SC 4868 the South Carolina Department of Revenue Sctax Form

What is the SC 4868 The South Carolina Department Of Revenue Sctax

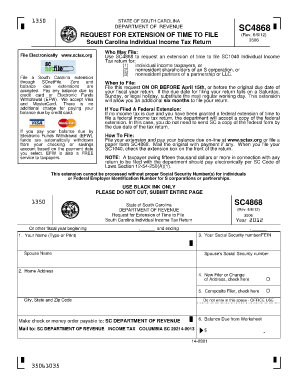

The SC 4868 form is an extension request provided by the South Carolina Department of Revenue. This form allows taxpayers to apply for an extension of time to file their state income tax returns. It is essential for individuals and businesses who may need additional time beyond the standard filing deadline to prepare their tax documents accurately. By submitting the SC 4868, taxpayers can avoid penalties associated with late filings while ensuring compliance with state tax regulations.

Steps to complete the SC 4868 The South Carolina Department Of Revenue Sctax

Completing the SC 4868 form involves several straightforward steps:

- Obtain the SC 4868 form from the South Carolina Department of Revenue website or through authorized tax preparation software.

- Fill in your personal information, including your name, address, and Social Security number or taxpayer identification number.

- Indicate the type of return for which you are requesting an extension.

- Estimate your tax liability and provide any payment information if applicable.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form by the due date, either electronically or by mail.

Legal use of the SC 4868 The South Carolina Department Of Revenue Sctax

The SC 4868 form is legally recognized as a valid request for an extension of time to file state income tax returns. To ensure its legal standing, it must be filled out accurately and submitted on time. The form adheres to the regulations outlined by the South Carolina Department of Revenue, making it crucial for taxpayers to follow the prescribed guidelines. Utilizing a reliable eSignature platform can further enhance the legal validity of the submitted form by providing a secure and compliant method for signing.

Filing Deadlines / Important Dates

Understanding the deadlines associated with the SC 4868 form is vital for compliance. The typical deadline for submitting the SC 4868 request aligns with the original due date of the state income tax return. For most taxpayers, this date falls on April fifteenth. If the deadline falls on a weekend or holiday, it is extended to the next business day. It is important to keep track of these dates to avoid penalties and ensure that your tax return is filed on time.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the SC 4868 form. It can be filed electronically through the South Carolina Department of Revenue's online portal, which is often the quickest method. Alternatively, taxpayers may choose to mail the completed form to the appropriate address provided by the department. In-person submissions are generally not required, but taxpayers can contact local offices for assistance if needed. Each submission method has its own processing times, so it is advisable to choose the one that best fits your timeline.

Required Documents

When completing the SC 4868 form, certain documents may be necessary to ensure accurate reporting. Taxpayers should have their previous year's tax return on hand, as it provides essential information for estimating the current year's tax liability. Additionally, any relevant income statements, such as W-2s or 1099s, should be gathered to support the figures provided on the form. Having these documents ready can streamline the completion process and help avoid errors.

Quick guide on how to complete sc 4868 the south carolina department of revenue sctax

Effortlessly Prepare SC 4868 The South Carolina Department Of Revenue Sctax on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers a viable eco-friendly alternative to conventional printed and signed documents, allowing you to easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your files quickly and without delays. Manage SC 4868 The South Carolina Department Of Revenue Sctax on any device using the airSlate SignNow applications available for Android or iOS and streamline any document-related process today.

The Simplest Way to Edit and Electronically Sign SC 4868 The South Carolina Department Of Revenue Sctax with Ease

- Find SC 4868 The South Carolina Department Of Revenue Sctax and select Get Form to begin.

- Utilize the tools provided to complete your document.

- Mark important sections of the document or conceal sensitive information with the specific tools offered by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional written signature.

- Verify all the details and click the Done button to save your modifications.

- Select your preferred method to send your document, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tiresome form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and electronically sign SC 4868 The South Carolina Department Of Revenue Sctax and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sc 4868 the south carolina department of revenue sctax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is SC 4868 and how does it relate to the South Carolina Department Of Revenue?

SC 4868 is a tax form utilized by taxpayers in South Carolina to request an extension for filing their individual income tax returns. This form is directly associated with the South Carolina Department Of Revenue, allowing taxpayers to manage their filing deadlines efficiently.

-

How can airSlate SignNow assist with completing SC 4868 for the South Carolina Department Of Revenue?

With airSlate SignNow, users can easily fill out and eSign the SC 4868 form online. Our platform simplifies document management, enabling a smooth completion process while ensuring compliance with the requirements of the South Carolina Department Of Revenue.

-

Are there any fees associated with filing SC 4868 through the airSlate SignNow platform?

Using airSlate SignNow comes with a cost-effective subscription model, allowing users to manage multiple documents, including SC 4868 for the South Carolina Department Of Revenue. Pricing details can be found on our website, tailored to suit various business needs.

-

What are the key features of airSlate SignNow that benefit SC 4868 filers?

airSlate SignNow offers features like user-friendly eSigning, secure storage, and real-time document tracking, which are particularly beneficial for anyone filing SC 4868 for the South Carolina Department Of Revenue. These features enhance efficiency and ensure that your documents are handled securely.

-

Can I integrate airSlate SignNow with other software for managing SC 4868 submissions?

Yes, airSlate SignNow seamlessly integrates with a variety of third-party applications, making it easy to manage your SC 4868 submissions alongside other financial tools. This integration ensures a smooth workflow for users filing with the South Carolina Department Of Revenue.

-

What are the benefits of using airSlate SignNow for business tax forms like SC 4868?

By using airSlate SignNow for SC 4868 and other business tax forms, users can save time, reduce paperwork, and ensure compliance with the South Carolina Department Of Revenue's requirements. The convenience of eSigning and document management signNowly enhances productivity.

-

Is it safe to use airSlate SignNow for submitting SC 4868 to the South Carolina Department Of Revenue?

Absolutely! airSlate SignNow prioritizes data security, implementing advanced encryption and compliance standards to protect your information while submitting SC 4868 to the South Carolina Department Of Revenue. Your documents are kept safe throughout the process.

Get more for SC 4868 The South Carolina Department Of Revenue Sctax

- Control number wv p006 pkg form

- Control number wv p007 pkg form

- Control number wv p008 pkg form

- Control number wv p010 pkg form

- Of county west virginia as my attorney infact to act as follows granting unto my attorney in fact full power to form

- Control number wv p012 pkg form

- Identity theft attorney general of virginia form

- West virginia real estate deed forms fill in the blank

Find out other SC 4868 The South Carolina Department Of Revenue Sctax

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy