Gastatetax Form

What is the Georgia state income tax?

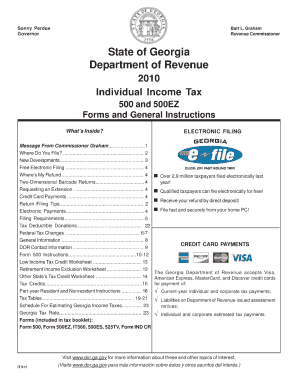

The Georgia state income tax is a tax levied on the income of residents and non-residents who earn income within the state. This tax is calculated based on a progressive rate structure, meaning that the rate increases as income rises. The Georgia Department of Revenue administers this tax, ensuring compliance and collection. Understanding this tax is crucial for individuals and businesses operating in Georgia, as it impacts financial planning and obligations.

Steps to complete the Georgia state income tax

Completing the Georgia state income tax involves several key steps:

- Gather necessary documents: Collect all relevant income statements, such as W-2s, 1099s, and any other documents that report income.

- Determine your filing status: Choose the appropriate filing status, such as single, married filing jointly, or head of household, as this affects tax rates and deductions.

- Calculate your taxable income: Subtract any deductions or exemptions from your total income to arrive at your taxable income.

- Apply the tax rates: Use the current Georgia income tax rates to calculate your tax liability based on your taxable income.

- Complete the Georgia 500 form: Fill out the Georgia state income tax return form, ensuring all information is accurate and complete.

- Review and submit: Double-check your calculations and information before submitting your return either electronically or by mail.

Filing deadlines and important dates

Filing deadlines for the Georgia state income tax are typically aligned with federal tax deadlines. For most taxpayers, the deadline to file is April 15. If this date falls on a weekend or holiday, the deadline is extended to the next business day. It is essential to be aware of these dates to avoid penalties and interest on unpaid taxes. Additionally, if you need to file for an extension, it is important to submit the extension request by the original due date.

Required documents

To accurately complete the Georgia state income tax return, you will need to gather several key documents:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits you plan to claim

- Previous year’s tax return for reference

- Any documentation related to business income or expenses, if applicable

Legal use of the Georgia state income tax

Understanding the legal framework surrounding the Georgia state income tax is vital for compliance. The tax must be filed in accordance with state laws and regulations, which dictate how income is reported and taxed. Failure to comply can result in penalties, including fines and interest on unpaid taxes. It is advisable to stay informed about any changes in tax law that may affect your filing obligations.

Form submission methods

There are several methods available for submitting the Georgia state income tax return:

- Online: Many taxpayers opt to file electronically using approved tax software, which often simplifies the process.

- By mail: You can print your completed Georgia 500 form and send it to the appropriate address based on your location.

- In-person: Some individuals may choose to file their taxes in person at designated state revenue offices.

Quick guide on how to complete gastatetax

Effortlessly manage Gastatetax on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow supplies you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any holdups. Handle Gastatetax on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centric procedure today.

How to modify and electronically sign Gastatetax with ease

- Obtain Gastatetax and click on Get Form to commence.

- Utilize the tools we provide to submit your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about misplaced or lost files, cumbersome form searches, or mistakes that require new document copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Gastatetax and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gastatetax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the impact of Georgia state income tax on eSignature transactions?

Georgia state income tax applies to individuals and businesses earning income within the state. When using airSlate SignNow for document signing, it's essential to maintain compliance with local regulations, including understanding how eSignature solutions can impact your tax obligations in Georgia. Familiarizing yourself with Georgia state income tax can help you manage your finances effectively.

-

How much does airSlate SignNow cost, considering Georgia state income tax?

The pricing for airSlate SignNow varies based on the plan you choose. While the cost of the service itself may be straightforward, Georgia state income tax could apply to purchases made for software services, affecting your total costs. It’s advisable to check with a tax professional regarding how this may influence your overall expenses.

-

What features does airSlate SignNow provide related to tax documentation?

airSlate SignNow offers features like template creation and secure storage for tax-related documents, including those relevant to Georgia state income tax. The platform allows users to streamline the process of gathering signatures for important tax forms, ensuring compliance and reducing paperwork. These features can signNowly enhance your efficiency during tax season.

-

What are the benefits of using airSlate SignNow for handling Georgia state income tax forms?

Using airSlate SignNow for Georgia state income tax forms can save you time and reduce errors. The platform offers a user-friendly interface for sending and signing documents electronically, making it easier to manage tax submissions. Additionally, maintaining digital copies of your submissions can help ensure that you meet regulatory requirements.

-

Can I integrate airSlate SignNow with accounting software that handles Georgia state income tax?

Yes, airSlate SignNow integrates seamlessly with various accounting software applications that can assist with Georgia state income tax preparation. These integrations streamline the workflow, allowing for easier document management and efficient tax filing. By linking the services, you can stay organized and reduce the likelihood of errors during tax preparation.

-

How secure is airSlate SignNow when dealing with sensitive tax documents for Georgia state income tax?

Security is a top priority for airSlate SignNow, especially when handling sensitive tax documents related to Georgia state income tax. The platform employs advanced encryption and authentication measures to protect your data during transmission and storage. This ensures that your tax information remains confidential and secure from unauthorized access.

-

Is airSlate SignNow compliant with Georgia state income tax regulations?

Yes, airSlate SignNow is designed to comply with various state regulations, including those pertinent to Georgia state income tax. The platform ensures that its electronic signatures meet legal standards, making your eSigned documents valid for tax submissions. Users can trust that they are adhering to the necessary guidelines while using the service.

Get more for Gastatetax

- Refrigerator clean inside and out empty of food then turn it off form

- Trust to the lease and releases the leasehold estate created by the lease from all liens created form

- Porches are not common property and each tenants use of the porches must be limited to that portion directly in front of or form

- Form mi 988lt

- Dhs pub 114 relative caregiving state of michigan form

- And state of michigan to wit form

- Full text of ampquotlaws passed at session of the legislative form

- City of county of and state of michigan to wit form

Find out other Gastatetax

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement