Mi W4p Form

What is the Mi W4p

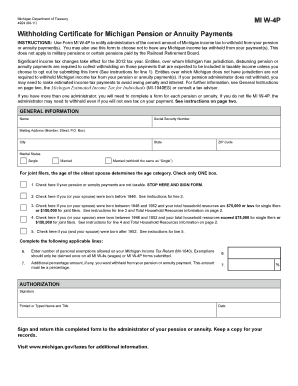

The Mi W4p form, officially known as the Michigan Employee's Withholding Allowance Certificate, is a crucial document for employees in Michigan. It is used to determine the amount of state income tax to withhold from an employee's paycheck. This form is essential for ensuring that the correct tax amount is deducted, helping employees avoid underpayment or overpayment of taxes throughout the year.

How to use the Mi W4p

To use the Mi W4p form effectively, employees must complete it accurately and submit it to their employer. The form requires personal information, including the employee's name, address, and Social Security number. Employees must also indicate their filing status and the number of allowances they are claiming. This information helps employers calculate the appropriate withholding amount based on Michigan state tax laws.

Steps to complete the Mi W4p

Completing the Mi W4p form involves several straightforward steps:

- Gather personal information, including your Social Security number and filing status.

- Determine the number of allowances you are eligible to claim based on your personal and financial situation.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions before submitting it.

- Submit the completed form to your employer's payroll department.

Legal use of the Mi W4p

The Mi W4p form is legally binding when completed and submitted according to state regulations. It must be filled out truthfully, as providing false information can lead to penalties, including fines or legal action. Employers are required to keep the form on file for record-keeping and compliance purposes. It is essential for both employees and employers to understand the legal implications of the information provided on this form.

Filing Deadlines / Important Dates

While there is no specific deadline for submitting the Mi W4p form, it is important to complete it as soon as employment begins or when there are changes in personal circumstances that affect withholding allowances. Keeping the form updated ensures that the correct amount of state income tax is withheld from paychecks throughout the year. Employees should also be aware of the annual tax filing deadline, typically April 15, to ensure compliance with state tax obligations.

Who Issues the Form

The Mi W4p form is issued by the Michigan Department of Treasury. It is available for download from their official website and can be obtained through employers who are required to provide it to new employees. The form is designed to help both employees and employers manage state tax withholding effectively, ensuring compliance with Michigan tax laws.

Quick guide on how to complete mi w4p

Complete Mi W4p effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Mi W4p on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign Mi W4p effortlessly

- Obtain Mi W4p and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information using features that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and possesses the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Mi W4p and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mi w4p

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is miw4p and how does it enhance document signing?

Miw4p is a feature within airSlate SignNow that streamlines the document signing process. It allows users to electronically sign documents quickly and securely, improving efficiency and reducing paper usage. This feature is ideal for businesses looking to modernize their workflows.

-

How does pricing work for miw4p on airSlate SignNow?

The pricing for miw4p on airSlate SignNow varies depending on the plan you choose. There are flexible options designed to meet the needs of different businesses, from startups to large enterprises. Each plan includes access to miw4p features that can help optimize your document signing process.

-

What key features does miw4p offer for users?

Miw4p provides users with essential features such as customizable templates, secure cloud storage, and real-time tracking of document status. Additionally, it supports multiple signature options, making it versatile for diverse industries. With miw4p, businesses can ensure a seamless signing experience.

-

How does miw4p benefit businesses in terms of efficiency?

Employing miw4p signNowly enhances business efficiency by reducing the time spent on document management. The electronic signature process is much faster than traditional methods, helping teams close deals and approvals quickly. This efficiency translates to improved workflow and increased productivity.

-

Can miw4p integrate with other software applications?

Yes, miw4p integrates seamlessly with various third-party applications including CRM and project management tools. This integration capability allows businesses to streamline processes and maintain a centralized hub for document handling. You can easily connect your existing systems to enhance workflow.

-

Is miw4p suitable for businesses of all sizes?

Absolutely! Miw4p is designed to cater to businesses of all sizes, from small startups to large corporations. Its scalable features ensure that all organizations can benefit from its document signing solutions, making it a valuable tool regardless of your business's scale.

-

What security measures does miw4p provide to protect sensitive documents?

Miw4p comes with robust security measures, including encryption and authentication protocols, to protect sensitive documents. airSlate SignNow takes document security seriously, ensuring that your data is safe from unauthorized access. This level of security helps build trust with clients and partners.

Get more for Mi W4p

- Registration rights agreement sample registration rights form

- Sample purchase agreement between tesoro petroleum corp form

- This putcall option agreement theagreement investor form

- Amended and restated general security agreement form

- Standstill agreement financial definition of standstill agreement form

- Assumption agreement of nab nordamerika beteiligungs holding form

- Transfer agency and services agreement as amended dated form

- Sec info merrill lynch mortgage investors inc 424b3 on form

Find out other Mi W4p

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple