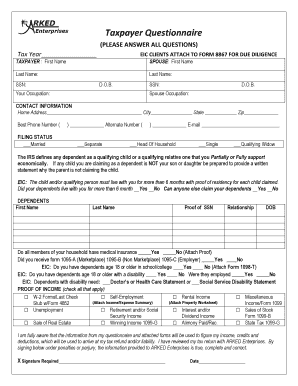

Taxpayer Questionnaire PLEASE ANSWER ALL QUESTIONS Tax Year EIC CLIENTS ATTACH to FORM 8867 for DUE DILIGENCE TAXPAYER First Nam

What is the Taxpayer Questionnaire?

The Taxpayer Questionnaire is a crucial document for clients applying for the Earned Income Credit (EIC) during the tax year. This form, which must be attached to Form 8867 for due diligence, collects essential personal information from taxpayers and their spouses. It includes fields for first names, last names, and Social Security Numbers, ensuring that all necessary details are accurately recorded. This questionnaire is designed to help tax preparers verify eligibility for the EIC and comply with IRS requirements.

Steps to Complete the Taxpayer Questionnaire

Completing the Taxpayer Questionnaire involves several straightforward steps:

- Begin by entering your first name and last name in the designated fields.

- Next, provide your spouse's first name and last name if applicable.

- Fill in the Social Security Numbers (SSNs) for both you and your spouse.

- Answer all questions thoroughly to ensure compliance with IRS guidelines.

- Review the completed questionnaire for accuracy before submission.

Each section of the questionnaire is important, as incomplete or inaccurate information may lead to delays or penalties.

Legal Use of the Taxpayer Questionnaire

The Taxpayer Questionnaire serves a legal purpose in the context of tax filings. It is a necessary component for establishing due diligence in claiming the Earned Income Credit. By accurately completing and submitting this questionnaire, taxpayers affirm that they meet the eligibility criteria set forth by the IRS. This document can be used as evidence in case of audits or disputes regarding EIC claims, making its proper completion essential for legal compliance.

IRS Guidelines for the Taxpayer Questionnaire

The IRS has established specific guidelines for the Taxpayer Questionnaire to ensure that all information is collected consistently and accurately. Tax preparers must adhere to these guidelines when assisting clients in completing the form. Key points include:

- All questions must be answered fully to avoid non-compliance issues.

- Tax preparers are responsible for verifying the accuracy of the information provided.

- Failure to comply with IRS guidelines may result in penalties for both the taxpayer and the preparer.

Understanding these guidelines is crucial for ensuring that the questionnaire meets all necessary legal requirements.

Required Documents for the Taxpayer Questionnaire

To complete the Taxpayer Questionnaire, certain documents may be required to support the information provided. These documents include:

- Proof of income, such as W-2 forms or 1099 statements.

- Documentation of any qualifying children, if applicable.

- Identification documents, including Social Security cards for all individuals listed on the form.

Gathering these documents in advance can streamline the completion process and ensure accuracy.

Form Submission Methods

The Taxpayer Questionnaire can be submitted in various ways, depending on the preferences of the taxpayer and the requirements of the tax preparer. Common submission methods include:

- Online submission through secure e-filing systems.

- Mailing the completed form to the appropriate IRS address.

- In-person submission at designated tax preparation offices.

Choosing the right submission method is important for ensuring timely processing of your tax return.

Quick guide on how to complete taxpayer questionnaire please answer all questions tax year eic clients attach to form 8867 for due diligence taxpayer first

Finalize Taxpayer Questionnaire PLEASE ANSWER ALL QUESTIONS Tax Year EIC CLIENTS ATTACH TO FORM 8867 FOR DUE DILIGENCE TAXPAYER First Nam effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely archive it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Handle Taxpayer Questionnaire PLEASE ANSWER ALL QUESTIONS Tax Year EIC CLIENTS ATTACH TO FORM 8867 FOR DUE DILIGENCE TAXPAYER First Nam across any platform with the airSlate SignNow Android or iOS applications and enhance any document-centric activity today.

How to alter and electronically sign Taxpayer Questionnaire PLEASE ANSWER ALL QUESTIONS Tax Year EIC CLIENTS ATTACH TO FORM 8867 FOR DUE DILIGENCE TAXPAYER First Nam with ease

- Obtain Taxpayer Questionnaire PLEASE ANSWER ALL QUESTIONS Tax Year EIC CLIENTS ATTACH TO FORM 8867 FOR DUE DILIGENCE TAXPAYER First Nam and then click Get Form to begin.

- Employ the tools we provide to complete your document.

- Emphasize key sections of your documents or redact sensitive details with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all information and then click the Done button to save your changes.

