Arizona Form 650a

What is the Arizona Form 650a

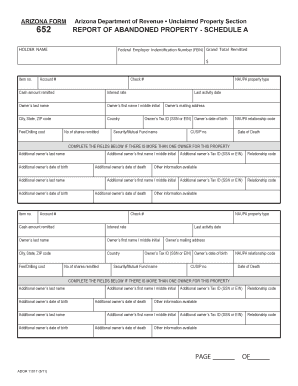

The Arizona Form 650a is a specific document used for reporting unclaimed property in the state of Arizona. This form is essential for businesses and organizations that hold unclaimed property, ensuring compliance with state laws regarding the reporting and remittance of such assets. The form captures detailed information about the property and its rightful owners, facilitating the process of returning unclaimed assets to individuals.

How to use the Arizona Form 650a

Using the Arizona Form 650a involves several key steps. First, gather all necessary information about the unclaimed property, including the owner's details and the type of property being reported. Next, accurately complete the form, ensuring all required fields are filled out. Once the form is filled, it can be submitted electronically or via mail, depending on your preference and the guidelines set by the Arizona Department of Revenue.

Steps to complete the Arizona Form 650a

Completing the Arizona Form 650a requires careful attention to detail. Follow these steps for accurate submission:

- Collect all relevant information regarding the unclaimed property.

- Access the Arizona Form 650a from the appropriate state resources.

- Fill in the property holder's information, including name, address, and contact details.

- Provide a detailed description of the unclaimed property.

- Review the form for accuracy and completeness.

- Submit the form either online or by mailing it to the designated address.

Legal use of the Arizona Form 650a

The Arizona Form 650a is legally binding when completed and submitted according to state regulations. It is crucial to adhere to the guidelines set forth by the Arizona Department of Revenue to ensure that the form is accepted. Compliance with eSignature laws is also necessary if the form is submitted electronically, as this enhances its legal validity.

Key elements of the Arizona Form 650a

Several key elements must be included in the Arizona Form 650a to ensure its validity and completeness. These elements include:

- Property holder's name and contact information.

- Description of the unclaimed property.

- Last known address of the property owner.

- Amount or value of the unclaimed property.

- Signature of the authorized representative, if applicable.

Form Submission Methods

The Arizona Form 650a can be submitted through various methods, providing flexibility for users. The available submission methods include:

- Online Submission: Users can complete and submit the form electronically through the Arizona Department of Revenue's online portal.

- Mail Submission: The completed form can be printed and mailed to the designated address provided by the state.

- In-Person Submission: Individuals may also choose to submit the form in person at designated state offices.

Quick guide on how to complete arizona form 650a 1375293

Effortlessly Prepare Arizona Form 650a on Any Device

Digital document management has become a trend among businesses and individuals alike. It offers a prime eco-friendly alternative to conventional printed and signed documents, allowing you to easily obtain the right form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without any holdups. Manage Arizona Form 650a on any device with the airSlate SignNow apps for Android or iOS, and enhance any document-related process today.

The Most Effective Way to Modify and eSign Arizona Form 650a with Ease

- Obtain Arizona Form 650a and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of your documents or conceal private information using tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal significance as an ordinary handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you'd like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Modify and eSign Arizona Form 650a and ensure superior communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona form 650a 1375293

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Arizona Form 650A and why do I need it?

The Arizona Form 650A is a document used by taxpayers in Arizona for various administrative and tax-related purposes. Completing the Arizona Form 650A accurately is crucial to ensure compliance with state regulations. Utilizing airSlate SignNow can streamline this process, making it easy to fill, sign, and submit the form efficiently.

-

How can airSlate SignNow help with completing the Arizona Form 650A?

airSlate SignNow provides an user-friendly interface that allows you to fill out and eSign the Arizona Form 650A in just a few clicks. With its customizable templates and document sharing capabilities, you can ensure all necessary signatures are collected swiftly. This efficiency saves time and helps reduce the risk of errors.

-

Are there any fees associated with using airSlate SignNow for the Arizona Form 650A?

Yes, airSlate SignNow offers various pricing plans designed to fit different business needs. These plans include features tailored for efficient document management, such as for handling the Arizona Form 650A. It's recommended to check their website for the latest pricing options.

-

Can I integrate airSlate SignNow with other tools for processing the Arizona Form 650A?

Absolutely! airSlate SignNow supports various integrations with popular business applications, allowing you to enhance your workflow while processing the Arizona Form 650A. Integrating with tools like CRM systems or cloud storage platforms can signNowly streamline your document management.

-

What benefits does airSlate SignNow offer when handling the Arizona Form 650A?

Using airSlate SignNow for the Arizona Form 650A provides multiple benefits, including fast and secure document signing, reduced paperwork, and improved collaboration. These features help you manage your forms more effectively, ensuring that you meet deadlines without hassle.

-

Is it secure to use airSlate SignNow for the Arizona Form 650A?

Yes, security is a top priority at airSlate SignNow. The platform uses industry-standard encryption to protect your documents while processing the Arizona Form 650A. This ensures that your sensitive information remains confidential and secure throughout the signing process.

-

How does airSlate SignNow make the Arizona Form 650A accessible for multiple users?

airSlate SignNow allows you to easily share the Arizona Form 650A with multiple users via email or direct links. This feature enables collaborative editing and signing, which is particularly useful for teams working on tax documents or for businesses needing multiple approvals.

Get more for Arizona Form 650a

- Contractors notice to owner individual 490202162 form

- Nevada mechanics lien law in construction faqs forms

- The horses to seller form

- Notice of pendency of action individual form

- Notice of pendency of action corporation form

- Lien claimant furnished or supplied labor form

- Free florida eviction notice formsprocess and laws

- 5 day notice of termination of form

Find out other Arizona Form 650a

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online