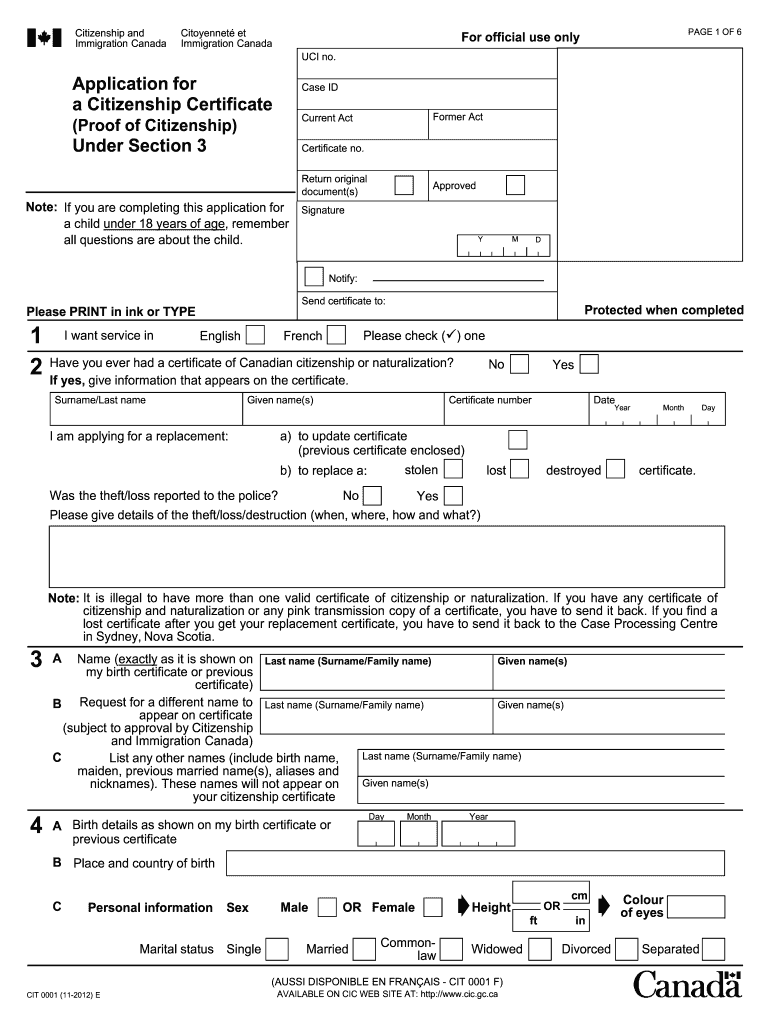

Cit 0001 Form

What is the CIT 0001?

The CIT 0001 form is a crucial document used for reporting specific tax information in the United States. This form is primarily utilized by businesses and individuals to disclose income, expenses, and other financial details to the Internal Revenue Service (IRS). Understanding the CIT 0001 is essential for ensuring compliance with federal tax regulations and accurately reporting financial activities.

How to use the CIT 0001

Using the CIT 0001 form involves several key steps. First, gather all necessary financial documents, including income statements and expense reports. Next, fill out the form with accurate information reflecting your financial situation. Ensure that all entries are clear and precise to avoid any discrepancies. After completing the form, review it thoroughly for accuracy before submission. Using digital tools can simplify this process, allowing for easier editing and secure submission.

Steps to complete the CIT 0001

Completing the CIT 0001 form requires careful attention to detail. Follow these steps for successful completion:

- Gather all relevant financial documents, including income and expense records.

- Access the CIT 0001 form through the IRS website or a trusted digital platform.

- Fill in your personal and business information accurately.

- Report all income and deductible expenses as required.

- Double-check all entries for accuracy and completeness.

- Submit the form electronically or via mail, depending on your preference.

Legal use of the CIT 0001

The CIT 0001 form is legally binding when filled out correctly and submitted in accordance with IRS guidelines. It is essential to comply with all relevant tax laws to avoid penalties. Digital signatures and electronic submissions are recognized as valid under the ESIGN Act, ensuring that your completed form holds legal weight. Maintaining accurate records and adhering to submission deadlines further solidifies the legal standing of your CIT 0001 form.

Required Documents

To successfully complete the CIT 0001 form, you will need specific documents that provide the necessary financial information. These may include:

- Income statements, such as W-2s or 1099s.

- Expense receipts and invoices.

- Prior tax returns for reference.

- Any additional documentation required by the IRS for specific deductions.

Form Submission Methods

The CIT 0001 form can be submitted through various methods, providing flexibility for users. Options include:

- Online submission via the IRS e-file system or trusted digital platforms.

- Mailing a paper copy of the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices, if necessary.

Filing Deadlines / Important Dates

Filing deadlines for the CIT 0001 form are critical to avoid penalties. Typically, the form must be submitted by April fifteenth of the following tax year. However, specific deadlines may vary based on individual circumstances, such as extensions or special tax situations. It is advisable to stay informed about any changes to filing dates to ensure timely submission.

Quick guide on how to complete cit 0001

Complete Cit 0001 effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can locate the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Cit 0001 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to edit and eSign Cit 0001 without hassle

- Locate Cit 0001 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information using tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you want to deliver your form, either by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Cit 0001 and guarantee effective communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cit 0001

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is CIT 0001 and how does it relate to airSlate SignNow?

CIT 0001 refers to a specific compliance requirement that businesses may encounter when using eSignature solutions. airSlate SignNow is designed to meet these standards, ensuring that your electronic signatures are legally binding and secure. Understanding CIT 0001 can help you leverage these capabilities effectively for your business.

-

How much does airSlate SignNow cost for solutions involving CIT 0001?

The pricing for airSlate SignNow varies based on the features you select, including support for CIT 0001 compliance. We offer flexible subscription plans that cater to different business needs and budgets. Contact our sales team for a tailored quote based on your specific requirements.

-

What features does airSlate SignNow offer for businesses needing CIT 0001 compliance?

airSlate SignNow provides several features that support CIT 0001, including customizable templates, secure document storage, and comprehensive audit trails. These features ensure that all processes comply with industry regulations while maintaining ease of use. Our platform is designed to streamline your document workflows while adhering to CIT 0001 standards.

-

Can airSlate SignNow integrate with other tools while addressing CIT 0001?

Yes, airSlate SignNow seamlessly integrates with various applications such as CRMs and project management tools while ensuring compliance with CIT 0001. This integration capability enhances your workflow efficiency without compromising on legal standards. Check our integration list to find compatible tools.

-

What are the benefits of using airSlate SignNow for CIT 0001 compliance?

Using airSlate SignNow for CIT 0001 compliance offers numerous benefits, including faster turnaround times for document signing and enhanced security. Our user-friendly interface allows teams to easily manage the signing process, increasing productivity. Compliance with CIT 0001 helps mitigate legal risks associated with electronic signatures.

-

Is training available for using airSlate SignNow within CIT 0001 guidelines?

Yes, airSlate SignNow offers training resources aimed at helping users understand how to operate the platform effectively while adhering to CIT 0001 guidelines. Our comprehensive tutorials and customer support are designed to facilitate a smooth onboarding experience. Access these resources through our help center.

-

How does airSlate SignNow ensure the security of documents in line with CIT 0001?

airSlate SignNow implements advanced security measures such as encryption and two-factor authentication to protect documents in compliance with CIT 0001. These protocols safeguard sensitive information, ensuring it remains confidential and secure throughout the signing process. Trust airSlate SignNow for reliable document security.

Get more for Cit 0001

- State of north carolina hereinafter referred to as the trustor and the trustee form

- Trustor and beneficiaries the trustor or settlor of this trust is form

- The beneficiary is the child of the trustor form

- Sample timber sale agreement north carolina forest service form

- Sample timber sale contractnc state extension publications form

- North state journal vol 4 issue 32 issuu form

- Working forest conservation easement form

- Rule 45 subpoena a in general 1 form dc courts

Find out other Cit 0001

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form