Quarterly Reporting Form Horry County Government Horrycounty

What is the Quarterly Reporting Form Horry County Government Horrycounty?

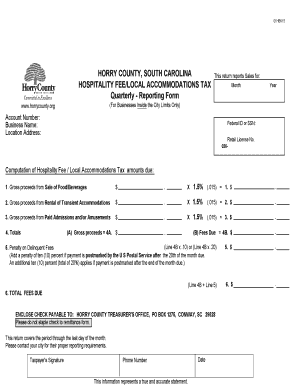

The Quarterly Reporting Form Horry County Government Horrycounty is a crucial document used by businesses and organizations operating within Horry County. This form is designed to collect essential information regarding financial activities, compliance with local regulations, and other pertinent data that may impact the county's governance and resource allocation. It serves as a means for the county to monitor economic activity and ensure that businesses adhere to local laws and regulations.

How to use the Quarterly Reporting Form Horry County Government Horrycounty

Using the Quarterly Reporting Form Horry County Government Horrycounty involves several steps to ensure accurate and timely submission. First, obtain the form from the official Horry County Government website or designated offices. Next, carefully read the instructions provided with the form to understand the required information. Fill out the form with accurate data, ensuring that all sections are completed as per the guidelines. After completing the form, review it for any errors before submission. Finally, submit the form through the designated method, whether online, by mail, or in person, as specified by the county.

Steps to complete the Quarterly Reporting Form Horry County Government Horrycounty

Completing the Quarterly Reporting Form Horry County Government Horrycounty involves a systematic approach:

- Download or request the form from the Horry County Government.

- Gather all necessary financial documents and records to ensure accurate reporting.

- Fill in your business information, including name, address, and contact details.

- Provide detailed financial data as required, including revenue, expenses, and any other relevant metrics.

- Review the completed form for accuracy and completeness.

- Submit the form by the specified deadline through the appropriate channel.

Key elements of the Quarterly Reporting Form Horry County Government Horrycounty

The Quarterly Reporting Form Horry County Government Horrycounty includes several key elements that must be addressed for successful completion. These elements typically consist of:

- Business Information: Name, address, and contact details of the business.

- Financial Data: Revenue, expenses, and other financial metrics relevant to the reporting period.

- Compliance Information: Any disclosures required by local regulations.

- Signature Section: A space for authorized personnel to sign and date the form, verifying the accuracy of the information provided.

Legal use of the Quarterly Reporting Form Horry County Government Horrycounty

The legal use of the Quarterly Reporting Form Horry County Government Horrycounty is essential for ensuring compliance with local laws and regulations. This form is legally binding when completed accurately and submitted on time. It is important to maintain records of the submitted forms and any supporting documentation, as these may be required for audits or inspections by county officials. Failure to submit the form or providing false information can result in penalties, fines, or other legal consequences.

Form Submission Methods (Online / Mail / In-Person)

The Quarterly Reporting Form Horry County Government Horrycounty can typically be submitted through various methods, providing flexibility for businesses. Common submission methods include:

- Online Submission: Many counties offer an online portal for form submission, allowing for quick and efficient processing.

- Mail: Forms can often be printed and mailed to the designated county office address.

- In-Person: Businesses may also have the option to submit forms in person at local government offices during business hours.

Quick guide on how to complete quarterly reporting form horry county government horrycounty

Effortlessly Prepare Quarterly Reporting Form Horry County Government Horrycounty on Any Device

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you need to swiftly create, edit, and eSign your documents without any delays. Manage Quarterly Reporting Form Horry County Government Horrycounty on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The Simplest Method to Edit and eSign Quarterly Reporting Form Horry County Government Horrycounty with Ease

- Locate Quarterly Reporting Form Horry County Government Horrycounty and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your updates.

- Choose how you want to share your form, via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors requiring new document printouts. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Quarterly Reporting Form Horry County Government Horrycounty and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the quarterly reporting form horry county government horrycounty

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Quarterly Reporting Form Horry County Government Horrycounty?

The Quarterly Reporting Form Horry County Government Horrycounty is a document required for local businesses to report financial and operational data to maintain compliance. It helps ensure transparency and accountability within the community.

-

How can airSlate SignNow help with the Quarterly Reporting Form Horry County Government Horrycounty?

airSlate SignNow simplifies the process of completing and submitting the Quarterly Reporting Form Horry County Government Horrycounty. Our platform allows businesses to securely eSign documents and manage submissions efficiently, saving time and reducing errors.

-

What are the pricing options for using airSlate SignNow for the Quarterly Reporting Form Horry County Government Horrycounty?

airSlate SignNow offers various pricing plans that fit different business needs. Our plans are cost-effective, especially for businesses that frequently handle the Quarterly Reporting Form Horry County Government Horrycounty. You can choose a plan based on the volume of documents you need to manage.

-

What features does airSlate SignNow offer for the Quarterly Reporting Form Horry County Government Horrycounty?

With airSlate SignNow, you can enjoy features like document templates, secure eSigning, and tracking capabilities for the Quarterly Reporting Form Horry County Government Horrycounty. These features enhance workflow efficiency and help ensure that your reports are submitted on time.

-

Is it easy to integrate airSlate SignNow with existing systems for the Quarterly Reporting Form Horry County Government Horrycounty?

Yes, airSlate SignNow offers seamless integrations with various platforms, making it easy to incorporate into your existing workflow for the Quarterly Reporting Form Horry County Government Horrycounty. This ensures you can connect with your favorite tools without disruption.

-

What are the benefits of using airSlate SignNow for the Quarterly Reporting Form Horry County Government Horrycounty?

Using airSlate SignNow for the Quarterly Reporting Form Horry County Government Horrycounty provides several benefits, including enhanced security, easy document retrieval, and improved collaboration among team members. It makes the submission process efficient and reliable.

-

Can I access the Quarterly Reporting Form Horry County Government Horrycounty from mobile devices?

Absolutely! airSlate SignNow is accessible from various mobile devices, allowing you to submit the Quarterly Reporting Form Horry County Government Horrycounty on the go. This flexibility is perfect for busy professionals needing to manage documents anytime and anywhere.

Get more for Quarterly Reporting Form Horry County Government Horrycounty

- Discharge attachment form

- Report to the judicial council courtscagov form

- Superior courtnorth carolina judicial branch form

- Supreme courtnorth carolina judicial branch form

- Adult ward form

- The north carolina judicial system the north carolina judicial branch form

- Control number ns ed1014 form

- Waiver of parents right to counsel form

Find out other Quarterly Reporting Form Horry County Government Horrycounty

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form