Cardholder Dispute Form Hdfc

What is the Cardholder Dispute Form Hdfc

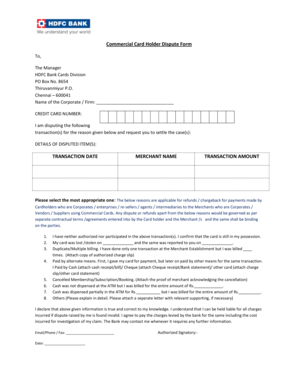

The Cardholder Dispute Form Hdfc is a document that allows customers to formally dispute charges on their HDFC credit card statements. This form is essential for cardholders who believe that a transaction is inaccurate, fraudulent, or unauthorized. By completing this form, customers initiate a process to investigate the disputed charge, which can lead to a resolution that may involve a refund or adjustment to their account. Understanding the purpose and function of this form is crucial for ensuring that your rights as a consumer are protected.

How to use the Cardholder Dispute Form Hdfc

Using the Cardholder Dispute Form Hdfc involves several straightforward steps. First, obtain the form from the HDFC website or customer service. Next, fill out the required fields, including your personal information, details of the disputed transaction, and the reason for the dispute. After completing the form, review it for accuracy before submission. It is important to provide as much detail as possible to facilitate a thorough investigation. Finally, submit the form according to the instructions provided, which may include online submission or mailing it to a designated address.

Steps to complete the Cardholder Dispute Form Hdfc

Completing the Cardholder Dispute Form Hdfc requires careful attention to detail. Follow these steps:

- Access the form from the HDFC website or request a physical copy.

- Fill in your personal information, including your name, address, and contact details.

- Provide your HDFC credit card number and the transaction date.

- Clearly describe the nature of the dispute, specifying whether it is due to fraud, billing errors, or other reasons.

- Attach any supporting documentation, such as receipts or statements, that may help in resolving the dispute.

- Review the completed form for accuracy and completeness.

- Submit the form as instructed, ensuring you keep a copy for your records.

Legal use of the Cardholder Dispute Form Hdfc

The Cardholder Dispute Form Hdfc is legally recognized as a formal request to investigate disputed charges. When filled out correctly and submitted according to HDFC’s guidelines, it serves as a legal document that can help protect the consumer's rights. The form must adhere to relevant regulations, such as the Fair Credit Billing Act, which outlines the rights of consumers regarding billing disputes. Proper use of this form can lead to a resolution that is compliant with legal standards and ensures that the consumer is treated fairly.

Required Documents

When submitting the Cardholder Dispute Form Hdfc, certain documents may be required to support your claim. These documents can include:

- A copy of your HDFC credit card statement highlighting the disputed transaction.

- Receipts or proof of purchase related to the transaction.

- Any correspondence with the merchant regarding the dispute.

- Your identification, such as a driver's license or passport, may be necessary for verification.

Providing these documents can expedite the investigation process and increase the likelihood of a favorable outcome.

Form Submission Methods

The Cardholder Dispute Form Hdfc can be submitted through various methods to accommodate customer preferences. Options typically include:

- Online submission via the HDFC website, where you can fill out and submit the form electronically.

- Mailing the completed form to the designated HDFC address, ensuring that you use a secure method to track your submission.

- In-person submission at an HDFC branch, where you can receive immediate assistance from bank personnel.

Choosing the most convenient submission method can help ensure that your dispute is addressed promptly.

Quick guide on how to complete cardholder dispute form hdfc

Complete Cardholder Dispute Form Hdfc effortlessly on any device

Digital document management has gained traction among both companies and individuals. It serves as an ideal sustainable alternative to conventional printed and signed documents, allowing you to find the right form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Cardholder Dispute Form Hdfc on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to revise and electronically sign Cardholder Dispute Form Hdfc with ease

- Find Cardholder Dispute Form Hdfc and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select pertinent sections of your documents or redact confidential information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Decide how you want to share your form, via email, text message (SMS), or an invite link, or download it to your computer.

Put an end to lost or misplaced documents, frustrating form searches, or errors that necessitate printing new document copies. airSlate SignNow covers all your document management needs in just a few clicks from any device you choose. Alter and electronically sign Cardholder Dispute Form Hdfc and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cardholder dispute form hdfc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the HDFC dispute form and when should I use it?

The HDFC dispute form is an official document designed for customers who wish to raise a dispute regarding transactions or services through HDFC Bank. You should use this form if you encounter unauthorized transactions, discrepancies, or service-related issues, ensuring timely resolution.

-

How can I obtain the HDFC dispute form?

You can easily obtain the HDFC dispute form through the HDFC Bank website or by visiting a local branch. Additionally, many online banking platforms allow you to download the form directly, facilitating quick access and submission for your dispute resolution.

-

What information do I need to fill out the HDFC dispute form?

To fill out the HDFC dispute form, you will need to provide personal information such as your account number, contact details, and the specifics of the transaction in question. Make sure to include any relevant documentation that supports your claim to assist in the dispute investigation process.

-

Is there a fee for submitting the HDFC dispute form?

Generally, there is no fee associated with submitting the HDFC dispute form, as it is a part of your banking rights to dispute transactions. Ensure you check the latest terms and conditions with HDFC Bank for any changes regarding fees if applicable.

-

How long does it take to resolve disputes submitted via the HDFC dispute form?

The resolution time for disputes submitted via the HDFC dispute form can vary, typically taking anywhere from a few days to a few weeks. HDFC Bank strives to resolve disputes promptly, so you should receive updates regarding the status of your claim throughout the process.

-

Can I track the status of my HDFC dispute form submission?

Yes, you can track the status of your HDFC dispute form submission through the HDFC Bank online banking portal or by contacting customer support. Keeping yourself updated on the status ensures you are informed about any actions taken regarding your dispute.

-

Are there any common reasons for submitting an HDFC dispute form?

Common reasons for submitting an HDFC dispute form include unauthorized transactions, double charging, incorrect billing, or failure to receive promised services. Understanding these scenarios can help you determine when to utilize the HDFC dispute form effectively.

Get more for Cardholder Dispute Form Hdfc

- The court in the exercise of its jurisdiction for the appointment of guardians of minors and upon proper petition by a form

- General guardian form

- Motion in the cause to form

- Name and address of guardian form

- Limited guardian of the estate form

- Limited general guardian form

- Owed decedent form

- Administration by clerk form

Find out other Cardholder Dispute Form Hdfc

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation