Form 1040X Rev November Amended U S Individual Income Tax Return

What is the Form 1040X Rev November Amended U S Individual Income Tax Return

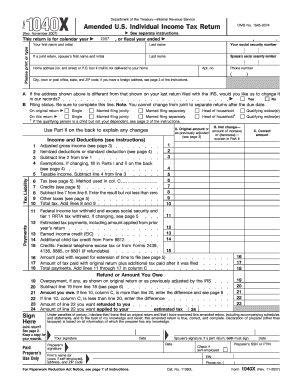

The Form 1040X Rev November Amended U S Individual Income Tax Return is a crucial document for U.S. taxpayers who need to correct or amend their previously filed tax returns. This form allows individuals to make changes to their original Form 1040, including adjustments to income, deductions, and credits. It is essential for ensuring that your tax information is accurate and up to date, potentially leading to a refund or reducing tax liabilities.

How to use the Form 1040X Rev November Amended U S Individual Income Tax Return

Using the Form 1040X involves several key steps. First, you need to gather your original tax return and any supporting documents that relate to the changes you wish to make. Next, complete the form by clearly indicating the corrections in the appropriate sections. It is important to explain the reasons for the amendments in the designated area. Once completed, you can submit the form either electronically or by mail, depending on your preference and eligibility.

Steps to complete the Form 1040X Rev November Amended U S Individual Income Tax Return

Completing the Form 1040X requires careful attention to detail. Start by filling out your personal information at the top of the form. Then, in Part I, provide the information from your original return, including the amounts as they were originally reported. In Part II, enter the corrected amounts and explain the changes in Part III. Ensure that all calculations are accurate, as errors can lead to processing delays. Finally, sign and date the form before submitting it.

Legal use of the Form 1040X Rev November Amended U S Individual Income Tax Return

The legal use of the Form 1040X is governed by IRS regulations. This form is recognized as a valid method for amending tax returns, provided it is completed accurately and submitted within the designated time frame. It is essential to adhere to IRS guidelines to ensure that any amendments are legally binding. Failure to comply with these regulations may result in penalties or denial of the requested changes.

Filing Deadlines / Important Dates

When filing the Form 1040X, it is important to be aware of the deadlines. Generally, you must file the amended return within three years from the original filing date or within two years from the date you paid the tax, whichever is later. Keeping track of these dates is crucial to ensure that you do not miss the opportunity to amend your return and potentially receive a refund.

Form Submission Methods (Online / Mail / In-Person)

The Form 1040X can be submitted through various methods. Taxpayers can file electronically using IRS-approved e-filing software, which simplifies the process and speeds up processing times. Alternatively, you can mail the completed form to the appropriate IRS address based on your state of residence. In-person submissions are generally not available for amended returns, so electronic filing or mailing are the primary options.

Quick guide on how to complete form 1040x rev november amended u s individual income tax return

Complete Form 1040X Rev November Amended U S Individual Income Tax Return effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Form 1040X Rev November Amended U S Individual Income Tax Return on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign Form 1040X Rev November Amended U S Individual Income Tax Return with ease

- Locate Form 1040X Rev November Amended U S Individual Income Tax Return and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information using tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign Form 1040X Rev November Amended U S Individual Income Tax Return to ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1040x rev november amended u s individual income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1040X Rev November Amended U S Individual Income Tax Return?

The Form 1040X Rev November Amended U S Individual Income Tax Return is a tax form used to amend previously filed tax returns. It allows individuals to correct errors, make changes, or claim additional deductions on their federal income tax return. This form is essential for ensuring your tax filings are accurate and up-to-date.

-

How does airSlate SignNow help with the Form 1040X Rev November Amended U S Individual Income Tax Return?

airSlate SignNow simplifies the process of preparing and eSigning the Form 1040X Rev November Amended U S Individual Income Tax Return. With its user-friendly interface, you can easily fill out the form, apply electronic signatures, and submit it securely, saving you time and effort during tax season.

-

Is there a cost associated with using airSlate SignNow for the Form 1040X Rev November Amended U S Individual Income Tax Return?

Yes, airSlate SignNow offers various pricing plans to accommodate different user needs. You can choose a subscription that fits your budget while allowing you to access features needed for the Form 1040X Rev November Amended U S Individual Income Tax Return. Check our website for current pricing details and special offers.

-

What features does airSlate SignNow offer for tax documents like the Form 1040X Rev November Amended U S Individual Income Tax Return?

airSlate SignNow provides features such as customizable templates, bulk sending, and advanced security options to protect your sensitive tax documents. For the Form 1040X Rev November Amended U S Individual Income Tax Return, these features enhance efficiency and ensure your documents are handled correctly and securely.

-

Can I integrate airSlate SignNow with other software for managing my Form 1040X Rev November Amended U S Individual Income Tax Return?

Absolutely! airSlate SignNow offers integration options with popular software like CRM tools, accounting platforms, and more. This means you can seamlessly manage and track your Form 1040X Rev November Amended U S Individual Income Tax Return within your preferred applications, enhancing workflow efficiency.

-

What are the benefits of using airSlate SignNow for my amended tax return?

Using airSlate SignNow to file your Form 1040X Rev November Amended U S Individual Income Tax Return provides numerous benefits. You'll have a cost-effective solution for electronic signing and document management, ensuring that you meet deadlines while minimizing paperwork. Additionally, the tracking features help you stay informed about the status of your submitted forms.

-

Is electronic filing of the Form 1040X Rev November Amended U S Individual Income Tax Return possible with airSlate SignNow?

Yes, airSlate SignNow supports electronic filing for the Form 1040X Rev November Amended U S Individual Income Tax Return. By utilizing our platform, you can prepare your amended return digitally, eSign it, and transmit it directly to the IRS, streamlining the entire process and reducing potential delays.

Get more for Form 1040X Rev November Amended U S Individual Income Tax Return

- Control number oh p007 pkg form

- Control number oh p009 pkg form

- Control number oh p011 pkg form

- Ohio statutory form power of attorney ohio state bar

- Ohio online legal formsproseniors

- Control number oh p013 pkg form

- Sc health care power of attorney south carolina hospital form

- Rules for changing domicile to reduce state income taxes form

Find out other Form 1040X Rev November Amended U S Individual Income Tax Return

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself