Fillable City of Wilmington Net Profit Tax Return Form

What is the Fillable City Of Wilmington Net Profit Tax Return

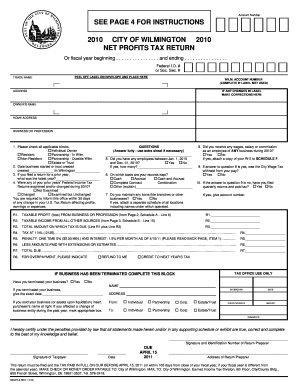

The Fillable City of Wilmington Net Profit Tax Return, commonly referred to as form WCWT 1, is a tax document used by businesses operating within the city of Wilmington, Delaware. This form is essential for reporting net profits and calculating the corresponding taxes owed to the city. It is designed to be user-friendly, allowing taxpayers to fill it out electronically, which simplifies the filing process and enhances accuracy. By utilizing a fillable format, businesses can easily input their financial data, ensuring compliance with local tax regulations.

How to use the Fillable City Of Wilmington Net Profit Tax Return

To use the Fillable City of Wilmington Net Profit Tax Return, start by downloading the form from an official source. Once you have the form, open it in a compatible PDF reader that supports fillable fields. Carefully enter your business's financial information, including gross receipts, allowable deductions, and any applicable credits. Ensure that all figures are accurate to avoid discrepancies. After completing the form, review it for any errors before electronically signing it and submitting it through the designated method, whether online, by mail, or in person.

Steps to complete the Fillable City Of Wilmington Net Profit Tax Return

Completing the Fillable City of Wilmington Net Profit Tax Return involves several key steps:

- Download the form from an official source.

- Open the form in a compatible PDF reader.

- Fill in your business information, including gross receipts and deductions.

- Double-check all entries for accuracy.

- Electronically sign the form.

- Submit the completed form through the appropriate channels.

Legal use of the Fillable City Of Wilmington Net Profit Tax Return

The Fillable City of Wilmington Net Profit Tax Return is legally binding when completed and submitted according to the established guidelines. To ensure its validity, it is crucial to adhere to the eSignature laws that govern electronic document submissions. This includes using a reliable eSignature platform that provides a certificate of completion, ensuring compliance with the ESIGN Act and other relevant legislation. Proper execution of this form safeguards against potential legal disputes and confirms that the information provided is accurate and complete.

Form Submission Methods (Online / Mail / In-Person)

There are several methods available for submitting the Fillable City of Wilmington Net Profit Tax Return. Taxpayers can choose to file online through the city’s designated tax portal, which offers a streamlined process for electronic submissions. Alternatively, the completed form can be mailed to the appropriate city department, ensuring that it is sent well before the filing deadline. For those who prefer a personal touch, in-person submissions are also accepted at designated city offices, where assistance may be available if needed.

Filing Deadlines / Important Dates

Filing deadlines for the City of Wilmington Net Profit Tax Return are crucial to avoid penalties. Typically, the tax return is due on or before April fifteenth of each year for the previous calendar year’s profits. It is advisable for businesses to mark their calendars and prepare their financial records in advance to ensure timely filing. Late submissions may incur fines or interest, making adherence to these deadlines essential for compliance.

Quick guide on how to complete fillable city of wilmington net profit tax return

Effortlessly Prepare Fillable City Of Wilmington Net Profit Tax Return on Any Device

The management of documents online has gained popularity among both businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Handle Fillable City Of Wilmington Net Profit Tax Return on any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

The Easiest Way to Edit and eSign Fillable City Of Wilmington Net Profit Tax Return with Ease

- Obtain Fillable City Of Wilmington Net Profit Tax Return and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Verify the details and click the Done button to finalize your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Fillable City Of Wilmington Net Profit Tax Return and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fillable city of wilmington net profit tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the city of Wilmington net profits tax return process?

The city of Wilmington net profits tax return process involves filing an annual return that reports the profits earned by businesses operating within the city. It's crucial for businesses to keep accurate records of their income and expenses to ensure compliance and minimize tax liabilities. airSlate SignNow offers tools to streamline document preparation and signing, making it easier to complete your tax returns.

-

How can airSlate SignNow help with filing my city of Wilmington net profits tax return?

airSlate SignNow helps streamline the filing of your city of Wilmington net profits tax return by providing an easy-to-use platform for eSigning necessary documents. You can securely send, receive, and store your tax-related documents all in one place. This efficiency helps you focus on your business while ensuring compliance with local tax regulations.

-

Are there any costs associated with using airSlate SignNow for my city of Wilmington net profits tax return?

While airSlate SignNow offers a range of pricing plans, the cost will depend on the features you need for filing your city of Wilmington net profits tax return. Many businesses find that the time and resources saved with our platform can outweigh the costs. Be sure to evaluate the pricing options to find the plan that best fits your document signing needs.

-

What features does airSlate SignNow offer for managing my city of Wilmington net profits tax return?

airSlate SignNow provides features such as document templates, eSignature solutions, and secure cloud storage to help you manage your city of Wilmington net profits tax return efficiently. These features enable you to quickly prepare and sign tax return documents while ensuring that they meet the necessary legal standards. This simplifies the filing process signNowly.

-

Can I integrate airSlate SignNow with accounting software for my city of Wilmington net profits tax return?

Yes, airSlate SignNow offers integration capabilities with various accounting software to streamline your city of Wilmington net profits tax return process. By connecting with your preferred accounting solutions, you can seamlessly transfer data, manage records, and ensure that your financial documents are always up-to-date. This integration saves time and reduces the risk of errors.

-

What are the benefits of using airSlate SignNow for my city of Wilmington net profits tax return?

Using airSlate SignNow for your city of Wilmington net profits tax return offers numerous benefits, including saving time and reducing administrative burdens. With our easy-to-use platform, you can manage all documentation and signatures electronically, minimizing the need for physical paperwork. Additionally, our secure and compliant process helps protect sensitive information.

-

Is airSlate SignNow secure for my city of Wilmington net profits tax return documents?

Absolutely! airSlate SignNow prioritizes security by implementing advanced encryption and compliant features that safeguard your city of Wilmington net profits tax return documents. Our platform ensures that all data is protected during transmission and storage, giving you peace of mind while handling sensitive information.

Get more for Fillable City Of Wilmington Net Profit Tax Return

- Lease of mobile manufactured home with option to purchase form

- Notice given pursuant to contract form

- Addendum regarding ampquottoll freeampquot numbers rentals form

- Return of late payment and denial of discount form

- Oath of office in the state of ohio keepandbeararmscom form

- Bus travel to hockey games and practices form

- In thename of court court ofname of countyname of state form

- Escrow agreement for sale of real property deposit of estimated purchase prices form

Find out other Fillable City Of Wilmington Net Profit Tax Return

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter