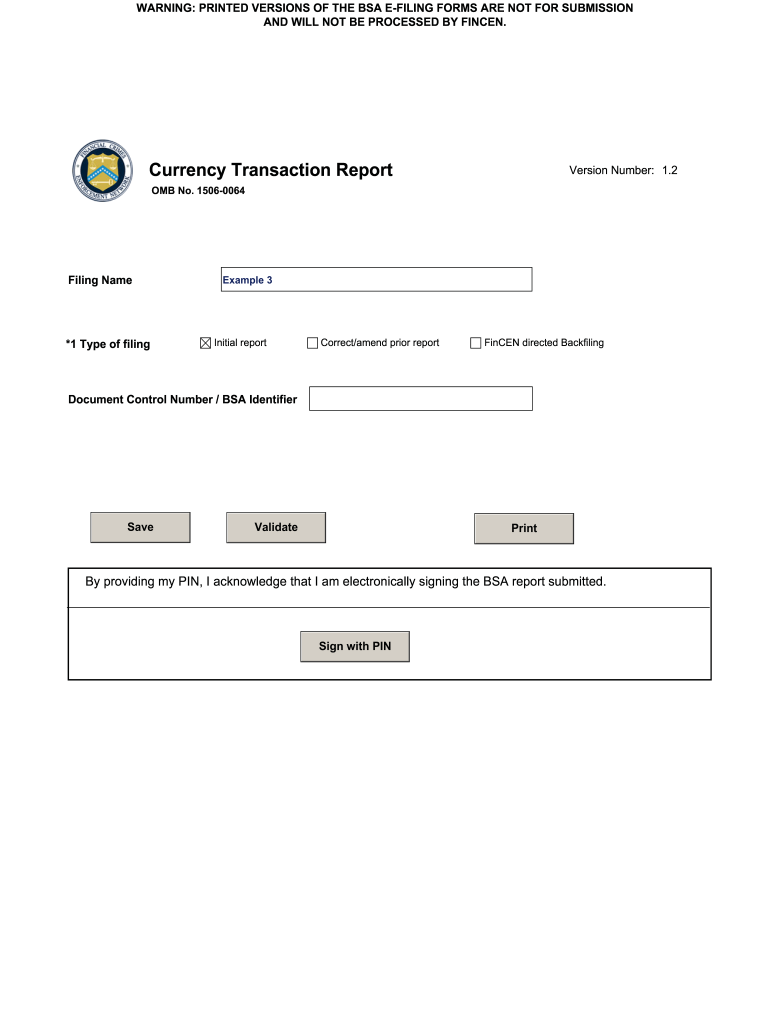

Currency Transaction Report Omb No 1506 0064 Form

What is the Currency Transaction Report OMB No

The Currency Transaction Report (CTR), identified as OMB No , is a crucial financial document mandated by the Bank Secrecy Act (BSA). It is designed to monitor large cash transactions, specifically those exceeding ten thousand dollars. Financial institutions, including banks and credit unions, are required to file this report with the Financial Crimes Enforcement Network (FinCEN) to help prevent money laundering and other financial crimes. The CTR captures essential information about the transaction, including the identity of the individual conducting the transaction, the amount, and the date.

How to Use the Currency Transaction Report OMB No

Utilizing the Currency Transaction Report involves several steps. First, financial institutions must determine if a transaction meets the reporting threshold of ten thousand dollars or more in cash. If so, they must complete the report accurately, ensuring all required fields are filled out. This includes details such as the name and address of the individual involved, the type of transaction, and the financial institution's information. Once completed, the report must be submitted electronically to FinCEN within 15 days of the transaction.

Steps to Complete the Currency Transaction Report OMB No

Completing the Currency Transaction Report requires careful attention to detail. Here are the key steps:

- Gather necessary information about the transaction, including the date, amount, and parties involved.

- Access the CTR form, ensuring you use the most current version.

- Fill in all required fields accurately, including the identity and address of the individual conducting the transaction.

- Review the completed form for any errors or omissions.

- Submit the form electronically to FinCEN within the required timeframe.

Legal Use of the Currency Transaction Report OMB No

The legal framework surrounding the Currency Transaction Report is rooted in the Bank Secrecy Act, which mandates financial institutions to report certain transactions to combat money laundering and other illicit activities. Failure to comply with these regulations can result in significant penalties for institutions. The report serves not only as a compliance tool but also as a means to maintain the integrity of the financial system by providing transparency in large cash transactions.

