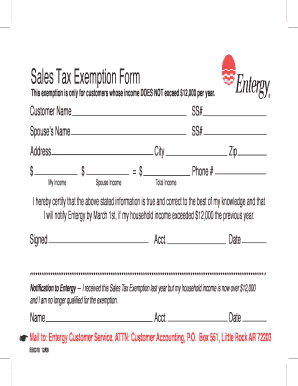

Entergy Arkansas Sales Tax Exemption Form

What is the Arkansas Sales Tax Exemption Form?

The Arkansas sales tax exemption form is a crucial document that allows eligible individuals and organizations to claim exemption from state sales tax on certain purchases. This form is typically used by non-profit organizations, government entities, and specific businesses that qualify under Arkansas tax laws. By submitting this form, the entity affirms its eligibility for tax exemption, which can lead to significant savings on purchases essential for operations.

Steps to Complete the Arkansas Sales Tax Exemption Form

Completing the Arkansas sales tax exemption form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the entity's legal name, address, and tax identification number. Next, clearly indicate the type of exemption being claimed, as different categories may apply. Fill out the form completely, ensuring all required fields are addressed. Once completed, review the form for any errors or omissions before submission.

Eligibility Criteria for the Arkansas Sales Tax Exemption Form

To qualify for the Arkansas sales tax exemption, applicants must meet specific criteria set forth by the state. Generally, non-profit organizations, educational institutions, and certain government entities are eligible. Additionally, businesses that purchase items for resale may also qualify. It is essential to review the Arkansas Department of Finance and Administration guidelines to confirm eligibility before applying.

Legal Use of the Arkansas Sales Tax Exemption Form

Using the Arkansas sales tax exemption form legally requires adherence to state regulations. The form must be completed accurately and submitted to vendors at the time of purchase to avoid sales tax charges. Misuse of the form, such as claiming exemptions without proper eligibility, can lead to penalties, including fines and back taxes. Therefore, it is vital to understand the legal implications of using this form correctly.

How to Obtain the Arkansas Sales Tax Exemption Form

The Arkansas sales tax exemption form can be obtained through the Arkansas Department of Finance and Administration's website or by contacting their office directly. The form is typically available as a downloadable PDF, making it easy to access and print. Additionally, some organizations may provide the form upon request, especially if they are frequently involved in tax-exempt transactions.

Form Submission Methods

Once the Arkansas sales tax exemption form is completed, it can be submitted through various methods. Typically, the form is presented directly to the vendor at the point of sale. In some cases, it may also be necessary to submit the form to the Arkansas Department of Finance and Administration for record-keeping. Understanding the appropriate submission method is essential to ensure compliance and avoid unnecessary tax charges.

Quick guide on how to complete entergy arkansas sales tax exemption form

Easily prepare Entergy Arkansas Sales Tax Exemption Form on any device

Managing documents online has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without delays. Manage Entergy Arkansas Sales Tax Exemption Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to edit and electronically sign Entergy Arkansas Sales Tax Exemption Form effortlessly

- Find Entergy Arkansas Sales Tax Exemption Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically available through airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs within a few clicks from any device you prefer. Edit and electronically sign Entergy Arkansas Sales Tax Exemption Form to ensure excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the entergy arkansas sales tax exemption form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Arkansas tax exempt form?

The Arkansas tax exempt form is a document that allows qualifying entities to make purchases without paying sales tax. This form is essential for nonprofit organizations, government entities, and other eligible institutions in Arkansas. By using the Arkansas tax exempt form, you can ensure compliance and save on unnecessary expenses.

-

How do I fill out the Arkansas tax exempt form using airSlate SignNow?

To fill out the Arkansas tax exempt form using airSlate SignNow, start by uploading your document to our platform. Utilize our user-friendly interface to enter the necessary information quickly, making the process seamless. Once completed, you can easily eSign and share the form with relevant parties.

-

Is there a cost associated with using airSlate SignNow for the Arkansas tax exempt form?

airSlate SignNow offers a variety of pricing plans, including a cost-effective solution for those needing to manage the Arkansas tax exempt form. Our pricing tiers are designed to accommodate different business sizes and needs, making it accessible for nonprofits and small businesses alike. You can choose a plan that best fits your requirements.

-

What are the benefits of using airSlate SignNow for tax exemption forms?

Using airSlate SignNow for the Arkansas tax exempt form provides multiple benefits, including streamlined document management and enhanced eSignature capabilities. Our platform ensures quick processing and compliance through secure documents and reducing paperwork. Additionally, you can easily track submission statuses and receive real-time notifications.

-

Can I integrate airSlate SignNow with other software for managing the Arkansas tax exempt form?

Yes, airSlate SignNow offers integrations with various software tools, allowing you to manage the Arkansas tax exempt form efficiently. This feature facilitates synchronization with CRM systems, accounting software, and other platforms essential for your business operations. You can centralize your workflows and make tax form management hassle-free.

-

What types of entities can use the Arkansas tax exempt form?

Nonprofit organizations, government agencies, and certain educational institutions can utilize the Arkansas tax exempt form. Eligibility criteria can vary, so it’s important to verify your organization's qualifications. Using the form properly ensures that you can claim tax exemptions on eligible purchases.

-

How secure is my data when using airSlate SignNow for tax exempt forms?

airSlate SignNow prioritizes data security, employing advanced encryption technology to protect your Arkansas tax exempt form and any associated information. We ensure compliance with industry standards for privacy and security, giving you peace of mind while managing sensitive documents. Your data is safe with us throughout the eSigning process.

Get more for Entergy Arkansas Sales Tax Exemption Form

- Washington documents form

- North carolina documents form

- Club agreement template form

- Real estate disclosure form

- Tattoo artist contract form

- Disposal without administration form

- Oregon contract for sale and purchase of real estate with no broker for residential home sale agreement form

- Va will living form

Find out other Entergy Arkansas Sales Tax Exemption Form

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now

- eSign Pennsylvania Sales Invoice Template Computer

- eSign Virginia Sales Invoice Template Computer

- eSign Oregon Assignment of Mortgage Online