Schedule E Rental Income Worksheet Form

What is the Schedule E Rental Income Worksheet

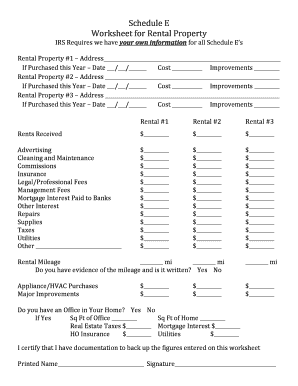

The Schedule E rental income worksheet is a form used by property owners to report income and expenses related to rental properties. It is an essential part of the U.S. tax filing process for individuals who earn rental income. This worksheet helps taxpayers calculate their net rental income or loss, which is then reported on their individual income tax returns. Understanding the components of the Schedule E worksheet is crucial for accurate reporting and compliance with IRS regulations.

How to use the Schedule E Rental Income Worksheet

Using the Schedule E rental income worksheet involves several steps to ensure accurate reporting of rental income and expenses. First, gather all relevant financial documents, including rental agreements, receipts for expenses, and any other documentation related to the property. Next, fill out the worksheet by entering the total rental income received and listing all deductible expenses, such as repairs, property management fees, and mortgage interest. Finally, calculate the net income or loss by subtracting the total expenses from the total income. This net figure will be reported on your tax return.

Steps to complete the Schedule E Rental Income Worksheet

Completing the Schedule E rental income worksheet requires careful attention to detail. Follow these steps for accurate completion:

- Gather all necessary documentation, including income statements and expense receipts.

- Enter your property information, including the address and the type of property.

- List all rental income received during the tax year.

- Detail all deductible expenses, categorizing them appropriately (e.g., repairs, utilities).

- Calculate the total income and total expenses.

- Determine your net rental income or loss by subtracting total expenses from total income.

Legal use of the Schedule E Rental Income Worksheet

The Schedule E rental income worksheet must be used in accordance with IRS guidelines to ensure legal compliance. It is important that all information reported is accurate and complete to avoid potential penalties. The worksheet serves as a formal declaration of rental income and expenses, and any discrepancies can lead to audits or legal issues. Utilizing electronic signature solutions, like those offered by signNow, can help ensure that your completed worksheet is securely signed and stored, providing an additional layer of legal protection.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule E rental income worksheet. Taxpayers must adhere to these regulations to ensure compliance. Key guidelines include accurately reporting all income, maintaining thorough records of expenses, and understanding which expenses are deductible. The IRS also outlines the importance of distinguishing between personal and rental use of properties, as this can affect the deductibility of certain expenses. Familiarizing yourself with these guidelines can help prevent errors and facilitate a smoother tax filing process.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule E rental income worksheet align with the general tax filing deadlines in the United States. Typically, individual tax returns, including Schedule E, are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions they may apply for, which can provide additional time to file. Staying informed about these important dates is crucial for timely compliance with tax obligations.

Quick guide on how to complete schedule e rental income worksheet

Manage Schedule E Rental Income Worksheet effortlessly on any device

Digital document handling has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed papers, allowing you to locate the necessary form and store it securely online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without delays. Oversee Schedule E Rental Income Worksheet on any platform using the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

How to adjust and electronically sign Schedule E Rental Income Worksheet with ease

- Obtain Schedule E Rental Income Worksheet and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select relevant sections of your documents or obscure private information using the tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Decide how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tiresome form searches, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Schedule E Rental Income Worksheet and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule e rental income worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a schedule e rental income worksheet?

A schedule e rental income worksheet is a tax document used to report income and expenses related to rental properties. It helps property owners summarize their rental income, deductions, and net profit or loss. Utilizing a well-structured worksheet can simplify tax preparation and ensure accurate reporting.

-

How can airSlate SignNow help me with my schedule e rental income worksheet?

airSlate SignNow provides a user-friendly platform to create, sign, and manage your schedule e rental income worksheet digitally. You can easily fill out the necessary details, sign the document, and share it with your accountant or tax preparer. This streamlines the tax process, saving time and reducing errors.

-

Is airSlate SignNow affordable for individual property owners needing a schedule e rental income worksheet?

Yes, airSlate SignNow offers cost-effective solutions that cater to individual property owners. With various pricing plans available, you can choose one that suits your budget while getting access to essential features for managing your schedule e rental income worksheet. The platform can save you both time and money.

-

What features does airSlate SignNow include for managing a schedule e rental income worksheet?

airSlate SignNow includes features such as eSigning, cloud storage, and customizable templates specifically for the schedule e rental income worksheet. These tools help you easily create and manage your documents from anywhere. The intuitive interface makes it accessible for users of all technical levels.

-

Can I integrate airSlate SignNow with my accounting software for my schedule e rental income worksheet?

Yes, airSlate SignNow can be integrated with popular accounting software, making it easy to sync your schedule e rental income worksheet with your financial records. This ensures that your income and expenses are accurately tracked, simplifying tax preparation. Seamless integration enhances efficiency, allowing for smoother workflows.

-

Are there any templates available for a schedule e rental income worksheet on airSlate SignNow?

Yes, airSlate SignNow offers a variety of customizable templates for the schedule e rental income worksheet. You can easily select a template, fill in your specific details, and personalize it to suit your needs. This feature accelerates document creation and ensures that you include all necessary information.

-

What benefits can I expect from using airSlate SignNow for my schedule e rental income worksheet?

Using airSlate SignNow for your schedule e rental income worksheet provides signNow benefits such as ease of use, time savings, and enhanced organization. The ability to eSign documents remotely allows you to complete your tax preparations without delays. Additionally, the platform's security features ensure your sensitive information is well-protected.

Get more for Schedule E Rental Income Worksheet

Find out other Schedule E Rental Income Worksheet

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License