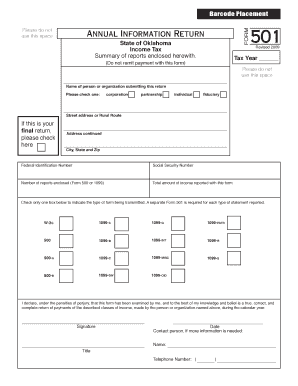

Oklahoma Annual Information Return

What is the Oklahoma Annual Information Return

The Oklahoma Annual Information Return is a form that businesses in Oklahoma must file annually to report various financial and operational details. This form is crucial for compliance with state regulations and provides the state with necessary information about the business's activities, income, and tax obligations. It is typically required for corporations, partnerships, and other business entities operating within the state.

Steps to complete the Oklahoma Annual Information Return

Completing the Oklahoma Annual Information Return involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and balance sheets. Next, fill out the form with accurate information regarding your business's income, expenses, and any applicable deductions. It is essential to review the form thoroughly for any errors before submission. Finally, submit the completed form by the designated deadline, either electronically or via mail, depending on your preference and the state's requirements.

Legal use of the Oklahoma Annual Information Return

The Oklahoma Annual Information Return is legally binding when completed and submitted according to state laws. It serves as an official record of a business's financial activities for the year. To ensure its legal validity, the form must be signed by an authorized representative of the business. Additionally, compliance with eSignature laws is critical when submitting the form electronically, as it enhances the document's legitimacy and security.

Filing Deadlines / Important Dates

Filing deadlines for the Oklahoma Annual Information Return are typically set for a specific date each year, often aligned with the end of the fiscal year for the business. It is essential to be aware of these deadlines to avoid penalties for late submission. Businesses should mark their calendars and prepare their documentation in advance to ensure timely filing. Late submissions may incur fines or additional scrutiny from state authorities.

Required Documents

To successfully complete the Oklahoma Annual Information Return, certain documents are required. These include financial statements such as income statements and balance sheets, tax identification numbers, and any supporting documentation related to deductions or credits claimed. Having these documents organized and readily available will streamline the completion process and help ensure accuracy.

Form Submission Methods (Online / Mail / In-Person)

The Oklahoma Annual Information Return can be submitted through various methods, providing flexibility for businesses. Options typically include online submission through the state’s official website, mailing a hard copy of the completed form, or delivering it in person to the appropriate state office. Each method has its own requirements and processing times, so businesses should choose the one that best fits their needs.

Penalties for Non-Compliance

Failure to file the Oklahoma Annual Information Return by the deadline can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for businesses to understand these consequences and prioritize compliance to avoid unnecessary financial burdens. Regularly reviewing filing requirements and deadlines can help mitigate the risk of non-compliance.

Quick guide on how to complete oklahoma annual information return 132893

Easily Prepare Oklahoma Annual Information Return on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally conscious substitute for traditional printed and signed documents, as you can easily find the right form and securely save it online. airSlate SignNow provides all the functionality you require to create, modify, and electronically sign your documents quickly and without delays. Manage Oklahoma Annual Information Return on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Alter and Electronically Sign Oklahoma Annual Information Return Effortlessly

- Find Oklahoma Annual Information Return and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or conceal confidential information using the tools provided by airSlate SignNow designed specifically for this task.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choosing. Edit and electronically sign Oklahoma Annual Information Return and facilitate excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oklahoma annual information return 132893

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oklahoma Annual Information Return?

The Oklahoma Annual Information Return is a tax document that organizations are required to submit to report their financial activities for the year. This form helps ensure compliance with state tax laws and provides important information to the state.

-

How can airSlate SignNow assist with the Oklahoma Annual Information Return?

airSlate SignNow streamlines the process of preparing and submitting the Oklahoma Annual Information Return by allowing you to easily eSign and manage your documents electronically. This reduces paperwork and the risk of errors, ensuring timely submissions.

-

What are the benefits of using airSlate SignNow for document signing?

Using airSlate SignNow for the Oklahoma Annual Information Return enhances efficiency by enabling secure electronic signatures. It also provides quick access to signed documents and keeps your compliance records well-organized, saving you time and hassle.

-

Is airSlate SignNow affordable for small businesses submitting the Oklahoma Annual Information Return?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to businesses of all sizes, including small businesses. These plans are designed to ensure that you can efficiently handle your Oklahoma Annual Information Return and other documents without breaking the bank.

-

Can airSlate SignNow integrate with other accounting software for the Oklahoma Annual Information Return?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, making it easier to manage your financial documents, including the Oklahoma Annual Information Return. This integration helps streamline your workflow and keeps all your financial data in sync.

-

What features does airSlate SignNow offer to support the Oklahoma Annual Information Return process?

airSlate SignNow provides a variety of features to support the Oklahoma Annual Information Return process, including reusable templates, automated reminders, and audit trails for tracking document status. These features help ensure that your returns are accurate and submitted on time.

-

How secure is airSlate SignNow when handling sensitive documents like the Oklahoma Annual Information Return?

airSlate SignNow employs robust security measures, including SSL encryption and advanced authentication, to protect sensitive documents, including the Oklahoma Annual Information Return. Your data's safety is our priority, ensuring compliance with data protection regulations.

Get more for Oklahoma Annual Information Return

- Not named in interrogatory no form

- 4 as a result of the occurrence were you made a defendant in any form

- Seeking criminal penalties form

- Use icon in a sentenceicon sentence examples form

- You may delete the fields not used form

- So if you only have one child delete form

- Party further agrees that they are not acting under duress or undue form

- Mt 599ppdf form

Find out other Oklahoma Annual Information Return

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form