Fill the Form of Distribution

What is the Fill The Form Of Distribution

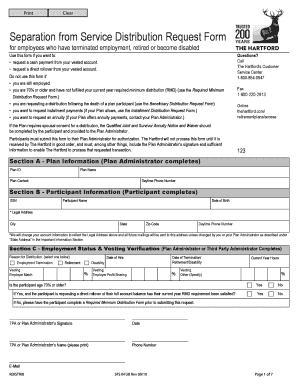

The Fill The Form Of Distribution is a crucial document used primarily in the context of distributing assets or income among beneficiaries or shareholders. This form is essential for ensuring that the distribution process is conducted legally and transparently. It typically outlines the specifics of the distribution, including the amounts allocated to each party and the method of distribution. Understanding this form is vital for individuals and businesses alike, as it helps maintain compliance with relevant laws and regulations.

Steps to complete the Fill The Form Of Distribution

Completing the Fill The Form Of Distribution involves several key steps to ensure accuracy and compliance. First, gather all necessary information about the beneficiaries or shareholders, including their names, addresses, and tax identification numbers. Next, clearly outline the distribution amounts for each party. It is important to ensure that the total distribution matches the total assets or income being distributed. After filling out the form, review it for any errors or omissions. Finally, ensure that all parties involved sign the form, as their signatures are often required for legal validation.

Legal use of the Fill The Form Of Distribution

The legal use of the Fill The Form Of Distribution is governed by various regulations that ensure its validity. In the United States, it is essential to comply with federal and state laws regarding asset distribution. This includes adhering to tax regulations and ensuring that the form is filled out accurately to avoid any legal disputes. Using a reliable digital tool, such as signNow, can help ensure that the form is completed and signed in accordance with the law, providing a secure and legally binding document.

Key elements of the Fill The Form Of Distribution

Several key elements must be included in the Fill The Form Of Distribution to ensure its effectiveness. These elements typically include:

- Beneficiary Information: Names and contact details of all beneficiaries or shareholders.

- Distribution Amounts: Specific amounts allocated to each beneficiary.

- Method of Distribution: Details on how the distribution will be carried out (e.g., cash, assets).

- Signatures: Required signatures from all parties involved to validate the form.

Form Submission Methods

The Fill The Form Of Distribution can be submitted through various methods, depending on the requirements of the issuing authority. Common submission methods include:

- Online Submission: Many organizations allow for digital submission through secure online portals.

- Mail: The form can also be printed and mailed to the relevant authority.

- In-Person: Some may prefer to submit the form in person at designated offices.

Examples of using the Fill The Form Of Distribution

There are various scenarios in which the Fill The Form Of Distribution is utilized. For instance, in estate planning, this form is often used to distribute assets among heirs following the death of an individual. In a business context, it may be used to allocate profits among shareholders after a successful fiscal year. Understanding these examples can help individuals and businesses navigate the distribution process more effectively.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the use of the Fill The Form Of Distribution, particularly in relation to tax implications. It is essential to ensure that all distributions are reported correctly to avoid penalties. The IRS requires that any income distributed to beneficiaries is reported on their tax returns. Familiarizing oneself with these guidelines can help ensure compliance and prevent any tax-related issues.

Quick guide on how to complete fill the form of distribution

Complete Fill The Form Of Distribution effortlessly on any device

Managing documents online has become increasingly favored by companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to locate the right form and secure it online safely. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without any hold-ups. Handle Fill The Form Of Distribution on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to adjust and eSign Fill The Form Of Distribution without hassle

- Obtain Fill The Form Of Distribution and then click Get Form to get started.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes moments and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks on any device of your choice. Modify and eSign Fill The Form Of Distribution and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fill the form of distribution

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to fill the form of distribution using airSlate SignNow?

To fill the form of distribution, simply log into your airSlate SignNow account, select the document you'd like to edit, and use our intuitive interface to fill in the necessary fields. Once you've filled the form of distribution, you can share it with your recipients for eSignature. This streamlined process saves time and reduces errors.

-

Are there any costs associated with filling the form of distribution?

airSlate SignNow offers various pricing plans tailored to different business needs, ensuring that filling the form of distribution remains cost-effective. You can choose from monthly or annual subscriptions, with options for additional features as needed. Explore our pricing page for detailed information to find a plan that suits your requirements.

-

What features are included when I fill the form of distribution?

When you fill the form of distribution with airSlate SignNow, you gain access to features like customizable templates, advanced field editing, and real-time status tracking. Additionally, our tools allow for easy collaboration with team members, making document management efficient. These features enhance your overall experience while filling and sending forms.

-

How can filling the form of distribution improve my business processes?

Filling the form of distribution can signNowly enhance your business processes by automating document workflows, thereby reducing turnaround time. airSlate SignNow empowers you to easily manage and track forms, increasing productivity and ensuring timely responses. Streamlining this process leads to better customer satisfaction and operational efficiency.

-

Does airSlate SignNow integrate with other applications for filling the form of distribution?

Yes, airSlate SignNow seamlessly integrates with numerous applications to streamline your document workflows. This includes CRM systems, cloud storage services, and more, allowing you to fill the form of distribution directly from your preferred tools. Explore our integrations page to see how we can fit into your existing workflow.

-

Is it easy to get started with filling the form of distribution on airSlate SignNow?

Absolutely! Getting started with filling the form of distribution on airSlate SignNow is quick and easy. Our user-friendly interface, along with helpful tutorials and customer support, will guide you through the initial setup. You’ll be completing and sending forms confidently in no time.

-

Can I track the status of the forms I fill for distribution?

Yes, airSlate SignNow allows you to track the status of the forms you fill for distribution in real-time. You receive notifications when recipients view or sign the document, which helps you stay informed and take necessary actions promptly. This feature enhances accountability and improves communication.

Get more for Fill The Form Of Distribution

- Iowa sales tax exemption certificatesiowa sales and use tax guideiowa department of revenueiowa sales and use tax guideiowa form

- Cole 2106 form 2106 department of the treasury internal

- 2021 form 1098 e student loan interest statement

- Wwwirsgovpubirs pdf2021 schedule j form 1040 internal revenue service

- 2021 form 8827 credit for prior year minimum taxcorporations

- Wwwirsgovforms pubsabout schedule a form 1040about schedule a form 1040 itemized deductions irs tax forms

- 2021 instrucciones para elformulario w 3pr instructions for form w 3pr instrucciones para elformulario w 3pr instructions for

- Fillable online declaration of requirement for air bag form

Find out other Fill The Form Of Distribution

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free