F625 109 000 Form

What is the F625 109 000

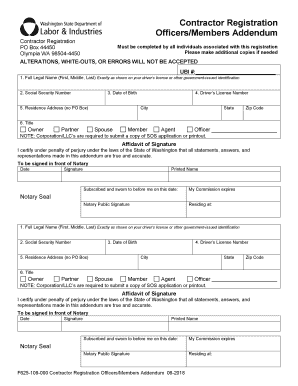

The F625 109 000 is a specific form used for various administrative purposes within the United States. It is essential for individuals and businesses to understand its function, as it often pertains to compliance with federal regulations. This form may be required for reporting certain financial activities or fulfilling specific legal obligations. Understanding its purpose can help ensure that users meet their responsibilities accurately and on time.

How to use the F625 109 000

Using the F625 109 000 involves several steps to ensure proper completion and submission. First, gather all necessary information and documentation required for the form. This may include personal identification details, financial records, or other relevant data. Next, carefully fill out the form, ensuring that all fields are completed accurately. After completing the form, review it for any errors or omissions before submitting it to the appropriate authority. Depending on the requirements, this may involve online submission, mailing, or in-person delivery.

Steps to complete the F625 109 000

Completing the F625 109 000 can be streamlined by following these steps:

- Gather necessary documents and information.

- Carefully read the instructions provided with the form.

- Fill out each section of the form accurately.

- Double-check for any errors or missing information.

- Submit the form according to the specified guidelines.

Legal use of the F625 109 000

The legal use of the F625 109 000 is crucial for ensuring compliance with U.S. regulations. This form must be filled out and submitted according to the guidelines set forth by relevant authorities. Failure to comply with these requirements can lead to penalties or legal issues. It is important to understand the legal implications of using this form, including any specific requirements related to signatures or supporting documents.

Filing Deadlines / Important Dates

Filing deadlines for the F625 109 000 can vary depending on the specific purpose of the form. It is essential to be aware of these deadlines to avoid any penalties or complications. Users should check the official guidelines or consult with a tax professional to ensure they are aware of the relevant dates associated with the form's submission.

Who Issues the Form

The F625 109 000 is typically issued by a governmental agency or department responsible for overseeing the specific area of compliance it addresses. This may include federal, state, or local authorities. Understanding which agency issues the form can help users navigate the submission process more effectively and ensure they are following the correct procedures.

Quick guide on how to complete f625 109 000 448051177

Effortlessly prepare F625 109 000 on any device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing access to the necessary forms and secure online storage. airSlate SignNow equips you with all the resources required to create, amend, and electronically sign your documents promptly without any hold-ups. Manage F625 109 000 on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

The simplest way to modify and electronically sign F625 109 000 with ease

- Obtain F625 109 000 and click on Get Form to begin.

- Utilize the tools at your disposal to fill out your document.

- Emphasize important sections of the documents or conceal sensitive data with the tools specifically available via airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your preference. Modify and electronically sign F625 109 000 to ensure outstanding communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the f625 109 000 448051177

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the f625 109 000 form and how does airSlate SignNow help with it?

The f625 109 000 form is a key tax document that businesses often need to manage electronically. airSlate SignNow provides an easy-to-use platform for sending and eSigning this form, ensuring compliance and efficiency in your document handling.

-

How much does airSlate SignNow cost for using the f625 109 000 form?

airSlate SignNow offers a cost-effective pricing plan that covers features necessary for managing the f625 109 000 form. Our plans are designed to cater to businesses of all sizes, allowing you to choose the one that best fits your needs without breaking the bank.

-

What features does airSlate SignNow offer for the f625 109 000 document?

With airSlate SignNow, you can easily create, send, and eSign the f625 109 000 document. Features such as customizable templates, real-time tracking, and secure cloud storage enhance your experience and ensure your documents are processed efficiently.

-

Is airSlate SignNow compliant with regulations for the f625 109 000 form?

Yes, airSlate SignNow is fully compliant with all necessary regulations for handling the f625 109 000 form. Our platform ensures that all eSignatures are legally binding, providing peace of mind that your document management meets compliance standards.

-

Can I integrate airSlate SignNow with other software for the f625 109 000 process?

Absolutely! airSlate SignNow seamlessly integrates with numerous software applications to enhance your workflow related to the f625 109 000 form. Whether it’s CRM systems or other document management tools, our integrations simplify the process.

-

What are the benefits of using airSlate SignNow for the f625 109 000 form?

Using airSlate SignNow for the f625 109 000 form offers signNow benefits like increased efficiency, reduced paperwork, and faster turnaround times. It empowers businesses to manage their document needs more effectively with a user-friendly interface.

-

How secure is airSlate SignNow when eSigning the f625 109 000 document?

Security is a top priority for airSlate SignNow. When eSigning the f625 109 000 document, all data is encrypted and protected, ensuring that your sensitive information remains confidential and secure from unauthorized access.

Get more for F625 109 000

- Timely pay rent form

- The lease is recorded form

- Free tenant renter background check form wordpdf

- To order cable tv service call form

- Divorce and resumption of my maiden name form

- All guardianship forms wisconsin court system circuit

- Insert whether this is an expedited appeal under app r 141 form

- Destruction certification form ingov

Find out other F625 109 000

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors