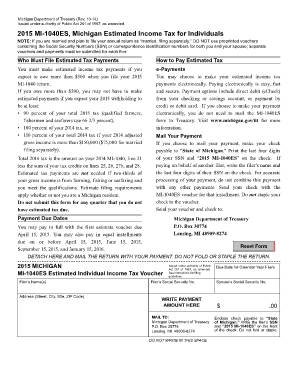

MI 1040ES, Michigan Estimated Income Tax for Individuals Michigan Form

What is the MI 1040ES, Michigan Estimated Income Tax For Individuals

The MI 1040ES is a form used by individuals in Michigan to report and pay estimated income taxes. This form is essential for taxpayers who expect to owe tax of $500 or more when they file their annual tax return. The MI 1040ES allows individuals to make quarterly estimated tax payments, ensuring they meet their tax obligations throughout the year rather than facing a larger bill at tax time.

This form is particularly relevant for self-employed individuals, retirees, and those with significant income not subject to withholding. By using the MI 1040ES, taxpayers can avoid underpayment penalties and interest that may accrue if they do not pay enough tax during the year.

Steps to Complete the MI 1040ES, Michigan Estimated Income Tax For Individuals

Completing the MI 1040ES involves several straightforward steps:

- Gather necessary financial information, including your expected income, deductions, and credits for the year.

- Determine your estimated tax liability using the Michigan tax tables or tax rate schedules.

- Complete the MI 1040ES form by entering your personal information and estimated tax amounts for each quarter.

- Review the form for accuracy, ensuring all calculations are correct.

- Submit the completed form along with your estimated tax payments by the due dates.

Following these steps can help ensure that your MI 1040ES is filled out correctly, minimizing the risk of errors that could lead to penalties.

Legal Use of the MI 1040ES, Michigan Estimated Income Tax For Individuals

The MI 1040ES is legally recognized as a valid method for individuals to report and pay estimated income taxes in Michigan. To be considered legally binding, the form must be filled out accurately and submitted by the specified deadlines. Compliance with state tax laws is crucial, as failure to file or pay estimated taxes can result in penalties and interest charges.

Using an electronic signature tool, such as signNow, can enhance the legal validity of your submission. This ensures that the form is securely signed and complies with the necessary electronic signature regulations, such as ESIGN and UETA.

Filing Deadlines / Important Dates

To avoid penalties, it is important to be aware of the filing deadlines for the MI 1040ES. Estimated tax payments are typically due on the following dates:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

Taxpayers should ensure that payments are made by these deadlines to avoid any additional charges.

Form Submission Methods

Taxpayers have several options for submitting the MI 1040ES:

- Online: Many individuals prefer to file electronically through the Michigan Department of Treasury's website or using approved e-filing software.

- Mail: Completed forms can be printed and mailed to the appropriate state tax office. It is advisable to use certified mail for tracking purposes.

- In-Person: Taxpayers may also choose to submit their forms in person at designated state tax offices.

Choosing the right submission method can help ensure timely processing of your estimated tax payments.

Key Elements of the MI 1040ES, Michigan Estimated Income Tax For Individuals

The MI 1040ES includes several key elements that taxpayers must complete:

- Personal Information: This includes your name, address, and Social Security number.

- Estimated Tax Liability: Taxpayers must calculate their expected tax for the year and divide it into quarterly payments.

- Payment Information: Each section of the form allows you to indicate the amount you are paying for each quarter.

Completing each of these elements accurately is essential for ensuring compliance and avoiding penalties.

Quick guide on how to complete mi 1040es michigan estimated income tax for individuals michigan

Complete MI 1040ES, Michigan Estimated Income Tax For Individuals Michigan effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools needed to create, modify, and eSign your documents quickly and without delays. Handle MI 1040ES, Michigan Estimated Income Tax For Individuals Michigan on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign MI 1040ES, Michigan Estimated Income Tax For Individuals Michigan with ease

- Find MI 1040ES, Michigan Estimated Income Tax For Individuals Michigan and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sending the form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Edit and eSign MI 1040ES, Michigan Estimated Income Tax For Individuals Michigan and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mi 1040es michigan estimated income tax for individuals michigan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Michigan estimated tax?

Michigan estimated tax is a method used by taxpayers, including individuals and businesses, to pay their estimated income tax throughout the year. It helps prevent underpayment penalties and ensures you're paying taxes based on your projected annual income. Utilizing tools like airSlate SignNow can help you manage and submit your estimated tax forms efficiently.

-

How do I calculate my Michigan estimated tax?

To calculate your Michigan estimated tax, you should estimate your annual income and apply the Michigan tax rates to determine your expected tax liability. Consider deductions and credits you may qualify for as well. For accurate calculations, using software that integrates with airSlate SignNow can simplify the process and keep your documents organized.

-

What are the due dates for Michigan estimated tax payments?

In Michigan, estimated tax payments are typically due quarterly, with deadlines falling on April 15, June 15, September 15, and January 15 of the following year. Failing to meet these deadlines can result in penalties. Tools like airSlate SignNow help you automate reminders and keep track of important dates, ensuring you never miss a payment.

-

Can I eSign my Michigan estimated tax forms with airSlate SignNow?

Yes, you can easily eSign your Michigan estimated tax forms using airSlate SignNow. Our platform allows you to securely sign documents electronically, making the submission process quicker and more convenient. Enjoy a seamless experience while ensuring compliance with Michigan tax regulations.

-

What features does airSlate SignNow offer for managing state taxes?

airSlate SignNow offers various features for managing state taxes, including document templates, electronic signatures, and secure sharing options. These features streamline your workflow, allowing you to focus on important financial decisions rather than paperwork. By utilizing our platform, you can efficiently handle your Michigan estimated tax submissions.

-

Is airSlate SignNow cost-effective for managing Michigan estimated tax?

Absolutely! airSlate SignNow provides a cost-effective solution for managing your Michigan estimated tax documentation. With various pricing plans, you can choose a package that fits your budget. By reducing the time and resources spent on tax management, you can save money and improve productivity.

-

How does airSlate SignNow integrate with accounting software for Michigan estimated tax?

airSlate SignNow seamlessly integrates with various accounting software to facilitate easier management of your Michigan estimated tax obligations. This integration allows you to import financial data, generate forms, and ensure accuracy in your tax filings. By combining these tools, you can enhance your tax preparation efficiency.

Get more for MI 1040ES, Michigan Estimated Income Tax For Individuals Michigan

- Mini golf course layout plan design and build process form

- Decedents estate inventory co courts form

- In consideration of the sum of ten dollars and other form

- Affidavit of self employed independent contractor form

- Enclosed you will find an application for employer identification number form

- Form of s corporation revocation tax allocation and

- Comes now and files its complaint against form

- Release of claims for future accidental personal injuries or form

Find out other MI 1040ES, Michigan Estimated Income Tax For Individuals Michigan

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free