Indemnity Form Hdfc Bank

What is the indemnity form HDFC Bank?

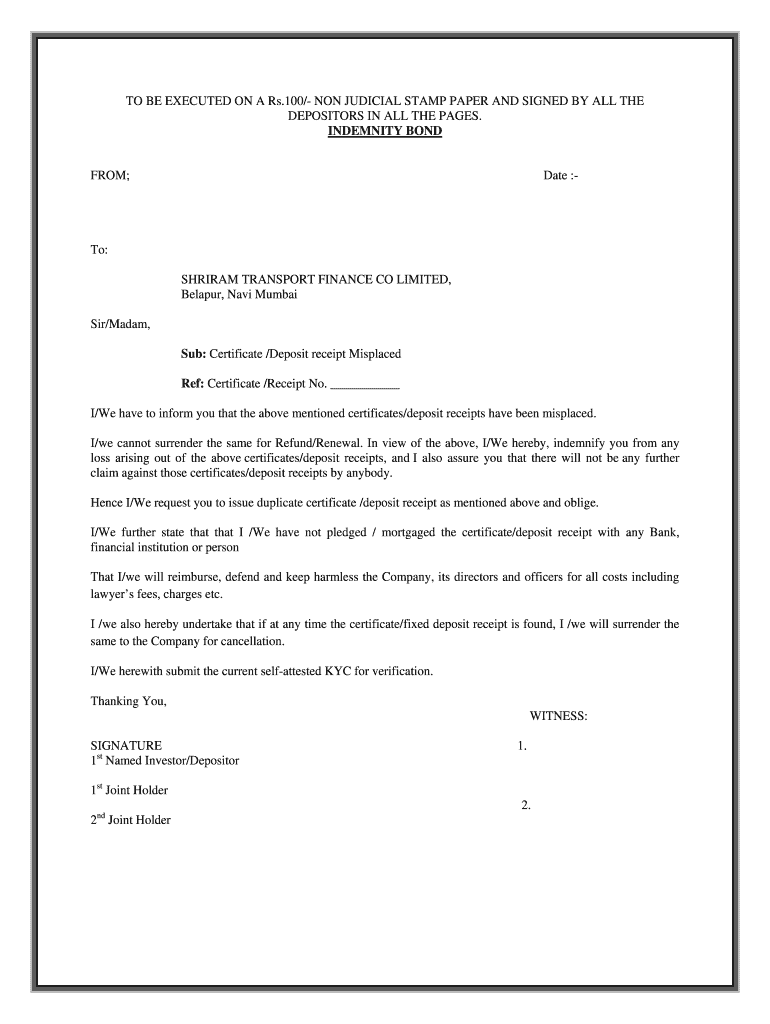

The indemnity form HDFC Bank is a legal document used to protect the bank and its customers from potential losses arising from specific transactions. This form is particularly relevant in cases of wrong transactions, where a customer seeks to rectify an error that may have occurred during a banking operation. By signing this document, the customer agrees to indemnify HDFC Bank against any claims or liabilities that may arise due to the transaction in question. The form serves as a safeguard for both parties, ensuring that the bank can process requests without the risk of financial repercussions.

How to use the indemnity form HDFC Bank

Using the indemnity form HDFC Bank involves several straightforward steps. First, the customer must obtain the form, typically available at HDFC Bank branches or through their official website. Once the form is acquired, the customer should fill in the necessary details, including personal information and specifics about the transaction in question. It is crucial to provide accurate information to avoid any delays in processing. After completing the form, the customer must sign it to validate the request. Finally, the completed form can be submitted to the bank either in person or electronically, depending on the bank's procedures.

Steps to complete the indemnity form HDFC Bank

Completing the indemnity form HDFC Bank requires careful attention to detail. Here are the essential steps:

- Obtain the indemnity form from HDFC Bank's website or a local branch.

- Fill in your personal details, including your name, address, and account number.

- Provide a clear description of the transaction that led to the need for the indemnity.

- Sign and date the form to confirm your agreement to the terms outlined.

- Submit the completed form to HDFC Bank via the preferred submission method.

