Form 8815 Instructions

What is the Form 8815 Instructions

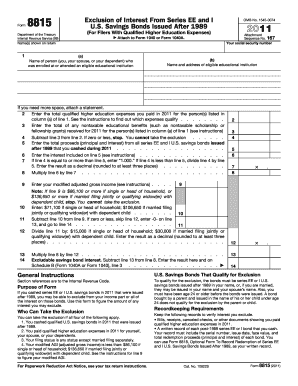

The Form 8815 is an important document used by taxpayers to claim a tax exemption on interest earned from qualified U.S. savings bonds. Specifically for the tax year 2020, the instructions for this form guide individuals on how to properly complete it to ensure compliance with IRS regulations. This form is particularly relevant for those who have used savings bonds to pay for qualified education expenses, allowing them to exclude some or all of the interest from their taxable income.

Steps to complete the Form 8815 Instructions

Completing the Form 8815 involves several key steps that ensure accurate reporting of savings bond interest. First, gather all necessary documents, including the Form 8815 itself and any related tax forms. Next, follow these steps:

- Identify the qualified savings bonds you have cashed during the tax year.

- Determine the amount of interest earned on these bonds.

- Complete the form by entering your personal information, including your Social Security number.

- Calculate the amount of interest that qualifies for exclusion based on the education expenses you have incurred.

- Review your entries for accuracy before submitting the form.

Legal use of the Form 8815 Instructions

Utilizing the Form 8815 correctly is essential for legal compliance with IRS regulations. The instructions outline the necessary criteria for claiming the tax exemption, ensuring that taxpayers understand their eligibility. It is crucial to adhere to the guidelines provided to avoid potential penalties or issues with the IRS. This includes accurately reporting your income and ensuring that the expenses claimed align with the requirements set forth by the IRS.

Filing Deadlines / Important Dates

For the tax year 2020, the deadline for filing Form 8815 coincides with the standard tax filing deadline, which is typically April 15 of the following year. Taxpayers should be aware of any extensions that may apply, as well as any specific dates that could affect their filing process. Timely submission of the form is critical to avoid late fees and ensure that any tax benefits are received without delay.

Required Documents

To successfully complete and file Form 8815, certain documents are required. These may include:

- IRS Form 8815 itself.

- Records of the savings bonds cashed during the tax year.

- Documentation of qualified education expenses, such as tuition statements or receipts.

- Personal identification information, including your Social Security number.

Who Issues the Form

The Form 8815 is issued by the Internal Revenue Service (IRS), which is the U.S. government agency responsible for tax collection and tax law enforcement. The IRS provides the official instructions and guidelines for completing the form, ensuring that taxpayers have the necessary resources to comply with tax regulations. It is important to refer to the IRS website or official publications for the most current version of the form and any updates to the instructions.

Quick guide on how to complete form 8815 instructions

Finish Form 8815 Instructions effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Handle Form 8815 Instructions on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest method to modify and electronically sign Form 8815 Instructions without hassle

- Find Form 8815 Instructions and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign feature, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Leave behind worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Alter and electronically sign Form 8815 Instructions and ensure great communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8815 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8815 2020 and who needs it?

Form 8815 2020 is a tax form used by individuals to report interest income for tax purposes. It is necessary for individuals who received a refund or adjustment to their bond interest. Understanding how to correctly fill out form 8815 2020 is crucial for accurate tax reporting.

-

How can airSlate SignNow assist with the completion of form 8815 2020?

airSlate SignNow provides an easy-to-use platform that allows users to fill out and eSign form 8815 2020 electronically. With its intuitive interface, you can streamline the completion process, ensuring you don’t miss any critical information or signatures.

-

Is there a cost associated with using airSlate SignNow for form 8815 2020?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including handling documents like form 8815 2020. You can choose a plan that fits your requirements and budget, making it a cost-effective solution for eSigning and document management.

-

What features does airSlate SignNow offer for managing form 8815 2020?

AirSlate SignNow offers several features such as customizable templates, real-time collaboration, and secure storage for documents like form 8815 2020. These tools help ensure that your forms are filled out correctly and securely shared with the necessary parties.

-

Can I integrate airSlate SignNow with other software for form 8815 2020 processing?

Yes, airSlate SignNow supports various integrations with popular business applications, making it easier to manage documents such as form 8815 2020. This allows for smoother workflows and enhances your ability to handle your forms efficiently.

-

What are the benefits of using airSlate SignNow for tax forms like form 8815 2020?

Using airSlate SignNow for tax forms like form 8815 2020 ensures a faster, more efficient process for document completion and eSigning. This not only saves time but also minimizes errors, helping you stay compliant and organized during tax season.

-

Is airSlate SignNow legally recognized for submitting form 8815 2020?

Yes, airSlate SignNow is legally recognized for electronic signatures and submissions, including for form 8815 2020. This means that using our platform ensures that your signed tax forms are valid and can be accepted by the IRS.

Get more for Form 8815 Instructions

Find out other Form 8815 Instructions

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word