Key Elements of the Currency Transaction Report OMB No

Several key elements must be included in the Currency Transaction Report to ensure its validity:

- Transaction Date: The exact date when the transaction occurred.

- Amount: The total cash amount involved in the transaction.

- Identifying Information: Details about the individual conducting the transaction, including name, address, and identification number.

- Financial Institution Details: Information about the bank or credit union processing the transaction.

Penalties for Non-Compliance

Non-compliance with the reporting requirements for the Currency Transaction Report can lead to severe consequences. Financial institutions may face hefty fines, which can reach up to twenty-five thousand dollars per violation. Additionally, persistent failure to report can result in criminal charges against the institution or its employees. Maintaining compliance is essential for protecting the institution's reputation and avoiding legal repercussions.

Quick guide on how to complete currency transaction report omb no 1506 0064

Complete Currency Transaction Report Omb No 1506 0064 with ease on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly replacement for traditional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly and without interruptions. Manage Currency Transaction Report Omb No 1506 0064 on any device using airSlate SignNow's Android or iOS applications and streamline your document processes today.

How to alter and eSign Currency Transaction Report Omb No 1506 0064 effortlessly

- Find Currency Transaction Report Omb No 1506 0064 and select Get Form to initiate the process.

- Utilize the available tools to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or disorganized documents, excessive form hunting, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Currency Transaction Report Omb No 1506 0064 and ensure remarkable communication throughout the document preparation stages with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the currency transaction report omb no 1506 0064

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a currency transaction report?

A currency transaction report (CTR) is a document that financial institutions are required to file for any cash transactions exceeding $10,000. It captures key details about the transaction, helping to prevent money laundering and ensure compliance with federal regulations. Understanding how to effectively generate and manage currency transaction reports is crucial for businesses handling signNow cash transactions.

-

How does airSlate SignNow help with currency transaction reports?

airSlate SignNow streamlines the process of creating and managing currency transaction reports by allowing businesses to easily generate, sign, and store these documents electronically. This ensures that all necessary information is captured accurately and securely. Our platform integrates with existing financial systems, making it simple to incorporate CTRs into your workflow.

-

Can I integrate airSlate SignNow with my existing financial software for currency transaction reporting?

Yes, airSlate SignNow offers seamless integrations with various financial software solutions to facilitate the creation of currency transaction reports. This capability allows your team to automate the reporting process and eliminate duplicate data entry. Enjoy enhanced efficiency and accuracy when managing your financial documents and CTRs.

-

What are the pricing plans for using airSlate SignNow for currency transaction reports?

airSlate SignNow offers competitive pricing plans designed to fit businesses of all sizes. You can choose a plan that suits your needs, whether you require basic eSignature features or advanced functionalities for generating currency transaction reports. Explore our pricing options to find a cost-effective solution tailored to your compliance requirements.

-

What features does airSlate SignNow provide for handling currency transaction reports?

Key features of airSlate SignNow for handling currency transaction reports include customizable templates, electronic signing, and secure cloud storage. These features ensure that your CTRs are created efficiently and maintained securely. Additionally, robust tracking and audit trails provide peace of mind concerning your financial documentation.

-

Is airSlate SignNow compliant with regulatory requirements for currency transaction reports?

Absolutely! airSlate SignNow is designed to comply with regulatory standards for currency transaction reports, ensuring that your business adheres to legal obligations. We prioritize security and compliance, so you can focus on your operations without worrying about meeting regulatory requirements for CTRs.

-

What benefits does airSlate SignNow offer for businesses managing currency transaction reports?

Using airSlate SignNow for managing currency transaction reports provides benefits such as increased efficiency, reduced paperwork, and improved accuracy. Our easy-to-use platform enhances collaboration and ensures that your teams can quickly access and sign critical transaction documents. By automating the CTR process, you save time and minimize compliance risks.

Get more for Currency Transaction Report Omb No 1506 0064

- Rocket lawyer affordable legal services free legal form

- Bundling them as well both based on mileage provided by form

- Owner specifically agrees that this release and waiver shall be construed as broadly and form

- Demand for notice of completion and acceptanceindividual form

- As grantors do hereby remise release and quitclaim unto a limited form

- As grantors do hereby grant release and warrant unto a limited form

- Warranty deed from an individual form

- Price hill press 072915 by enquirer media issuu form

Find out other Currency Transaction Report Omb No 1506 0064

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter