Form 1102

What is the Form 1102

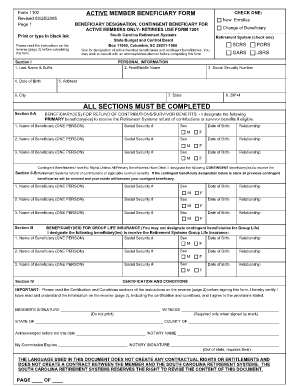

The Form 1102, known as the active member beneficiary form, is a crucial document used primarily in the context of beneficiary designations for active members of certain retirement plans. This form allows individuals to specify who will receive benefits in the event of their passing. It is essential for ensuring that beneficiaries are clearly identified and that their rights to benefits are protected. Understanding the purpose and implications of this form is vital for anyone involved in managing or participating in retirement plans.

How to use the Form 1102

Using the Form 1102 effectively involves several key steps. First, individuals must accurately fill out the form with the necessary personal and beneficiary information. This includes the names, addresses, and relationship of the beneficiaries to the member. After completing the form, it should be submitted to the appropriate retirement plan administrator. Ensuring that the form is signed and dated is crucial, as this validates the document and confirms the member's intentions regarding their beneficiaries.

Steps to complete the Form 1102

Completing the Form 1102 requires careful attention to detail. Here are the steps to follow:

- Obtain the latest version of the Form 1102 from your retirement plan administrator.

- Fill in your personal information, including your full name, address, and member identification number.

- Identify your beneficiaries by providing their names, addresses, and relationship to you.

- Review the form for accuracy and completeness to avoid any delays.

- Sign and date the form to validate it.

- Submit the completed form to your retirement plan administrator, either online or by mail, as specified by your plan.

Legal use of the Form 1102

The legal validity of the Form 1102 hinges on compliance with relevant laws governing beneficiary designations. In the United States, the form must meet specific legal standards to ensure that it is enforceable. This includes having the proper signatures and adhering to the requirements set forth by the Employee Retirement Income Security Act (ERISA) and other applicable regulations. Using a reliable electronic signature platform can enhance the legal standing of the form by providing necessary compliance with eSignature laws.

Key elements of the Form 1102

Several key elements must be included in the Form 1102 to ensure its effectiveness. These elements include:

- Member Information: Full name, address, and identification number.

- Beneficiary Details: Names, addresses, and relationships of all designated beneficiaries.

- Signatures: Required signatures from the member and, if necessary, witnesses or notaries.

- Date: The date of completion must be clearly indicated.

How to obtain the Form 1102

The Form 1102 can typically be obtained from your retirement plan administrator or the official website of the organization managing your retirement plan. It is important to ensure that you are using the most current version of the form, as updates may occur. If you are unsure where to find the form, contacting your plan administrator directly can provide clarity and ensure you have the necessary documentation to proceed.

Quick guide on how to complete form 1102

Effortlessly prepare Form 1102 on any device

The management of online documents has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly option to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Form 1102 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Form 1102 with ease

- Obtain Form 1102 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive information using tools that airSlate SignNow provides specifically for that function.

- Create your signature with the Sign feature, which takes mere seconds and has the same legal standing as a traditional handwritten signature.

- Review all the details and then click the Done button to save your updates.

- Choose how you would like to send your form, either via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Form 1102 to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1102

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the api 1102 pdf and how can it benefit my business?

The api 1102 pdf is a method for electronically signing documents and managing workflows within airSlate SignNow. It streamlines the document signing process, saves time, and reduces paperwork, which can signNowly enhance your business operations.

-

How much does using the api 1102 pdf feature cost?

The pricing for using the api 1102 pdf within airSlate SignNow varies based on the plan you choose. We offer different subscriptions that cater to various business needs, ensuring you get a cost-effective solution for your document signing requirements.

-

Can I integrate other applications with api 1102 pdf?

Yes, airSlate SignNow allows integration with various applications, enhancing the functionality of the api 1102 pdf. You can seamlessly connect it with popular tools like CRM and project management software for an optimal document workflow.

-

What are the key features of the api 1102 pdf in airSlate SignNow?

The api 1102 pdf features include secure electronic signatures, customizable templates, and the ability to track document status in real-time. These features are designed to streamline your signing process and improve user experience.

-

Who can benefit from using api 1102 pdf?

Businesses of all sizes can benefit from using the api 1102 pdf to manage document workflows efficiently. Whether you’re a small startup or a large corporation, this feature is designed to optimize your document processes.

-

Is the api 1102 pdf secure for confidential documents?

Absolutely, the api 1102 pdf prioritizes security. airSlate SignNow employs encryption and compliance with industry standards to ensure that your confidential documents are protected throughout the signing process.

-

How easy is it to create documents with api 1102 pdf?

Creating documents with the api 1102 pdf is user-friendly and straightforward. Users can upload files, add text fields, and configure eSignature settings in just a few clicks, making document creation a breeze.

Get more for Form 1102

Find out other Form 1102

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template

- Sign North Carolina Profit and Loss Statement Computer

- Sign Florida Non-Compete Agreement Fast

- How Can I Sign Hawaii Non-Compete Agreement

- Sign Oklahoma General Partnership Agreement Online

- Sign Tennessee Non-Compete Agreement Computer

- Sign Tennessee Non-Compete Agreement Mobile

- Sign Utah Non-Compete Agreement Secure

- Sign Texas General Partnership Agreement Easy

- Sign Alabama LLC Operating Agreement Online

- Sign Colorado LLC Operating Agreement Myself

- Sign Colorado LLC Operating Agreement Easy

- Can I Sign Colorado LLC Operating Agreement

- Sign Kentucky LLC Operating Agreement Later