Form W 4p

What is the Form W-4P

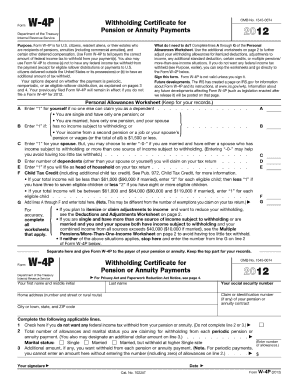

The Form W-4P, also known as the Withholding Certificate for Pension or Annuity Payments, is a tax form used by individuals to instruct payers on how much federal income tax to withhold from their pension or annuity payments. This form is particularly important for retirees or those receiving retirement benefits, as it helps ensure that the correct amount of tax is withheld throughout the year. By accurately completing this form, individuals can avoid under-withholding, which may lead to a tax bill at the end of the year.

How to use the Form W-4P

Using the Form W-4P involves a few straightforward steps. First, individuals must obtain the form, which can be downloaded from the IRS website or requested from their pension plan administrator. Next, they should fill out the personal information section, including their name, address, and Social Security number. The form also requires individuals to specify their filing status and any additional withholding amounts they wish to request. Once completed, the form should be submitted to the payer of the pension or annuity payments, not the IRS.

Steps to complete the Form W-4P

Completing the Form W-4P requires careful attention to detail. Here are the steps to follow:

- Download the Form W-4P from the IRS website or obtain a copy from your pension plan administrator.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate your filing status, such as single, married, or head of household.

- Decide if you want additional tax withheld and specify the amount, if applicable.

- Sign and date the form to validate it.

- Submit the completed form to your pension or annuity payer.

Legal use of the Form W-4P

The legal use of the Form W-4P is governed by IRS regulations. By completing and submitting this form, individuals are providing their payers with the necessary information to withhold the correct amount of federal income tax. It is essential to ensure that the form is filled out accurately, as incorrect information can lead to penalties or an unexpected tax liability. The form is legally binding in the sense that it reflects the taxpayer's intent regarding withholding and must be honored by the payer.

Filing Deadlines / Important Dates

While the Form W-4P does not have a specific filing deadline like tax returns, it is crucial to submit it to your pension or annuity payer as soon as you determine your withholding needs. This is especially important if there are changes in your financial situation, such as retirement or changes in income. Keeping the form updated ensures that the correct amount of tax is withheld throughout the year, helping to avoid any surprises during tax season.

Examples of using the Form W-4P

There are various scenarios in which individuals would use the Form W-4P. For instance, a retiree receiving monthly pension payments may decide to adjust their withholding to account for additional income from part-time work. Similarly, someone who has recently married may wish to update their filing status to reflect their new situation, which could affect their withholding amounts. Each of these examples highlights the form's flexibility in accommodating changes in personal circumstances.

Quick guide on how to complete form w 4p

Prepare Form W 4p effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely save it online. airSlate SignNow equips you with all the essential tools to create, modify, and eSign your documents swiftly without delays. Handle Form W 4p on any device with the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

The easiest way to modify and eSign Form W 4p smoothly

- Find Form W 4p and then click Get Form to commence.

- Employ the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and bears the same legal validity as a conventional handwritten signature.

- Verify all the information and then click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from the device of your preference. Modify and eSign Form W 4p and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 4p

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form W 4p and how can airSlate SignNow help?

The Form W 4p is a tax form used by employees to indicate their withholding allowances. airSlate SignNow simplifies the process of filling out and eSigning the Form W 4p, ensuring accurate and efficient submissions.

-

What are the features of airSlate SignNow related to the Form W 4p?

airSlate SignNow offers several features for the Form W 4p, including customizable templates, secure eSignature capabilities, and easy document sharing. These features streamline the process and make compliance easier for both employees and HR departments.

-

Is there a cost to use airSlate SignNow for the Form W 4p?

Yes, there is a cost associated with using airSlate SignNow, but we offer various pricing plans that cater to different business needs. The cost is justified by the time savings and increased efficiency in handling the Form W 4p and other documents.

-

How does airSlate SignNow ensure the security of the Form W 4p?

airSlate SignNow uses advanced encryption and secure servers to protect your Form W 4p and other sensitive documents. Our platform complies with industry standards and regulations to keep your information safe during eSigning.

-

Can I integrate airSlate SignNow with other software for managing the Form W 4p?

Yes, airSlate SignNow offers integrations with popular software tools that can help you manage tax documents, including the Form W 4p. This seamless integration enhances productivity and ensures all your documents are connected.

-

What benefits does using airSlate SignNow provide for handling the Form W 4p?

Using airSlate SignNow for the Form W 4p provides several benefits, such as reduced paper waste, faster processing times, and an easier way to track document statuses. Our platform allows businesses to manage their tax forms efficiently and reliably.

-

How quickly can I complete the Form W 4p with airSlate SignNow?

You can complete the Form W 4p quickly with airSlate SignNow, as our user-friendly interface allows you to fill, sign, and send documents in minutes. Most users find that the streamlined process saves them considerable time compared to traditional methods.

Get more for Form W 4p

- Stipulation for tender of funds into court form

- Tennessees court system tennessee comptroller of the form

- Section 1 the presbytery of the cascades and its committees form

- Come now the parties and stipulate as follows form

- Letter opinion ruling on defendants demurrer to complaint form

- Defendant counter plaintiff form

- Morris v monotech of mississippi inc civil action no 1 form

- Quot and submits its brief in opposition to the motion for form

Find out other Form W 4p

- Sign South Dakota Banking Limited Power Of Attorney Mobile

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement