when dealing with the Pa Schedule T Form?

AirSlate SignNow prioritizes your security and privacy when handling the Pa Schedule T Form. Our platform uses advanced encryption methods and complies with industry standards to protect your sensitive information. You can trust that your documents remain confidential and secure throughout the signing process.

-

Can I track the status of my Pa Schedule T Form with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your Pa Schedule T Form in real-time. You will receive notifications when your document is viewed, signed, or completed, helping you stay informed throughout the process. This feature adds transparency and accountability to your document management.

Get more for Pa Schedule T Form

Find out other Pa Schedule T Form

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF