Form SFCT1 Solid Fuel Carbon Tax Return Form Revenue Revenue

What is the Form SFCT1 Solid Fuel Carbon Tax Return Form?

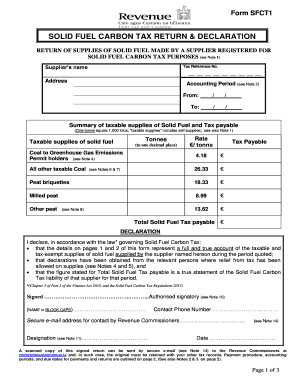

The Form SFCT1 Solid Fuel Carbon Tax Return Form is a tax document used in the United States for reporting carbon emissions related to solid fuel usage. This form is essential for businesses and individuals who are liable for carbon taxes under federal or state regulations. It captures details about the quantity of solid fuel consumed, the associated carbon emissions, and the tax owed. Proper completion of this form is crucial for compliance with environmental regulations and for accurate tax reporting.

How to use the Form SFCT1 Solid Fuel Carbon Tax Return Form

Using the Form SFCT1 involves several steps to ensure accurate reporting. First, gather all necessary data regarding solid fuel consumption and emissions. Next, fill out the form with the required details, including your identification information and the specifics of your fuel usage. After completing the form, review it for accuracy before submitting it to the appropriate tax authority. Utilizing digital tools for this process can streamline the completion and submission, making it easier to manage your tax obligations.

Steps to complete the Form SFCT1 Solid Fuel Carbon Tax Return Form

Completing the Form SFCT1 requires careful attention to detail. Here are the steps to follow:

- Collect all relevant information about your solid fuel consumption.

- Access the Form SFCT1, either in paper form or digitally.

- Fill in your personal or business information at the top of the form.

- Report the quantity of solid fuel used and calculate the associated carbon emissions.

- Determine the tax owed based on the emissions reported.

- Review the completed form for accuracy and completeness.

- Submit the form to the relevant tax authority by the designated deadline.

Legal use of the Form SFCT1 Solid Fuel Carbon Tax Return Form

The Form SFCT1 is legally binding when completed and submitted according to the regulations set forth by tax authorities. To ensure its legal standing, it must include accurate information and be signed by the responsible party. Digital signatures, when compliant with eSignature laws, can also provide a legally recognized method of signing the form. Understanding the legal implications of this form helps users maintain compliance and avoid potential penalties.

Key elements of the Form SFCT1 Solid Fuel Carbon Tax Return Form

The key elements of the Form SFCT1 include:

- Identification Information: Details about the filer, including name and address.

- Fuel Consumption Data: Quantities of solid fuel used during the reporting period.

- Carbon Emissions Calculation: A section for calculating the total emissions based on fuel usage.

- Tax Calculation: A breakdown of the tax owed based on reported emissions.

- Signature Section: A place for the responsible party to sign and date the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form SFCT1 can vary based on state and federal regulations. It is essential to check the specific deadlines applicable to your situation to avoid late fees or penalties. Generally, forms must be submitted annually, with deadlines typically falling at the end of the tax year. Keeping track of these important dates ensures timely compliance and helps maintain good standing with tax authorities.

Quick guide on how to complete form sfct1 solid fuel carbon tax return form revenue revenue

Manage Form SFCT1 Solid Fuel Carbon Tax Return Form Revenue Revenue seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily access the right form and safely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Handle Form SFCT1 Solid Fuel Carbon Tax Return Form Revenue Revenue on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to edit and electronically sign Form SFCT1 Solid Fuel Carbon Tax Return Form Revenue Revenue effortlessly

- Locate Form SFCT1 Solid Fuel Carbon Tax Return Form Revenue Revenue and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign feature, which takes only a few seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, frustrating form searches, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form SFCT1 Solid Fuel Carbon Tax Return Form Revenue Revenue to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form sfct1 solid fuel carbon tax return form revenue revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form SFCT1 Solid Fuel Carbon Tax Return Form Revenue?

The Form SFCT1 Solid Fuel Carbon Tax Return Form Revenue is a legal document used for reporting carbon tax obligations related to solid fuel sales. This form is essential for businesses to comply with governmental regulations and accurately calculate their carbon taxes. By using airSlate SignNow, you can easily complete and eSign this form efficiently.

-

How can airSlate SignNow help with the Form SFCT1 Solid Fuel Carbon Tax Return Form Revenue?

airSlate SignNow provides a simple and cost-effective solution for filling out the Form SFCT1 Solid Fuel Carbon Tax Return Form Revenue. Our platform allows you to fill, sign, and manage documents securely online. You can streamline your tax reporting processes and minimize the risk of errors using our user-friendly tools.

-

Is there a cost associated with using airSlate SignNow for the Form SFCT1 Solid Fuel Carbon Tax Return Form Revenue?

Yes, airSlate SignNow offers a variety of pricing plans tailored to suit different business needs. Our pricing is competitive, and you can choose a plan based on your frequency of use for documents like the Form SFCT1 Solid Fuel Carbon Tax Return Form Revenue. We also provide value by reducing time spent on paperwork and improving efficiency.

-

Can I integrate airSlate SignNow with other applications while using the Form SFCT1 Solid Fuel Carbon Tax Return Form Revenue?

Absolutely! airSlate SignNow supports various integrations, allowing you to connect with popular applications like Google Drive, Salesforce, and Microsoft Office. This flexibility ensures that handling the Form SFCT1 Solid Fuel Carbon Tax Return Form Revenue fits seamlessly into your existing workflows.

-

What features does airSlate SignNow offer to assist with the Form SFCT1 Solid Fuel Carbon Tax Return Form Revenue?

airSlate SignNow offers features like customizable templates, digital signatures, and document tracking which are all beneficial for managing the Form SFCT1 Solid Fuel Carbon Tax Return Form Revenue. These features enhance collaboration and ensure compliance while maintaining a clear audit trail for your records.

-

How secure is the information handled in the Form SFCT1 Solid Fuel Carbon Tax Return Form Revenue using airSlate SignNow?

Security is a top priority at airSlate SignNow. We use advanced encryption protocols to protect all data, including information in the Form SFCT1 Solid Fuel Carbon Tax Return Form Revenue. Your documents are stored securely, ensuring only authorized users have access, thereby maintaining confidentiality and compliance.

-

Is airSlate SignNow suitable for businesses of all sizes when managing the Form SFCT1 Solid Fuel Carbon Tax Return Form Revenue?

Yes, airSlate SignNow is designed to accommodate businesses of all sizes, from startups to large enterprises. Our platform's scalability ensures that regardless of your volume of transactions or complexity of the Form SFCT1 Solid Fuel Carbon Tax Return Form Revenue, we offer tools to support your needs efficiently.

Get more for Form SFCT1 Solid Fuel Carbon Tax Return Form Revenue Revenue

Find out other Form SFCT1 Solid Fuel Carbon Tax Return Form Revenue Revenue

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online