Colorado Estimated Tax Vouchers Form

What is the Colorado Estimated Tax Vouchers Form

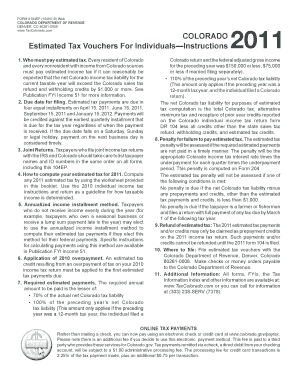

The Colorado Estimated Tax Vouchers Form is a crucial document for individuals and businesses that need to report and pay estimated taxes to the state of Colorado. This form is designed for taxpayers who expect to owe tax of $1,000 or more when filing their annual tax return. By using this form, taxpayers can make quarterly payments throughout the year, helping to manage their tax liabilities more effectively and avoid penalties for underpayment.

How to use the Colorado Estimated Tax Vouchers Form

Using the Colorado Estimated Tax Vouchers Form involves several steps. First, taxpayers should determine their estimated tax liability for the year, which can be based on previous tax returns or current income projections. Once the estimated amount is calculated, taxpayers can fill out the form, indicating the payment amounts and due dates for each quarter. The completed vouchers can then be submitted along with the corresponding payments to ensure compliance with state tax regulations.

Steps to complete the Colorado Estimated Tax Vouchers Form

Completing the Colorado Estimated Tax Vouchers Form requires careful attention to detail. Here are the steps to follow:

- Gather necessary financial documents, including previous tax returns and current income statements.

- Calculate your estimated tax liability for the year.

- Fill out the form with your personal information and estimated tax amounts for each quarter.

- Review the form for accuracy to avoid errors that could lead to penalties.

- Submit the completed vouchers along with your payments by the due dates.

Legal use of the Colorado Estimated Tax Vouchers Form

The Colorado Estimated Tax Vouchers Form is legally binding when completed correctly and submitted on time. To ensure its validity, taxpayers must adhere to state regulations regarding estimated tax payments. This includes making accurate calculations and submitting payments by the specified deadlines. Electronic submission of the form is permissible, provided that it meets the legal requirements for eSignatures and document integrity.

Filing Deadlines / Important Dates

Filing deadlines for the Colorado Estimated Tax Vouchers Form are critical for compliance. Generally, estimated tax payments are due on the 15th of April, June, September, and January of the following year. Taxpayers should mark these dates on their calendars to avoid late fees and penalties. It is advisable to check for any changes in deadlines or additional requirements each tax year.

Form Submission Methods

The Colorado Estimated Tax Vouchers Form can be submitted using various methods. Taxpayers can choose to file online through the Colorado Department of Revenue's website, which offers a convenient and secure way to manage tax payments. Alternatively, the form can be mailed to the appropriate tax office or delivered in person. Each method has its own processing times and requirements, so it is important to select the one that best suits your needs.

Quick guide on how to complete colorado estimated tax vouchers form

Finalize Colorado Estimated Tax Vouchers Form effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents swiftly without delays. Manage Colorado Estimated Tax Vouchers Form on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Colorado Estimated Tax Vouchers Form without hassle

- Find Colorado Estimated Tax Vouchers Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or mislaid files, tiresome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Colorado Estimated Tax Vouchers Form and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the colorado estimated tax vouchers form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Colorado Estimated Tax Vouchers Form?

The Colorado Estimated Tax Vouchers Form is a document that taxpayers in Colorado use to calculate and pay their estimated tax liabilities throughout the year. This form helps individuals and businesses keep their tax contributions on track and avoid penalties. By utilizing the Colorado Estimated Tax Vouchers Form, taxpayers can manage their financial obligations more effectively.

-

How can I obtain the Colorado Estimated Tax Vouchers Form?

You can easily obtain the Colorado Estimated Tax Vouchers Form from the Colorado Department of Revenue's website or through airSlate SignNow, which offers an efficient eSigning solution for documents. Simply search for the form on the state's site or create it digitally with our platform. This ensures you have access to the most current version of the form.

-

What are the benefits of using airSlate SignNow for the Colorado Estimated Tax Vouchers Form?

Using airSlate SignNow for the Colorado Estimated Tax Vouchers Form streamlines the process of filling out and submitting your tax forms. Our platform offers easy electronic signatures, secure storage, and quick document sharing, making tax management simpler and more efficient. This can help you stay organized and meet filing deadlines without the hassle.

-

Is there a cost associated with using airSlate SignNow for the Colorado Estimated Tax Vouchers Form?

Yes, there is a subscription cost associated with using airSlate SignNow, which provides a variety of plans to accommodate different needs. Our service is designed to be cost-effective, especially for businesses that require regular access to features like eSigning and document management. You can choose a plan that best suits your volume of use.

-

Can I integrate airSlate SignNow with other software for managing my Colorado Estimated Tax Vouchers Form?

Absolutely! airSlate SignNow offers seamless integrations with various business applications, which can enhance your workflow for managing the Colorado Estimated Tax Vouchers Form. Whether you're using accounting software or project management tools, our integrations help streamline your document handling process.

-

What features does airSlate SignNow provide for the Colorado Estimated Tax Vouchers Form?

airSlate SignNow offers several features to simplify the management of the Colorado Estimated Tax Vouchers Form, including template creation, automated reminders, and real-time tracking. These tools ensure that you are always informed about the status of your documents and help you stay compliant with filing deadlines.

-

How secure is my data when using airSlate SignNow for the Colorado Estimated Tax Vouchers Form?

Data security is a top priority at airSlate SignNow. Our platform utilizes industry-leading encryption and complies with strict privacy regulations to protect your information when handling the Colorado Estimated Tax Vouchers Form. You can trust that your sensitive data is secure throughout the entire process.

Get more for Colorado Estimated Tax Vouchers Form

- Full text of ampquotimmigration of the irish quakers into form

- Order to show cause imposing form

- Release east coast title agency form

- Answer to 1 complaint and affirmative defenses by google form

- Stipulation of dismissal with form

- You are hereby commanded to attend and give testimony before the above named form

- You are hereby commanded to attend and give testimony before the above named court form

- Uniform commercial arbitration memorandum appendix xxii b

Find out other Colorado Estimated Tax Vouchers Form

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form