NPT Return Phila Form

What is the Philadelphia NPT Return?

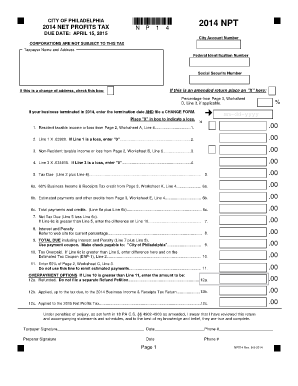

The Philadelphia NPT (Net Profits Tax) Return is a tax form required for businesses operating within the city of Philadelphia. This form is used to report net profits earned by businesses and to calculate the corresponding tax liability. The NPT is applicable to various business entities, including corporations, partnerships, and sole proprietorships. Understanding this form is crucial for compliance with local tax regulations and for avoiding potential penalties.

Steps to Complete the Philadelphia NPT Return

Completing the Philadelphia NPT Return involves several key steps to ensure accurate reporting and compliance. First, gather all necessary financial documents, including income statements, expense reports, and previous tax returns. Next, calculate your net profits by subtracting allowable business expenses from your total income. Once you have determined your net profits, fill out the NPT form with the required information, including your business details and financial figures. Finally, review the completed form for accuracy before submitting it to the appropriate tax authority.

Legal Use of the Philadelphia NPT Return

The Philadelphia NPT Return must be completed and filed in accordance with local tax laws. It is legally binding and serves as an official record of a business's financial activity within the city. To ensure its legal validity, businesses must adhere to the guidelines set forth by the Philadelphia Department of Revenue. This includes meeting filing deadlines and maintaining accurate records to support the figures reported on the NPT Return.

Filing Deadlines / Important Dates

Filing deadlines for the Philadelphia NPT Return are crucial for compliance. Typically, the return is due on the fifteenth day of the fourth month following the end of the tax year. For businesses operating on a calendar year, this means the return is due by April 15. It is important for businesses to mark their calendars and prepare their documentation in advance to avoid late fees and penalties.

Required Documents

To successfully complete the Philadelphia NPT Return, businesses must gather specific documents. These typically include:

- Income statements detailing total revenue

- Expense reports outlining all deductible costs

- Previous year’s NPT Return for reference

- Any supporting documentation for claimed deductions

Having these documents ready will facilitate a smoother filing process and help ensure accuracy in reporting.

Penalties for Non-Compliance

Failing to file the Philadelphia NPT Return on time can result in significant penalties. Businesses may face fines and interest on unpaid taxes, which can accumulate quickly. Additionally, non-compliance may lead to audits and further scrutiny from tax authorities. It is essential for businesses to prioritize timely filing to avoid these consequences.

Quick guide on how to complete npt return phila

Effortlessly Prepare NPT Return Phila on Any Device

Managing documents online has become increasingly favored by companies and individuals alike. It offers a perfect environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your files quickly and without delays. Manage NPT Return Phila on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Modify and eSign NPT Return Phila Smoothly

- Locate NPT Return Phila and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you prefer to send your form, via email, SMS, invitation link, or download it to your computer.

Put an end to the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign NPT Return Phila and ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the npt return phila

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Philadelphia NPT form?

The Philadelphia NPT form is a specific legal document used in Pennsylvania for the purpose of transferring property ownership. Using airSlate SignNow can streamline the process of completing and eSigning your Philadelphia NPT form, making it easier and more efficient.

-

How can airSlate SignNow help me complete the Philadelphia NPT form?

airSlate SignNow provides an intuitive platform to easily fill out the Philadelphia NPT form online. With features like template management and electronic signatures, you can efficiently prepare the document and ensure it is legally binding.

-

Is there a fee for using airSlate SignNow with the Philadelphia NPT form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including options for individuals and businesses. By subscribing, you'll gain access not only to the Philadelphia NPT form but also to a suite of tools designed to enhance your document signing experience.

-

Are there any integrations available for the Philadelphia NPT form on airSlate SignNow?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications and platforms, allowing you to easily upload and manage your Philadelphia NPT form alongside other essential documents. This integration enhances your productivity and ensures your workflow remains uninterrupted.

-

What features does airSlate SignNow offer for managing the Philadelphia NPT form?

airSlate SignNow provides numerous features for managing the Philadelphia NPT form, including email notifications, reminders, and the ability to track document status. These features help keep your transaction organized and ensure you never lose sight of your document's progress.

-

Can I access the Philadelphia NPT form from mobile devices using airSlate SignNow?

Yes, airSlate SignNow is mobile-friendly, so you can easily access and complete the Philadelphia NPT form from your smartphone or tablet. This accessibility ensures you can manage your documents on-the-go without any hassle.

-

Is the Philadelphia NPT form legally valid when signed electronically?

Yes, the Philadelphia NPT form signed electronically through airSlate SignNow complies with legal standards, making it fully valid. Electronic signatures are recognized under U.S. law, ensuring that your signed document holds up against legal scrutiny.

Get more for NPT Return Phila

- Answer complaint form

- Agreement between company form

- Nonexclusive license to hunt and fish on property or land of another form

- Motion requesting additional time to respond to motion for summary judgment with notice of motion form

- Summary judgment 481377625 form

- Fence permit application form

- Affirmative defense action form

- Cattle lease form

Find out other NPT Return Phila

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT