Delaware Senior School Property Tax Credit Form

What is the Delaware Senior School Property Tax Credit

The Delaware Senior School Property Tax Credit is a financial benefit designed to assist eligible senior citizens with their property tax obligations. This program aims to alleviate some of the financial burdens faced by seniors living in Delaware, allowing them to retain their homes while managing their expenses. The credit is applied directly to the property tax bill, reducing the amount owed by qualifying homeowners.

Eligibility Criteria

To qualify for the Delaware Senior School Property Tax Credit, applicants must meet specific criteria. Generally, applicants must be at least sixty-five years old and must have owned and occupied the property for at least three years. Additionally, the property must be their primary residence, and the applicant's income must fall below a certain threshold set by the state. It is essential to review the latest guidelines to ensure compliance with all eligibility requirements.

Steps to complete the Delaware Senior School Property Tax Credit

Completing the Delaware Senior School Property Tax Credit involves several key steps:

- Gather necessary documentation, including proof of age, residency, and income.

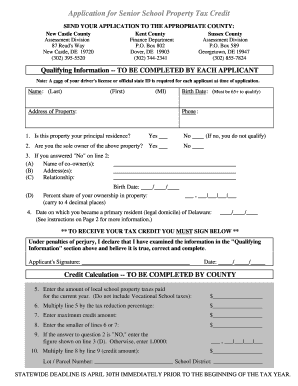

- Obtain the application form from the appropriate state or local authority.

- Fill out the application form accurately, ensuring all required information is provided.

- Submit the completed application along with any supporting documents to the designated agency.

- Await confirmation of approval or any additional requests for information.

How to obtain the Delaware Senior School Property Tax Credit

To obtain the Delaware Senior School Property Tax Credit, seniors should first confirm their eligibility. Once eligibility is established, they can access the application form through the Delaware Division of Revenue or their local tax office. The form can typically be downloaded online or requested in person. After filling out the form, it must be submitted according to the instructions provided, either online, by mail, or in person.

Required Documents

Applicants must provide several documents when applying for the Delaware Senior School Property Tax Credit. Commonly required documents include:

- Proof of age, such as a birth certificate or government-issued ID.

- Documentation of property ownership, like a deed or mortgage statement.

- Proof of residency, such as utility bills or bank statements.

- Income verification documents, including tax returns or pay stubs.

Legal use of the Delaware Senior School Property Tax Credit

The Delaware Senior School Property Tax Credit is governed by state laws that outline its legal use and parameters. It is crucial for applicants to understand these regulations to ensure they are applying correctly and receiving the benefits they are entitled to. Misuse of the credit can result in penalties, including the potential repayment of the credit and fines. Therefore, adhering to legal guidelines is essential for all applicants.

Quick guide on how to complete delaware senior school property tax credit

Complete Delaware Senior School Property Tax Credit effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed materials, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Delaware Senior School Property Tax Credit on any device with airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to modify and eSign Delaware Senior School Property Tax Credit effortlessly

- Locate Delaware Senior School Property Tax Credit and click Get Form to begin.

- Utilize the tools available to finalize your document.

- Emphasize important sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device. Alter and eSign Delaware Senior School Property Tax Credit and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the delaware senior school property tax credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Delaware senior school property tax credit?

The Delaware senior school property tax credit is a financial benefit provided to eligible senior citizens in Delaware, reducing their property tax burden. This credit is designed to assist seniors living on fixed incomes by lowering their school property taxes. To qualify, seniors must meet specific age and residency requirements.

-

Who is eligible for the Delaware senior school property tax credit?

Eligibility for the Delaware senior school property tax credit is primarily based on age and residency. Seniors must be at least 65 years old and must own and occupy their home as their primary residence. Additional income or asset limits may apply, so it's essential to check the specific criteria.

-

How do I apply for the Delaware senior school property tax credit?

To apply for the Delaware senior school property tax credit, eligible seniors should file an application with their local school district. It is recommended to gather all necessary documents, including proof of age and residency, to streamline the application process. Deadlines and specific application processes vary by district, so checking with the local office is crucial.

-

What documents are required to apply for the Delaware senior school property tax credit?

When applying for the Delaware senior school property tax credit, seniors typically need to provide proof of age, such as a birth certificate or driver's license, and evidence of residency, like a utility bill. Additionally, some districts may require income documentation. Always consult the specific application guidelines for your district.

-

How much can I save with the Delaware senior school property tax credit?

The Delaware senior school property tax credit can signNowly reduce property tax bills, depending on the school district's rates and the property’s assessed value. While the exact amount of savings varies, seniors can expect to see a reduction that may provide considerable financial relief. It's advisable to contact local authorities for precise figures.

-

Is the Delaware senior school property tax credit a one-time benefit?

No, the Delaware senior school property tax credit is not a one-time benefit. Eligible seniors can receive this credit annually as long as they continue to meet the eligibility requirements. This ongoing support is designed to help seniors manage their tax obligations consistently over the years.

-

How does the Delaware senior school property tax credit impact my overall property tax responsibilities?

Applying for the Delaware senior school property tax credit directly reduces the amount of property tax you owe, thereby easing your overall tax responsibilities. However, it's important to remember that while this credit helps with school taxes, other property taxes remain unaffected. Seniors should review their entire tax situation.

Get more for Delaware Senior School Property Tax Credit

Find out other Delaware Senior School Property Tax Credit

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe