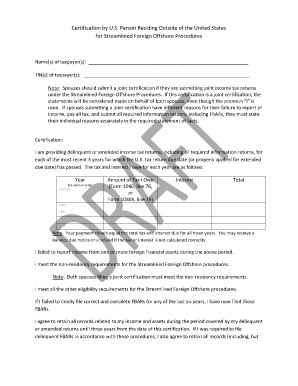

Form 14653 Statement Example

What is the Form 14653 Statement Example

The Form 14653, also known as the Statement of Non-Willful Conduct, is a document used by U.S. taxpayers to explain their non-willful failure to report foreign financial assets. This form is particularly relevant for individuals participating in the IRS's Offshore Voluntary Disclosure Program. The purpose of the form is to provide a clear narrative that outlines the reasons for the non-compliance, which can help mitigate penalties associated with the failure to report.

How to use the Form 14653 Statement Example

Using the Form 14653 involves detailing your circumstances regarding foreign financial accounts. You should clearly articulate the reasons for your non-willful conduct, ensuring that your statements are honest and precise. The form requires you to provide information about your financial situation, including the nature of your foreign accounts and any steps taken to rectify the reporting issues. It's important to be thorough, as this information will be evaluated by the IRS to determine your eligibility for reduced penalties.

Steps to complete the Form 14653 Statement Example

Completing the Form 14653 involves several key steps:

- Gather relevant documentation regarding your foreign financial accounts.

- Clearly describe the circumstances that led to your non-compliance.

- Detail any actions you have taken to correct the reporting issues.

- Review your statements for accuracy and completeness.

- Submit the completed form as part of your voluntary disclosure submission.

Legal use of the Form 14653 Statement Example

The Form 14653 is legally binding when completed accurately and submitted in accordance with IRS guidelines. It serves as a formal declaration of your non-willful conduct and is essential for those seeking to avoid or reduce penalties. Compliance with the form's requirements is crucial, as any misrepresentation or omission could lead to further legal complications.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the Form 14653. Taxpayers must ensure that they follow these guidelines closely to avoid any issues with their disclosures. The IRS emphasizes the importance of transparency and accuracy in reporting foreign financial accounts, and any discrepancies can lead to penalties or disqualification from the voluntary disclosure program.

Required Documents

When completing the Form 14653, you may need to provide supporting documentation. This can include:

- Bank statements from foreign accounts.

- Documentation showing your efforts to comply with reporting requirements.

- Any correspondence with the IRS regarding your foreign financial accounts.

Having these documents ready can enhance the credibility of your statement and support your case for non-willful conduct.

Eligibility Criteria

To use the Form 14653, you must meet certain eligibility criteria set by the IRS. Generally, this includes being a U.S. taxpayer who has failed to report foreign financial assets due to non-willful conduct. You should also be prepared to demonstrate that your failure to report was not intentional and that you have taken steps to comply with tax obligations moving forward.

Quick guide on how to complete form 14653 statement example

Complete Form 14653 Statement Example effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an excellent eco-conscious substitute for traditional printed and signed documents, allowing you to locate the appropriate form and safely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without interruptions. Manage Form 14653 Statement Example on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-centric operation today.

The easiest way to modify and electronically sign Form 14653 Statement Example with ease

- Locate Form 14653 Statement Example and click Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Emphasize signNow sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature with the Sign feature, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you want to deliver your form, via email, text (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 14653 Statement Example and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 14653 statement example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 14653 statement example used for?

The form 14653 statement example is primarily used by taxpayers to provide an explanation and details regarding non-compliance with IRS tax obligations. It serves as a mechanism for taxpayers to present their case for penalty relief and offers a structured approach to clarify their specific situation.

-

How can airSlate SignNow help me with the form 14653 statement example?

airSlate SignNow simplifies the process of preparing and sending your form 14653 statement example by providing an intuitive eSignature platform. You can easily complete the document, gather signatures, and track its status, ensuring an efficient and compliant submission to the IRS.

-

What features does airSlate SignNow offer for managing the form 14653 statement example?

airSlate SignNow offers features such as customizable templates, advanced security options, and real-time collaboration for the form 14653 statement example. These tools enhance your ability to manage documents efficiently, ensuring that all necessary parties can accurately review and sign the statement.

-

Is there a template available for the form 14653 statement example on airSlate SignNow?

Yes, airSlate SignNow provides a customizable template for the form 14653 statement example, making it easier for users to fill out the required information. This template streamlines the preparation process, allowing you to focus on presenting the necessary details effectively.

-

What is the pricing model for airSlate SignNow when using the form 14653 statement example?

airSlate SignNow operates on a subscription-based pricing model, ensuring cost-effectiveness while utilizing features related to the form 14653 statement example. Plans are designed to fit various business needs, providing flexibility and scalability as your requirements grow.

-

Can I integrate other tools with airSlate SignNow for the form 14653 statement example?

Yes, airSlate SignNow offers integrations with various business tools and applications to enhance your workflow when handling the form 14653 statement example. These integrations help streamline processes and ensure that documents are easily accessible across your preferred platforms.

-

What benefits does using airSlate SignNow provide when submitting the form 14653 statement example?

Using airSlate SignNow for your form 14653 statement example provides numerous benefits, including increased efficiency, reduced errors, and enhanced security for sensitive information. The platform ensures that your documents are processed quickly and provides tracking features to monitor their status.

Get more for Form 14653 Statement Example

- Supreme courtpage 3immigrationcourtsidecom form

- Manufactured home transaction form

- Additional debtors name provide only one debtor name 20a or 20b use exact full name do not omit modify or abbreviate any part form

- Item 6a or 6b and item 7a or 7b and item 7c form

- Filing office copy ucc financing statement amendment additional party form ucc3ap rev

- Enter in item 3 the basis for the belief by the debtor of record identified in item 5 that the record identified in item 1 is form

- New mexico legal last will and testament form for single

- Illinois legal last will and testament form for married

Find out other Form 14653 Statement Example

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word