FATCACRS Annexure Bank of India Form

What is the FATCACRS Annexure Bank Of India

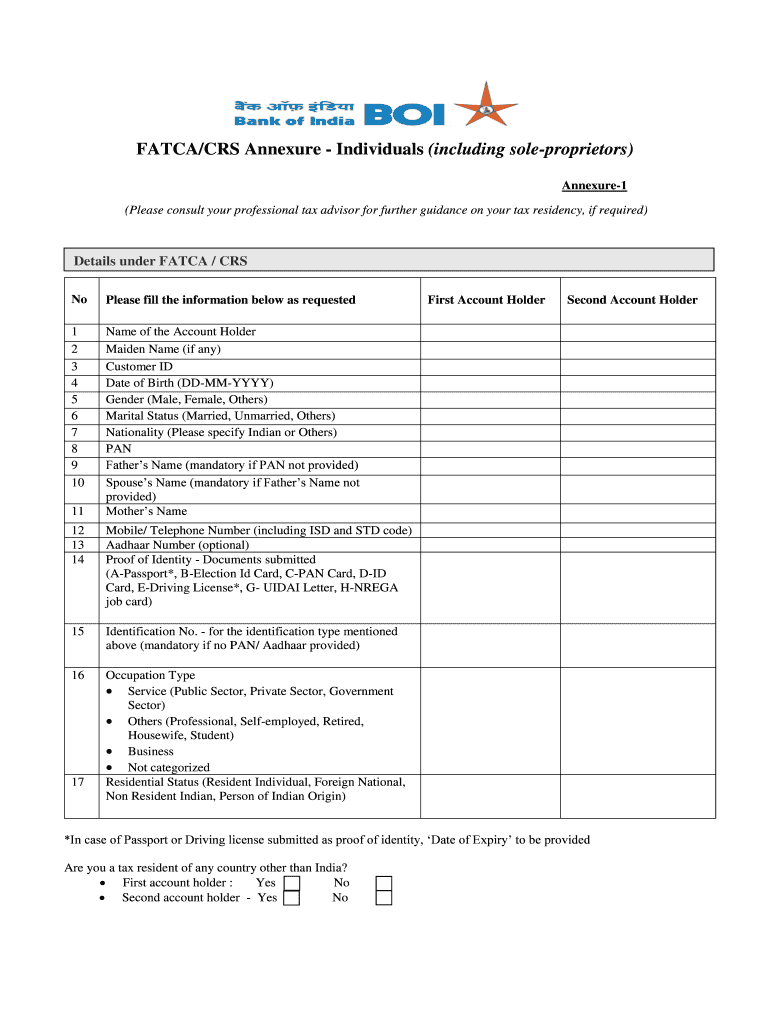

The FATCACRS Annexure Bank Of India is a specific form used for compliance with the Foreign Account Tax Compliance Act (FATCA) regulations. This form is essential for financial institutions to report information about foreign financial accounts held by U.S. taxpayers. The FATCACRS Annexure ensures that the necessary data is collected and submitted to the appropriate authorities, thereby aiding in the prevention of tax evasion. It is crucial for both individuals and businesses involved in international finance to understand this form's requirements and implications.

Steps to complete the FATCACRS Annexure Bank Of India

Completing the FATCACRS Annexure Bank Of India involves several key steps to ensure accuracy and compliance. Begin by gathering all relevant financial information, including account details and taxpayer identification numbers. Next, fill out the form with precise data, ensuring that all sections are completed as required. It is important to review the form for any errors or omissions before submission. Once finalized, the form can be submitted electronically or via traditional mail, depending on the guidelines provided by the Bank of India.

Legal use of the FATCACRS Annexure Bank Of India

The legal use of the FATCACRS Annexure Bank Of India is governed by U.S. tax laws and international agreements. This form must be completed accurately to ensure compliance with FATCA, which mandates that foreign financial institutions report certain information about U.S. account holders. Failure to comply can result in significant penalties for both the financial institution and the account holder. Understanding the legal ramifications of this form is essential for maintaining compliance and avoiding potential legal issues.

How to obtain the FATCACRS Annexure Bank Of India

To obtain the FATCACRS Annexure Bank Of India, individuals or businesses can typically access the form through the official Bank of India website or by visiting a local branch. It may also be available through financial institutions that offer services related to international banking. Ensuring that you have the most current version of the form is important, as regulations may change over time. If assistance is needed, consulting with a tax professional or financial advisor can provide additional guidance.

Examples of using the FATCACRS Annexure Bank Of India

Examples of using the FATCACRS Annexure Bank Of India include scenarios where U.S. citizens or residents hold accounts in foreign banks. For instance, if a U.S. taxpayer has an investment account in India, the FATCACRS Annexure must be completed to report this account to the IRS. Additionally, businesses operating internationally may also need to file this form to disclose foreign accounts held by the company. Understanding these examples can help clarify the form's practical applications.

Required Documents

When completing the FATCACRS Annexure Bank Of India, several documents may be required to ensure the form is filled out correctly. These documents typically include proof of identity, such as a passport or driver's license, tax identification numbers, and financial statements from foreign accounts. Having these documents ready can streamline the process and help avoid delays in submission. It is advisable to check with the Bank of India for any specific documentation requirements related to the form.

Quick guide on how to complete fatcacrs annexure bank of india

Complete FATCACRS Annexure Bank Of India seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage FATCACRS Annexure Bank Of India on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign FATCACRS Annexure Bank Of India with ease

- Find FATCACRS Annexure Bank Of India and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your alterations.

- Choose how you wish to send your form, via email, text (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you select. Edit and eSign FATCACRS Annexure Bank Of India and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fatcacrs annexure bank of india

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is FATCACRS Annexure Bank Of India?

The FATCACRS Annexure Bank Of India refers to the specific documentation required for complying with FATCA regulations while dealing with the Bank of India. This annexure plays an essential role in ensuring that financial institutions report information about account holders who are U.S. taxpayers. Understanding this documentation is crucial for businesses engaging with the Bank of India.

-

How can airSlate SignNow assist with FATCACRS Annexure Bank Of India?

airSlate SignNow simplifies the process of sending and eSigning the FATCACRS Annexure Bank Of India by offering an intuitive platform for document management. With our electronic signature solution, you can quickly prepare, send, and track documents, ensuring compliance while saving time. Thus, you can focus on your core business issues.

-

Is there a cost associated with using airSlate SignNow for FATCACRS Annexure Bank Of India?

Yes, airSlate SignNow operates on a subscription basis. We offer various pricing plans tailored to meet your needs, ensuring you find an economical solution for managing the FATCACRS Annexure Bank Of India. You can choose a plan that provides the features necessary for your business.

-

What features does airSlate SignNow offer for managing FATCACRS Annexure Bank Of India?

airSlate SignNow provides features like customizable templates, real-time tracking, and secure cloud storage specifically designed for documents like the FATCACRS Annexure Bank Of India. These tools help streamline your document workflows, enhance collaboration, and ensure compliance with regulatory needs.

-

Are there integrations available for airSlate SignNow with other software related to FATCACRS Annexure Bank Of India?

Yes, airSlate SignNow offers numerous integrations with popular software applications such as CRM systems, accounting tools, and document management platforms. These integrations allow you to effortlessly manage and send the FATCACRS Annexure Bank Of India without interrupting your existing workflows.

-

What benefits does airSlate SignNow provide for handling FATCACRS Annexure Bank Of India?

Using airSlate SignNow provides signNow benefits like speed, security, and ease of use, particularly for the FATCACRS Annexure Bank Of India. By adopting electronic signatures and a streamlined document process, you reduce paper waste, ensure compliance, and improve the overall efficiency of your financial operations.

-

Can airSlate SignNow help businesses in case of compliance issues related to FATCACRS Annexure Bank Of India?

Absolutely. airSlate SignNow is designed to enhance compliance with various regulations, including those related to the FATCACRS Annexure Bank Of India. Our platform offers audit trails and secure documentation to help protect your business and adequately address compliance inquiries.

Get more for FATCACRS Annexure Bank Of India

- Guarantee agreement for leaseco signer agreement form

- Elsewhere in the building and landlord reserves the right to remove any and all objectionable items and nuisances form

- Affidavit claiming senior citizen exemption from transfer tax form

- Form tp 584 i919instructions for form tp 584 taxnygov

- Third party notification for real property taxes application form

- New york state department of taxation and finance tp 584 i form

- Ptax 343 application for the homestead exemption for form

- The basis of venue is form

Find out other FATCACRS Annexure Bank Of India

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now