- Choose how you would like to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Taxpayer Questionnaire PLEASE ANSWER ALL QUESTIONS Tax Year EIC CLIENTS ATTACH TO FORM 8867 FOR DUE DILIGENCE TAXPAYER First Nam and ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the taxpayer questionnaire please answer all questions tax year eic clients attach to form 8867 for due diligence taxpayer first

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'Taxpayer Questionnaire PLEASE ANSWER ALL QUESTIONS Tax Year EIC CLIENTS ATTACH TO FORM 8867 FOR DUE DILIGENCE TAXPAYER First Name SPOUSE First Name Last Name Last Name SSN D.'?

The 'Taxpayer Questionnaire PLEASE ANSWER ALL QUESTIONS Tax Year EIC CLIENTS ATTACH TO FORM 8867 FOR DUE DILIGENCE TAXPAYER First Name SPOUSE First Name Last Name Last Name SSN D.' is a comprehensive form that requires taxpayers to provide essential personal and financial information for due diligence. This form is vital for ensuring compliance with IRS regulations while claiming the Earned Income Credit (EIC). By completing this questionnaire thoroughly, clients can help streamline the filing process.

-

How does airSlate SignNow help in completing the Taxpayer Questionnaire?

With airSlate SignNow, clients can easily complete the 'Taxpayer Questionnaire PLEASE ANSWER ALL QUESTIONS Tax Year EIC CLIENTS ATTACH TO FORM 8867 FOR DUE DILIGENCE TAXPAYER First Name SPOUSE First Name Last Name Last Name SSN D.' through our intuitive eSigning platform. Our solution allows users to fill out the questionnaire directly online, ensuring accuracy and efficiency. This simplifies the process and allows you to submit the form by integrating it directly with IRS standards.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for your tax documentation, including the 'Taxpayer Questionnaire PLEASE ANSWER ALL QUESTIONS Tax Year EIC CLIENTS ATTACH TO FORM 8867 FOR DUE DILIGENCE TAXPAYER First Name SPOUSE First Name Last Name Last Name SSN D.', ensures a secure and efficient process. Our platform offers real-time collaboration, easy document tracking, and robust security features to protect your sensitive information. This enhances your workflow and compliance while reducing the time spent on paperwork.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow provides a cost-effective solution for small businesses managing documents, including the 'Taxpayer Questionnaire PLEASE ANSWER ALL QUESTIONS Tax Year EIC CLIENTS ATTACH TO FORM 8867 FOR DUE DILIGENCE TAXPAYER First Name SPOUSE First Name Last Name Last Name SSN D.'. Our pricing structure is designed to accommodate businesses of all sizes, making it accessible without compromising on features or security. This allows small businesses to efficiently manage their tax documentation and compliance needs.

-

Can airSlate SignNow integrate with other accounting software?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software to streamline the process of filling out the 'Taxpayer Questionnaire PLEASE ANSWER ALL QUESTIONS Tax Year EIC CLIENTS ATTACH TO FORM 8867 FOR DUE DILIGENCE TAXPAYER First Name SPOUSE First Name Last Name Last Name SSN D.'. This integration enables users to automatically import data, reducing discrepancies and ensuring that you have the correct information on file when completing forms. Enhanced integration features save you time and simplify your workflows.

-

How secure is the information submitted through airSlate SignNow?

Security is a top priority at airSlate SignNow. When you submit the 'Taxpayer Questionnaire PLEASE ANSWER ALL QUESTIONS Tax Year EIC CLIENTS ATTACH TO FORM 8867 FOR DUE DILIGENCE TAXPAYER First Name SPOUSE First Name Last Name Last Name SSN D.', your data is protected through advanced encryption standards and secure storage protocols. Additionally, our platform regularly undergoes security audits to ensure compliance with industry standards, safeguarding your sensitive information at all times.

-

What features does airSlate SignNow offer for tax-related documents?

airSlate SignNow offers a variety of features specifically tailored for tax-related documents, such as the 'Taxpayer Questionnaire PLEASE ANSWER ALL QUESTIONS Tax Year EIC CLIENTS ATTACH TO FORM 8867 FOR DUE DILIGENCE TAXPAYER First Name SPOUSE First Name Last Name Last Name SSN D.'. These include customizable templates, automated workflows, eSigning capabilities, and compliance tracking. Such features streamline the process, making it easier for users to manage and complete their tax documentation efficiently.

Get more for Taxpayer Questionnaire PLEASE ANSWER ALL QUESTIONS Tax Year EIC CLIENTS ATTACH TO FORM 8867 FOR DUE DILIGENCE TAXPAYER First Nam

- Insurance sub lessee shall during the entire term of the lease keep in full force and effect a form

- Forms rhode island

- Stipulationpdf fpdf doc docxrhode island forms workflow

- Rejected usually within five 5 days of form

- End of lease form

- Application for sub lease page 1 form

- Tenant print name form

- Disconnected phone and utility services form

Find out other Taxpayer Questionnaire PLEASE ANSWER ALL QUESTIONS Tax Year EIC CLIENTS ATTACH TO FORM 8867 FOR DUE DILIGENCE TAXPAYER First Nam

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document