Legal use of the indemnity form HDFC Bank

The legal use of the indemnity form HDFC Bank is governed by specific regulations that ensure its validity. For the form to be legally binding, it must meet certain criteria, including proper execution with signatures and adherence to local laws regarding indemnity agreements. The form should clearly outline the obligations of both the bank and the customer, providing a transparent framework for resolving disputes. Additionally, compliance with relevant eSignature laws is crucial when submitting the form electronically, ensuring that all parties are protected under applicable legal frameworks.

Key elements of the indemnity form HDFC Bank

Understanding the key elements of the indemnity form HDFC Bank is essential for effective use. The form typically includes:

- Customer's personal information, such as name and account number.

- A detailed description of the transaction in question.

- Terms and conditions outlining the responsibilities of both parties.

- Signature and date fields for the customer to validate the form.

- Instructions for submission, including any required supporting documents.

How to obtain the indemnity form HDFC Bank

Obtaining the indemnity form HDFC Bank is a simple process. Customers can visit any HDFC Bank branch to request the form directly from bank staff. Alternatively, the form may be available for download from the official HDFC Bank website, providing a convenient option for those who prefer to complete the form at home. It is advisable to check for the latest version of the form to ensure compliance with any recent updates or changes in bank policy.

Quick guide on how to complete hdfc indemnity form

Complete hdfc indemnity form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle indemnity form hdfc bank on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign hdfc bank indemnity bond format without hassle

- Obtain indemnity form hdfc bank for wrong transaction and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign hdfc bank indemnity form and ensure effective communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to indemnity letter format

Create this form in 5 minutes!

How to create an eSignature for the indemnity format for bank

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask indemnity format

-

What is the HDFC Bank indemnity bond format?

The HDFC Bank indemnity bond format is a standardized document used by the bank to ensure protection against any potential claims. It outlines the responsibilities of the parties involved and serves as a safeguard for HDFC Bank in the event of losses or disputes. You can easily obtain this format through the bank or create one using our solutions.

-

How can I obtain the HDFC Bank indemnity bond format?

To obtain the HDFC Bank indemnity bond format, you can visit the official HDFC Bank website or request it directly at a local branch. Additionally, our platform provides templates that can help you create an indemnity bond format suitable for your specific needs, ensuring compliance with HDFC Bank requirements.

-

What features does airSlate SignNow offer for managing indemnity bonds?

AirSlate SignNow offers a user-friendly interface for drafting and managing indemnity bonds, including the HDFC Bank indemnity bond format. You can easily customize the document, securely eSign it, and share it with stakeholders. Our platform streamlines the entire workflow, saving you time and reducing the risk of errors.

-

Are there any costs associated with using airSlate SignNow for indemnity bonds?

Using airSlate SignNow for managing your HDFC Bank indemnity bond format is cost-effective with various pricing plans to suit different business needs. We offer a free trial, which allows you to explore our features before committing to a plan. Pricing starts competitively, ensuring you get great value for document management.

-

How does airSlate SignNow ensure the security of my indemnity bond documents?

AirSlate SignNow employs robust security measures to protect your indemnity bond documents, including the HDFC Bank indemnity bond format. We use encryption technology and secure access controls to safeguard sensitive information. Additionally, our platform adheres to industry-standard compliance regulations, ensuring your data remains secure.

-

Can I integrate airSlate SignNow with other applications to manage my indemnity bonds?

Yes, airSlate SignNow supports seamless integration with various applications like CRM systems, cloud storage services, and project management tools. This allows you to efficiently manage your HDFC Bank indemnity bond format alongside other business processes. Integrations enhance productivity and ensure a smooth workflow.

-

What are the benefits of using airSlate SignNow for indemnity bonds?

Using airSlate SignNow for your HDFC Bank indemnity bond format not only simplifies the eSigning process but also enhances collaboration among teams. It reduces the time taken to prepare and sign documents and minimizes errors associated with manual handling. Overall, it offers a reliable solution to streamline your document management.

Get more for letter for lost fixed deposit certificate

Find out other indemnity form hdfc bank

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement