Crs Self Certification Form Template

What is the CRS Self Certification Form Template

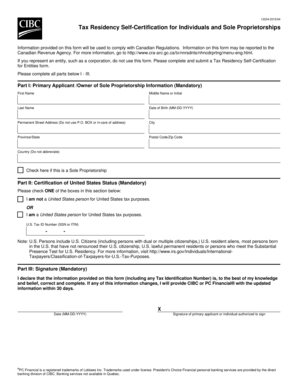

The CRS self certification form template is a standardized document used to determine an individual's tax residency status under the Common Reporting Standard (CRS). This form is essential for financial institutions to collect information about account holders who may be subject to tax obligations in their country of residence. The template typically includes sections for personal details, residency information, and declarations regarding tax compliance. Understanding this form is crucial for individuals and businesses to ensure proper adherence to international tax regulations.

Steps to Complete the CRS Self Certification Form Template

Completing the CRS self certification form template involves several key steps:

- Gather Required Information: Collect personal identification details, including your name, address, date of birth, and tax identification number.

- Determine Tax Residency: Identify your tax residency status based on where you are liable to pay taxes.

- Fill Out the Form: Accurately complete all sections of the form, ensuring that the information provided is truthful and up-to-date.

- Review the Form: Double-check all entries for accuracy to avoid potential issues with tax authorities.

- Submit the Form: Follow the submission guidelines as specified by the financial institution or tax authority requesting the form.

Legal Use of the CRS Self Certification Form Template

The legal use of the CRS self certification form template is vital for compliance with international tax regulations. Financial institutions are required to collect this form to report information about account holders to their respective tax authorities. Failure to provide accurate information can lead to penalties, including fines or legal action. It is important for individuals to understand their obligations and ensure that the form is filled out correctly to avoid complications.

Required Documents

When completing the CRS self certification form template, certain documents may be required to support the information provided. These documents typically include:

- Government-issued identification, such as a passport or driver's license.

- Proof of residency, which may include utility bills or bank statements showing your name and address.

- Tax identification number or Social Security number, if applicable.

Having these documents ready can help streamline the completion process and ensure compliance with tax regulations.

Penalties for Non-Compliance

Non-compliance with the CRS self certification form requirements can lead to significant penalties. Financial institutions may impose fines or restrictions on accounts if the form is not submitted or is filled out incorrectly. Additionally, tax authorities may pursue legal action against individuals who fail to report their tax residency status accurately. It is crucial to understand the implications of non-compliance and to ensure that the form is completed and submitted in a timely manner.

Examples of Using the CRS Self Certification Form Template

The CRS self certification form template can be used in various scenarios, including:

- Opening a new bank account where the institution requires proof of tax residency.

- Applying for investment accounts that necessitate compliance with tax reporting standards.

- Updating personal information with financial institutions to reflect changes in residency status.

These examples illustrate the importance of the form in maintaining compliance with international tax obligations.

Quick guide on how to complete crs self certification form template

Prepare Crs Self Certification Form Template effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without any delays. Handle Crs Self Certification Form Template on any device with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The easiest way to edit and electronically sign Crs Self Certification Form Template without hassle

- Obtain Crs Self Certification Form Template and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign tool, which takes only seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies of documents. airSlate SignNow fulfills your needs in document management with just a few clicks from any device you prefer. Edit and electronically sign Crs Self Certification Form Template and guarantee outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the crs self certification form template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is tax residency self certification?

Tax residency self certification is a process where individuals confirm their tax residency status, typically required by financial institutions. It involves providing information about your residence and tax obligations to ensure compliance with local and international tax laws.

-

How does airSlate SignNow support tax residency self certification?

airSlate SignNow offers a streamlined platform for businesses to create, distribute, and manage tax residency self certification documents. By utilizing our eSignature capabilities, you can easily obtain necessary signatures and ensure your documents are legally binding and compliant.

-

What are the benefits of using airSlate SignNow for tax residency self certification?

Using airSlate SignNow for tax residency self certification enhances efficiency, reduces paperwork, and speeds up the compliance process. Our platform is user-friendly and provides secure storage for all your certification documents, making tracking and managing easier.

-

Is airSlate SignNow cost-effective for tax residency self certification solutions?

Yes, airSlate SignNow offers competitive pricing plans designed to accommodate businesses of all sizes. Our cost-effective solutions not only simplify tax residency self certification but also help reduce administrative costs.

-

Can I integrate airSlate SignNow with other software for tax residency self certification?

Absolutely! airSlate SignNow allows seamless integration with various third-party applications, making it easy to incorporate our services into your existing workflows for tax residency self certification. This enhances overall efficiency and helps maintain consistency across processes.

-

What features does airSlate SignNow provide for managing tax residency self certification documents?

airSlate SignNow includes features such as online document creation, eSigning, template management, and automated workflows for tax residency self certification. These tools help businesses effectively manage their documentation processes and ensure compliance.

-

How secure is airSlate SignNow for handling tax residency self certification documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols and comply with data protection regulations, ensuring that your tax residency self certification documents are secure from unauthorized access.

Get more for Crs Self Certification Form Template

- Control number ky p072 pkg form

- Finance forms ky finance and administration cabinet

- Control number ky p077 pkg form

- Kentucky living will form formswift

- Identity theft and security freezes kentucky attorney general form

- Control number ky p085 pkg form

- Control number ky p086 pkg form

- Control number ky p088 pkg form

Find out other Crs Self Certification Form Template

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement