Nys Department of Taxation and Finance Rp 420 B Form

What is the Nys Department Of Taxation And Finance Rp 420 B Form

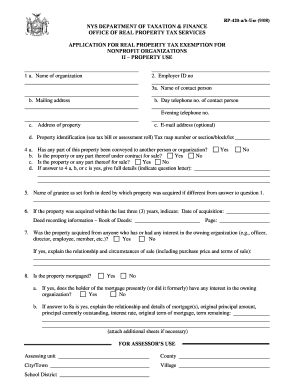

The Nys Department Of Taxation And Finance Rp 420 B Form is a specific document used for reporting certain financial information related to property tax exemptions in New York State. This form is primarily utilized by property owners who are seeking to claim benefits or exemptions on their property taxes. Understanding the purpose of this form is essential for ensuring compliance with state tax regulations and for maximizing potential tax savings.

How to use the Nys Department Of Taxation And Finance Rp 420 B Form

Using the Nys Department Of Taxation And Finance Rp 420 B Form involves several steps. First, ensure that you meet the eligibility criteria for the exemptions you are claiming. Next, gather all necessary documentation, such as proof of ownership and any supporting financial records. Carefully fill out the form, ensuring that all information is accurate and complete. Finally, submit the form according to the specific guidelines outlined by the New York State Department of Taxation and Finance.

Steps to complete the Nys Department Of Taxation And Finance Rp 420 B Form

Completing the Nys Department Of Taxation And Finance Rp 420 B Form requires attention to detail. Begin by downloading the form from the official website or obtaining a physical copy. Follow these steps:

- Read the instructions carefully to understand the requirements.

- Fill in your personal and property information accurately.

- Provide any necessary financial documentation as required.

- Review the completed form for any errors or omissions.

- Submit the form by the deadline specified by the state.

Key elements of the Nys Department Of Taxation And Finance Rp 420 B Form

Several key elements must be included in the Nys Department Of Taxation And Finance Rp 420 B Form to ensure it is processed correctly. These elements typically include:

- Property owner's name and contact information.

- Property address and identification number.

- Details of the exemption being claimed.

- Signature of the property owner or authorized representative.

Form Submission Methods

The Nys Department Of Taxation And Finance Rp 420 B Form can be submitted through various methods. Property owners may choose to submit the form online via the New York State Department of Taxation and Finance website, or they can send a physical copy through the mail. In some cases, in-person submission may also be an option, depending on local regulations and office availability.

Legal use of the Nys Department Of Taxation And Finance Rp 420 B Form

The legal use of the Nys Department Of Taxation And Finance Rp 420 B Form is governed by state tax laws. It is essential for property owners to understand that submitting this form inaccurately or late may result in penalties or denial of the claimed exemptions. Compliance with all legal requirements ensures that the form is valid and that the property owner can benefit from the exemptions available.

Quick guide on how to complete nys department of taxation and finance rp 420 b form

Prepare Nys Department Of Taxation And Finance Rp 420 B Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Nys Department Of Taxation And Finance Rp 420 B Form on any device with airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

The easiest way to modify and eSign Nys Department Of Taxation And Finance Rp 420 B Form effortlessly

- Locate Nys Department Of Taxation And Finance Rp 420 B Form and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Purge the frustration of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document versions. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your selection. Modify and eSign Nys Department Of Taxation And Finance Rp 420 B Form and ensure exceptional communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nys department of taxation and finance rp 420 b form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nys Department Of Taxation And Finance Rp 420 B Form?

The Nys Department Of Taxation And Finance Rp 420 B Form is an official document required for certain tax-related transactions in New York State. It serves to report specific tax information and ensure compliance with state regulations. Understanding this form is crucial for timely tax management.

-

How can airSlate SignNow help with the Nys Department Of Taxation And Finance Rp 420 B Form?

airSlate SignNow streamlines the process of completing and submitting the Nys Department Of Taxation And Finance Rp 420 B Form by providing an intuitive platform for eSigning and document management. Users can easily fill out the form, add signatures, and send it directly to the relevant agency, simplifying the workflow and ensuring accuracy.

-

Is there a cost associated with using airSlate SignNow for the Nys Department Of Taxation And Finance Rp 420 B Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan allows users to utilize the platform for eSigning documents, including the Nys Department Of Taxation And Finance Rp 420 B Form. The affordable pricing is designed to provide cost-effective solutions for businesses of any size.

-

What features does airSlate SignNow offer for the Nys Department Of Taxation And Finance Rp 420 B Form?

airSlate SignNow provides several features beneficial for managing the Nys Department Of Taxation And Finance Rp 420 B Form, such as customizable templates, secure eSigning, and real-time tracking. These features enhance efficiency and help ensure that all documents are handled in compliance with regulations.

-

Can I integrate airSlate SignNow with other software for filing the Nys Department Of Taxation And Finance Rp 420 B Form?

Absolutely! airSlate SignNow supports integration with various popular applications, making it easy to incorporate into your existing workflow for filing the Nys Department Of Taxation And Finance Rp 420 B Form. This seamless integration enhances productivity by allowing users to manage documents from their preferred platforms.

-

What are the benefits of using airSlate SignNow for tax forms like the Nys Department Of Taxation And Finance Rp 420 B Form?

Using airSlate SignNow ensures that the completion and submission of the Nys Department Of Taxation And Finance Rp 420 B Form are not only quicker but also more secure. The platform enhances collaboration among team members and provides audit trails for compliance purposes, offering peace of mind for businesses.

-

Is airSlate SignNow suitable for small businesses dealing with the Nys Department Of Taxation And Finance Rp 420 B Form?

Yes, airSlate SignNow is designed to be user-friendly and cost-effective, making it an excellent choice for small businesses handling the Nys Department Of Taxation And Finance Rp 420 B Form. The platform's simplicity allows small business owners to manage their documents efficiently without needing extensive technical knowledge.

Get more for Nys Department Of Taxation And Finance Rp 420 B Form

- Quit claim deed oklahoma county oklahoma form

- Oklahoma legal forms oklahoma legal documents

- Control number ok p004 pkg form

- Control number ok p005 pkg form

- Control number ok p006 pkg form

- Control number ok p007 pkg form

- This document was acknowledged before me on date form

- Control number ok p011 pkg form

Find out other Nys Department Of Taxation And Finance Rp 420 B Form

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online