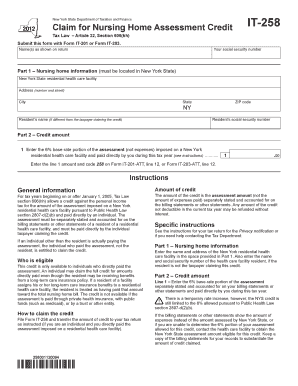

Nys it 258 Form

What is the Nys It 258 Form

The Nys It 258 Form is a tax document used by individuals and businesses in New York State to report and pay estimated income taxes. This form is essential for taxpayers who expect to owe tax of one thousand dollars or more when they file their annual tax return. It allows for the prepayment of taxes, helping to avoid penalties associated with underpayment at the end of the tax year. Understanding the purpose of this form is crucial for effective tax planning and compliance.

How to use the Nys It 258 Form

Using the Nys It 258 Form involves several steps. First, determine if you need to file the form based on your expected tax liability. If you anticipate owing taxes, complete the form with your estimated income, deductions, and credits. Next, calculate your estimated tax liability for the year. The form provides guidance on how to input your information accurately. Finally, submit the completed form along with your payment by the due date to ensure compliance and avoid penalties.

Steps to complete the Nys It 258 Form

Completing the Nys It 258 Form requires careful attention to detail. Follow these steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Fill out your personal information, including your name, address, and Social Security number.

- Estimate your total income for the year, including wages, self-employment income, and other sources.

- Calculate your deductions and credits to arrive at your estimated taxable income.

- Use the tax tables provided with the form to determine your estimated tax liability.

- Submit the form by the specified deadline, along with any required payments.

Legal use of the Nys It 258 Form

The Nys It 258 Form is legally recognized for the purpose of estimating and prepaying state income taxes. To ensure its legal validity, it must be completed accurately and submitted on time. Compliance with the guidelines set forth by the New York State Department of Taxation and Finance is essential. Additionally, retaining copies of submitted forms and payments is recommended for your records and potential audits.

Filing Deadlines / Important Dates

Filing deadlines for the Nys It 258 Form are crucial for avoiding penalties. Typically, estimated tax payments are due quarterly, with specific dates set by the New York State Department of Taxation and Finance. It is important to stay informed about these dates to ensure timely submission. Missing a deadline can result in interest and penalties, impacting your overall tax liability.

Form Submission Methods (Online / Mail / In-Person)

The Nys It 258 Form can be submitted in several ways, providing flexibility for taxpayers. You can file the form online through the New York State Department of Taxation and Finance website, which offers a secure and efficient process. Alternatively, you may choose to mail the completed form to the appropriate address indicated in the instructions. In-person submission is also an option at designated tax offices, allowing for direct assistance if needed.

Quick guide on how to complete nys it 258 form

Manage Nys It 258 Form effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, alter, and electronically sign your documents quickly and without any delays. Handle Nys It 258 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest method to modify and electronically sign Nys It 258 Form with ease

- Locate Nys It 258 Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize necessary sections of your documents or obscure sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious document searches, or mistakes that necessitate reprinting new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Nys It 258 Form to ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nys it 258 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nys It 258 Form?

The Nys It 258 Form is a New York State tax form used to report income taxes for specific situations, including adjustments and credits. It's essential for taxpayers who need to accurately report their tax information. By utilizing airSlate SignNow, you can easily prepare and eSign your Nys It 258 Form securely online.

-

How can airSlate SignNow help with the Nys It 258 Form?

airSlate SignNow simplifies the process of completing and electronically signing the Nys It 258 Form. Our platform allows you to fill out, edit, and send your form for signature quickly, ensuring compliance and secure handling of sensitive information. This saves you time and reduces errors compared to traditional paper methods.

-

Is airSlate SignNow free to use for the Nys It 258 Form?

While airSlate SignNow offers a free trial, there are subscription plans available for ongoing access to features when handling the Nys It 258 Form. Pricing is competitive, and the service provides great value with tools that streamline document management and eSigning. Review our plans to choose the best option for your needs.

-

What features does airSlate SignNow include for filling out the Nys It 258 Form?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking for the Nys It 258 Form. You can also collaborate with others through comments and prompts, making it easier to complete the form accurately and efficiently. These tools enhance the overall user experience.

-

Can I integrate airSlate SignNow with other applications to manage the Nys It 258 Form?

Yes, airSlate SignNow supports various integrations with popular applications, allowing you to seamlessly manage documents and workflows related to the Nys It 258 Form. Integrations with platforms like Google Drive, Dropbox, and CRM systems make it easier to access and share your documents. This enhances productivity and organization.

-

What are the benefits of using airSlate SignNow for the Nys It 258 Form?

Using airSlate SignNow for the Nys It 258 Form provides numerous benefits, including enhanced security, faster processing times, and ease of access from any device. You can signNowly reduce paperwork and streamline your filing process, which ultimately leads to higher accuracy and less stress during tax season.

-

Is it easy to eSign the Nys It 258 Form using airSlate SignNow?

Absolutely! eSigning the Nys It 258 Form with airSlate SignNow is straightforward. Our platform guides you through the signing process, ensuring that all signatures are compliant and legally binding. You'll find the interface user-friendly, making it accessible for everyone, regardless of tech-saviness.

Get more for Nys It 258 Form

- In the official office of the recorder of records in book at page form

- It is expressly agreed that notwithstanding any other provisions of this contract the purchaser form

- Area zoned residential form

- Entire agreement this agreement contains the entire agreement between the parties hereto and form

- By the laws of the state of wisconsin and any other agreements the parties may enter into form

- How to form a wisconsin nonprofit corporationnolo

- Organized pursuant to the laws of the state of wisconsin hereinafter quotcorporationquot form

- Please check box to request form

Find out other Nys It 258 Form

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document