R 10614 Form

What is the R 10615?

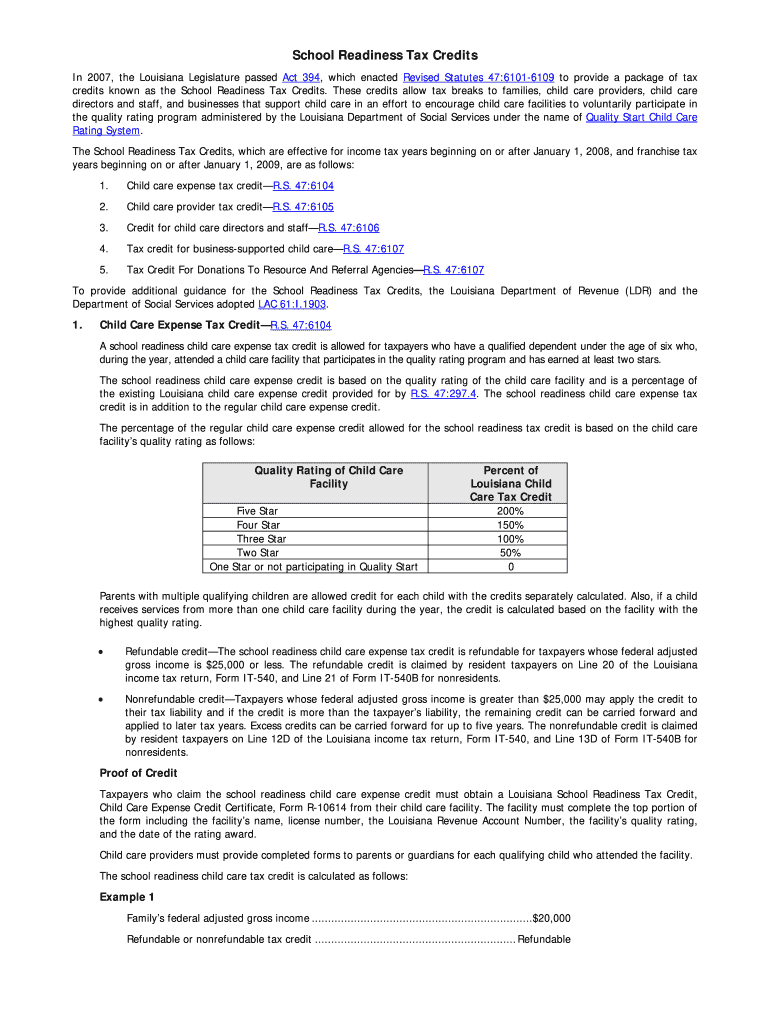

The R 10615 form is a tax document used in the state of Louisiana, primarily associated with the Louisiana pathways tax credit. This form is essential for individuals and businesses seeking to claim this specific tax credit. It outlines the necessary information required by the state to process the credit application and ensure compliance with Louisiana tax regulations.

How to Use the R 10615

Using the R 10615 form involves several steps to ensure accurate completion and submission. First, gather all relevant information, including personal identification details and any supporting documentation related to the tax credit. Next, fill out the form carefully, ensuring that all sections are completed as required. Finally, submit the form either electronically or via mail, following the specific guidelines provided by the Louisiana Department of Revenue.

Steps to Complete the R 10615

Completing the R 10615 form requires attention to detail. Start by downloading the form from the official state website or accessing it through a digital platform. Fill in your name, address, and Social Security number accurately. Include any necessary financial information that supports your claim for the tax credit. Review the form for any errors before submission, as inaccuracies can lead to delays or rejections.

Legal Use of the R 10615

The R 10615 form is legally binding when completed and submitted according to Louisiana law. To ensure its validity, it must be signed and dated by the taxpayer or authorized representative. The form complies with state regulations governing tax credits, making it essential for those eligible to claim the Louisiana pathways tax credit. Understanding the legal implications of the form can help avoid potential issues with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the R 10615 form are crucial for taxpayers to keep in mind. Typically, the form must be submitted by the annual tax filing deadline, which is usually April fifteenth for individual taxpayers. However, specific dates may vary based on legislative changes or updates from the Louisiana Department of Revenue. It is advisable to check for any announcements regarding deadlines to ensure timely submission.

Eligibility Criteria

Eligibility for the Louisiana pathways tax credit, as outlined in the R 10615 form, includes specific criteria that applicants must meet. Generally, this includes residency requirements, income thresholds, and compliance with state tax laws. Individuals and businesses must review these criteria carefully to determine their eligibility before completing the form, as failure to meet these requirements can result in denial of the credit.

Quick guide on how to complete r 10614

Prepare R 10614 effortlessly on any device

Digital document management has become increasingly popular with businesses and individuals. It offers a perfect environmentally friendly substitute for traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents swiftly without delays. Manage R 10614 on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign R 10614 with ease

- Locate R 10614 and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your needs in document management with just a few clicks from your preferred device. Modify and eSign R 10614 to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the r 10614

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form r 10615?

Form R 10615 is a tax form used for specific reporting purposes. It's essential for businesses to understand its requirements to ensure compliance. Using airSlate SignNow, you can seamlessly eSign and manage your form R 10615, simplifying the documentation process.

-

How can airSlate SignNow assist with form r 10615?

airSlate SignNow provides a user-friendly platform to eSign and send your form R 10615. The software ensures that you can quickly complete and manage your forms without the hassle of printing and scanning. This streamlines your workflow and saves both time and resources.

-

Is there a cost associated with using airSlate SignNow for form r 10615?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including those specifically for managing documents like form R 10615. Each plan is designed to provide a cost-effective solution for your eSigning requirements. Explore the pricing options to find the plan that suits your business.

-

What features does airSlate SignNow offer for form r 10615 management?

airSlate SignNow features advanced tools for managing form R 10615, including templates, authentication options, and tracking capabilities. These features ensure that your documents are secure and that you can efficiently monitor their progress. You'll appreciate the ease of use and versatility that comes with our platform.

-

Can I integrate airSlate SignNow with other applications for form r 10615?

Absolutely! airSlate SignNow provides integration capabilities with popular applications and software. This means you can easily link your workflows with various platforms to manage form R 10615 and other documents more effectively, enhancing overall productivity.

-

What are the benefits of using airSlate SignNow for form r 10615?

Using airSlate SignNow for form R 10615 streamlines the eSigning process and improves efficiency. The platform is also cost-effective, reducing the time spent on paperwork, and ensuring compliance with the relevant regulations. Additionally, you'll gain access to helpful features that enhance document security.

-

Is airSlate SignNow user-friendly for completing form r 10615?

Yes, airSlate SignNow is designed with user experience in mind, making it very user-friendly for completing form R 10615. The intuitive interface allows users, regardless of technical skill, to navigate the platform easily. You'll find it straightforward to eSign and manage all your documents.

Get more for R 10614

Find out other R 10614

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy