Arizona Form A1 QRT Arizona Quarterly Withholding Tax Return Azdor

What is the Arizona Form A1 QRT Arizona Quarterly Withholding Tax Return?

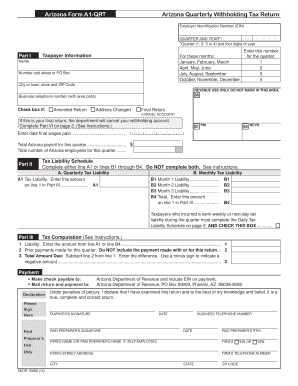

The Arizona Form A1 QRT is a tax document used by employers to report and remit state income tax withheld from employees' wages on a quarterly basis. This form is essential for ensuring compliance with Arizona's tax regulations. It helps the Arizona Department of Revenue track withholding amounts and ensures that employers meet their tax obligations in a timely manner. The form must be accurately filled out to reflect the total wages paid and the corresponding tax withheld during the quarter.

Steps to Complete the Arizona Form A1 QRT Arizona Quarterly Withholding Tax Return

Completing the Arizona Form A1 QRT involves several key steps:

- Gather necessary information: Collect data on total wages paid to employees and the amount of state tax withheld during the quarter.

- Fill out the form: Enter the required information in the appropriate fields, ensuring accuracy in reporting wages and tax amounts.

- Review for errors: Double-check all entries to avoid mistakes that could lead to penalties or delays.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person, and ensure it is sent by the due date.

Key Elements of the Arizona Form A1 QRT Arizona Quarterly Withholding Tax Return

The Arizona Form A1 QRT includes several important elements that must be completed:

- Employer Information: This section requires the employer's name, address, and taxpayer identification number.

- Employee Wages: Report the total wages paid to employees during the quarter.

- Tax Withheld: Indicate the total amount of state income tax withheld from employees' wages.

- Signature: The form must be signed by an authorized representative of the business to validate the submission.

Legal Use of the Arizona Form A1 QRT Arizona Quarterly Withholding Tax Return

The Arizona Form A1 QRT is legally binding when completed and submitted according to state regulations. It serves as an official record of the taxes withheld and is used by the Arizona Department of Revenue for auditing and compliance purposes. Employers must ensure that the information provided is accurate and submitted on time to avoid penalties. Compliance with state tax laws is crucial for maintaining good standing and avoiding legal issues.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for the Arizona Form A1 QRT to ensure timely compliance. The form is due on the last day of the month following the end of each quarter. The specific deadlines are:

- First Quarter (January - March): Due by April 30

- Second Quarter (April - June): Due by July 31

- Third Quarter (July - September): Due by October 31

- Fourth Quarter (October - December): Due by January 31 of the following year

Form Submission Methods

The Arizona Form A1 QRT can be submitted through various methods, providing flexibility for employers. The available submission methods include:

- Online: Employers can file the form electronically through the Arizona Department of Revenue's online portal.

- By Mail: The completed form can be printed and mailed to the appropriate address provided by the Arizona Department of Revenue.

- In-Person: Employers may also choose to submit the form in person at designated state offices.

Quick guide on how to complete arizona form a1 qrt arizona quarterly withholding tax return azdor

Prepare Arizona Form A1 QRT Arizona Quarterly Withholding Tax Return Azdor effortlessly on any device

Web-based document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can access the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your files quickly without delays. Manage Arizona Form A1 QRT Arizona Quarterly Withholding Tax Return Azdor on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign Arizona Form A1 QRT Arizona Quarterly Withholding Tax Return Azdor with ease

- Find Arizona Form A1 QRT Arizona Quarterly Withholding Tax Return Azdor and click Get Form to begin.

- Use the resources we offer to fill out your document.

- Highlight relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Verify all the details and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign Arizona Form A1 QRT Arizona Quarterly Withholding Tax Return Azdor and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona form a1 qrt arizona quarterly withholding tax return azdor

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the a1 qrt form, and how can I use it?

The a1 qrt form is a digital document designed for efficient signing and sharing within airSlate SignNow. It streamlines the process of obtaining signatures and managing approvals, making it easier for users to handle important paperwork online.

-

Is there a cost associated with using the a1 qrt form?

Yes, using the a1 qrt form with airSlate SignNow comes with competitive pricing plans. We offer various subscription options to meet different business needs, ensuring that our eSignature solutions remain cost-effective for all users.

-

What features does the a1 qrt form offer?

The a1 qrt form includes several robust features such as customizable templates, real-time collaboration, and secure storage. It allows users to track their document's progress and ensures that signatures are obtained quickly and efficiently.

-

What are the benefits of using the a1 qrt form for my business?

Utilizing the a1 qrt form can signNowly enhance your business's operational efficiency. It reduces the time spent on document management while ensuring compliance and security, which helps in boosting productivity and improving customer satisfaction.

-

Can I integrate the a1 qrt form with other software?

Absolutely! The a1 qrt form is designed to seamlessly integrate with various applications like CRM systems and project management tools. This ensures that your document workflows remain uninterrupted and can be easily managed within your existing software environment.

-

How secure is the a1 qrt form when used for eSigning?

The a1 qrt form is built with advanced security measures to protect your documents and data. airSlate SignNow employs encryption and secure access protocols to ensure that all eSignatures are legal and tamper-proof, safeguarding your business transactions.

-

What types of industries can benefit from the a1 qrt form?

The a1 qrt form is versatile and can benefit a wide range of industries, including healthcare, real estate, and finance. Any business that requires formal documentation and signatures can streamline its processes by utilizing this powerful tool within airSlate SignNow.

Get more for Arizona Form A1 QRT Arizona Quarterly Withholding Tax Return Azdor

- Recruiter split fee agreement my health recruiter form

- First amended and restated operating agreement secgov form

- Invention disclosure formdocx south dakota state university

- General form of employment agreement with trade secrets

- Business reorganization attorneys berger singerman llp law firm form

- Employment agreement with assembler of electromechanical form

- Request for re admittance to collegeuniversity form

- Independent contractor agreement with sales representative form

Find out other Arizona Form A1 QRT Arizona Quarterly Withholding Tax Return Azdor

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple