Schedule C Form

What is the Schedule C Form

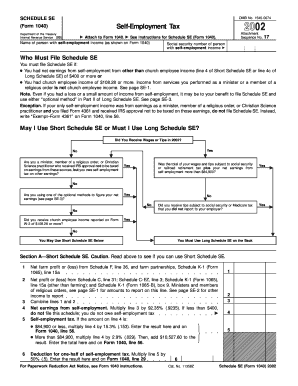

The Schedule C Form, officially known as the "Profit or Loss from Business," is a tax document used by sole proprietors in the United States to report income and expenses related to their business activities. This form is essential for individuals who are self-employed, allowing them to calculate their taxable income from their business operations. The Schedule C Form is filed as part of the individual income tax return, specifically with Form 1040. It provides a detailed overview of the business's financial performance, including gross receipts, cost of goods sold, and various deductions that can lower taxable income.

Steps to complete the Schedule C Form

Completing the Schedule C Form requires careful attention to detail to ensure accuracy and compliance with IRS regulations. Here are the key steps involved:

- Gather financial records: Collect all relevant documents, including income statements, receipts for expenses, and bank statements.

- Report income: Enter your total gross receipts or sales from your business on the form.

- Calculate cost of goods sold: If applicable, complete the section for cost of goods sold to determine the direct costs associated with producing your products.

- List expenses: Itemize your business expenses, such as advertising, utilities, and wages paid to employees, ensuring you have documentation for each expense.

- Determine net profit or loss: Subtract total expenses from gross income to find your net profit or loss, which will be reported on your Form 1040.

How to use the Schedule C Form

The Schedule C Form is used primarily for reporting income and expenses for sole proprietorships. To effectively use this form:

- Ensure you are eligible to file as a sole proprietor, which typically includes individuals who own an unincorporated business.

- Complete the form accurately, reflecting all income and expenses related to your business activities.

- File the Schedule C Form along with your annual Form 1040 by the tax deadline to avoid penalties.

Legal use of the Schedule C Form

The Schedule C Form is legally binding when completed accurately and submitted in compliance with IRS regulations. It is important to ensure that all reported figures are truthful and substantiated by appropriate documentation. Misreporting income or expenses can lead to penalties, including fines or audits. Using a reliable eSignature solution can help ensure that the form is signed and submitted securely, maintaining compliance with legal standards.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule C Form align with the annual tax return deadlines. Typically, individual tax returns, including the Schedule C, are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to keep track of any changes in tax law or deadlines announced by the IRS, especially for extensions or special circumstances.

Examples of using the Schedule C Form

Common scenarios for using the Schedule C Form include:

- A freelance graphic designer reporting income from various clients and deducting expenses such as software subscriptions and office supplies.

- A small business owner operating a retail store, reporting sales revenue and deducting costs like inventory and rent.

- A consultant providing services to businesses, detailing income and deducting travel and marketing expenses.

Required Documents

To complete the Schedule C Form, you will need several key documents:

- Income records: Invoices, sales receipts, and bank statements showing income received.

- Expense documentation: Receipts and invoices for business-related expenses, including utilities, supplies, and any other costs incurred.

- Previous tax returns: Having prior year returns can help in accurately reporting income and expenses.

Quick guide on how to complete schedule c form

Complete Schedule C Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed papers, allowing you to access the proper form and securely preserve it online. airSlate SignNow equips you with all the resources necessary to produce, modify, and eSign your documents swiftly without hurdles. Handle Schedule C Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to adjust and eSign Schedule C Form without stress

- Locate Schedule C Form and select Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or overlooked documents, tedious form searching, or mistakes requiring new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Schedule C Form to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule c form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Schedule C Form and why do I need it?

A Schedule C Form is used by sole proprietors to report income and expenses from their business. It helps you calculate your net profit or loss, which is essential for tax purposes. Understanding how to fill out the Schedule C Form accurately can minimize your tax liability and ensure compliance with IRS regulations.

-

How does airSlate SignNow assist with completing the Schedule C Form?

airSlate SignNow streamlines the process of filling out and signing your Schedule C Form digitally. Our platform provides templates and easy document management tools, helping you save time while ensuring accuracy. With airSlate SignNow, you can focus on your business while we take care of your document needs.

-

What are the pricing options for access to airSlate SignNow features related to the Schedule C Form?

airSlate SignNow offers several pricing tiers to fit various business needs, including a free trial to explore features relevant to your Schedule C Form. Our subscription plans are affordable and packed with features like unlimited eSigning and document storage. Choose the plan that best suits your requirements and budget.

-

Can I integrate airSlate SignNow with other tools for managing my Schedule C Form?

Yes, airSlate SignNow integrates seamlessly with various software, including accounting tools like QuickBooks and tax preparation software. These integrations help streamline the preparation of your Schedule C Form, making it easier to import and manage your financial data. This ensures that your documentation is accurate and easily accessible.

-

Is it secure to store my Schedule C Form documents in airSlate SignNow?

Absolutely! airSlate SignNow employs advanced encryption and security protocols to protect your Schedule C Form and other documents. Our platform ensures that your sensitive financial information remains safe, allowing you to sign and store documents with confidence.

-

Can airSlate SignNow help me track the status of my Schedule C Form?

Yes, airSlate SignNow provides real-time tracking of your Schedule C Form throughout the signing process. You will receive notifications when documents are viewed and signed, ensuring that you stay informed. This feature helps enhance communication with clients and stakeholders involved in the document workflow.

-

What benefits can I expect from using airSlate SignNow for my Schedule C Form preparation?

Using airSlate SignNow for your Schedule C Form preparation simplifies the process with user-friendly features. You can eSign documents quickly, eliminate paper clutter, and access templates designed for maximum efficiency. This ultimately saves you time and minimizes the stress of tax season.

Get more for Schedule C Form

Find out other Schedule C Form

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free