Income Tax Form Vsi R

What is the Income Tax Form Vsi R

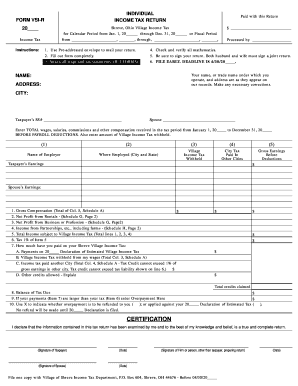

The Income Tax Form Vsi R is a specific document used by taxpayers in the United States to report their income and calculate their tax obligations. This form is essential for individuals and businesses, as it helps ensure compliance with federal tax laws. The form collects various information, including income sources, deductions, and credits, allowing the IRS to assess the correct tax liability. Understanding the purpose and requirements of the Vsi R is crucial for accurate tax filing.

How to use the Income Tax Form Vsi R

Using the Income Tax Form Vsi R involves several steps to ensure accurate completion. First, gather all necessary financial documents, including W-2s, 1099s, and records of deductions. Next, carefully fill out the form by entering your personal information, income details, and applicable deductions. It is important to double-check all entries for accuracy. Once completed, you can submit the form electronically or by mail, depending on your preference and the specific requirements of the IRS.

Steps to complete the Income Tax Form Vsi R

Completing the Income Tax Form Vsi R requires a systematic approach:

- Collect all relevant financial documents, such as income statements and receipts for deductions.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income accurately, ensuring that each amount corresponds with the supporting documents.

- Detail any deductions or credits you are eligible for, following the IRS guidelines.

- Review the entire form for any errors or omissions before submitting.

Legal use of the Income Tax Form Vsi R

The legal use of the Income Tax Form Vsi R is governed by IRS regulations. To ensure that your form is legally binding, it must be completed accurately and submitted within the designated filing period. Electronic submissions are accepted, provided they comply with eSignature laws, such as the ESIGN Act and UETA. Using a reliable eSignature solution can help maintain the integrity and legality of your submission.

Filing Deadlines / Important Dates

Filing deadlines for the Income Tax Form Vsi R are crucial for compliance. Typically, the deadline for individual taxpayers is April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to be aware of any changes in deadlines, especially for extensions or special circumstances that may affect your filing date.

Required Documents

To complete the Income Tax Form Vsi R accurately, certain documents are required. These include:

- W-2 forms from employers, detailing wages and taxes withheld.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as medical costs or charitable contributions.

- Records of any other income sources, including interest and dividends.

Form Submission Methods (Online / Mail / In-Person)

The Income Tax Form Vsi R can be submitted through various methods. Taxpayers may choose to file online using IRS-approved software, which often provides guidance throughout the process. Alternatively, forms can be mailed to the appropriate IRS address, ensuring that they are postmarked by the filing deadline. In-person submissions are generally not common but may be available at certain IRS offices during tax season.

Quick guide on how to complete income tax form vsi r

Effortlessly Prepare Income Tax Form Vsi R on Any Device

Digital document management has gained immense traction among organizations and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without any hold-ups. Manage Income Tax Form Vsi R on any device using airSlate SignNow's Android or iOS applications and enhance your document-focused tasks today.

The easiest way to modify and eSign Income Tax Form Vsi R seamlessly

- Find Income Tax Form Vsi R and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive data using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method for sharing your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassles of lost or mislaid files, tedious form searching, or errors that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Alter and eSign Income Tax Form Vsi R and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the income tax form vsi r

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form vsi and how does it work?

What is form vsi? It's a digital form solution that streamlines the process of creating, sending, and signing documents online. By utilizing form vsi, users can easily input data, attach required files, and send forms for eSignature, making document management more efficient.

-

What are the benefits of using form vsi?

Using form vsi provides numerous benefits, including reduced paperwork, faster turnaround times, and improved accuracy. It enhances collaboration among team members by enabling easy sharing of forms and facilitates tracking the status of documents, leading to a smoother workflow.

-

Can I integrate form vsi with other tools?

Yes, form vsi can be seamlessly integrated with various applications to enhance functionality. You can connect it with CRM systems, project management tools, and cloud storage services to ensure all your documents and data are easily accessible and well-organized.

-

What is the pricing structure for form vsi?

The pricing for form vsi varies based on the features and number of users you need. airSlate SignNow offers flexible plans to cater to different business sizes and requirements, ensuring that you only pay for what you need while maximizing the benefits of what is form vsi.

-

Is form vsi secure for sensitive documents?

Absolutely, form vsi provides robust security measures to protect your sensitive documents. With industry-standard encryption, secure cloud storage, and compliance with legal regulations, users can trust that their data is safe when using what is form vsi.

-

How can form vsi improve my business's efficiency?

What is form vsi? It is designed to simplify and automate common documentation tasks, which can signNowly reduce the time spent on manual processes. By integrating eSignature capabilities, businesses can close deals faster and minimize delays in approvals, enhancing overall efficiency.

-

Do I need any special software to use form vsi?

No special software is required to use form vsi. It's a cloud-based solution that can be accessed from any device with an internet connection, allowing users to manage their documents anytime and anywhere without the need for installations.

Get more for Income Tax Form Vsi R

- Foregoing form

- Name of person acknowledged form

- Hereinafter referred to as the quotsellers whether one or more and form

- For and in consideration of the sum of dollars receipt of form

- Sample storm drainage easement form

- On land of form

- Control number me 00fc 01 form

- P 355 sworn statement of personal representative to close form

Find out other Income Tax Form Vsi R

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF