Hawaii L 80 Tracer Request for Net Income Tax State Legal Forms

What is the Hawaii L 80 Tracer Request For Net Income Tax State Legal Forms

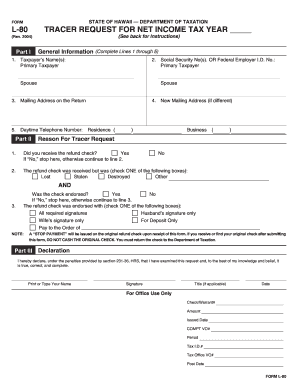

The Hawaii L 80 Tracer Request For Net Income Tax State Legal Forms is a specific document used by taxpayers in Hawaii to request information regarding their net income tax. This form is essential for individuals or entities that need to trace their tax records for various reasons, such as verifying payments or ensuring compliance with state tax laws. It serves as an official request to the Department of Taxation in Hawaii, allowing taxpayers to obtain necessary details about their tax filings and payments.

How to use the Hawaii L 80 Tracer Request For Net Income Tax State Legal Forms

Using the Hawaii L 80 Tracer Request For Net Income Tax State Legal Forms involves several straightforward steps. First, ensure you have the correct form, which can typically be downloaded from the state’s tax website. Next, fill out the required fields, providing accurate information such as your name, address, Social Security number, and the specific details of the tax year you are inquiring about. After completing the form, submit it as directed, either electronically or via mail, to the appropriate tax office.

Steps to complete the Hawaii L 80 Tracer Request For Net Income Tax State Legal Forms

Completing the Hawaii L 80 Tracer Request For Net Income Tax State Legal Forms requires careful attention to detail. Follow these steps:

- Download the form from the Hawaii Department of Taxation website.

- Fill in your personal information, including your full name, address, and Social Security number.

- Specify the tax year for which you are requesting information.

- Provide any additional details required by the form, such as prior payment amounts or filing status.

- Review the completed form for accuracy.

- Submit the form according to the instructions provided, ensuring you keep a copy for your records.

Legal use of the Hawaii L 80 Tracer Request For Net Income Tax State Legal Forms

The legal use of the Hawaii L 80 Tracer Request For Net Income Tax State Legal Forms is crucial for maintaining compliance with state tax regulations. This form is legally recognized as a valid request for tax information, and it must be filled out correctly to ensure that the information received is accurate and reliable. Taxpayers should be aware that any false information provided on the form can lead to penalties or legal repercussions.

Required Documents

When submitting the Hawaii L 80 Tracer Request For Net Income Tax State Legal Forms, certain documents may be required to support your request. These may include:

- A copy of your previous tax returns for the relevant years.

- Proof of identity, such as a driver's license or state ID.

- Any correspondence from the Department of Taxation regarding your tax status.

Having these documents ready can facilitate a smoother process and help ensure that your request is processed without delays.

Form Submission Methods (Online / Mail / In-Person)

The Hawaii L 80 Tracer Request For Net Income Tax State Legal Forms can be submitted through various methods, depending on your preference and the options provided by the state:

- Online: Many taxpayers may have the option to submit the form electronically via the Hawaii Department of Taxation's online portal.

- Mail: You can print the completed form and send it to the designated tax office address.

- In-Person: Some individuals may choose to deliver the form directly to a local tax office for immediate processing.

Quick guide on how to complete hawaii l 80 tracer request for net income tax state legal forms

Complete Hawaii L 80 Tracer Request For Net Income Tax State Legal Forms with ease on any device

Digital document management has become favored among enterprises and individuals. It offers a superb eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Hawaii L 80 Tracer Request For Net Income Tax State Legal Forms on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Hawaii L 80 Tracer Request For Net Income Tax State Legal Forms effortlessly

- Locate Hawaii L 80 Tracer Request For Net Income Tax State Legal Forms and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant portions of the documents or redact sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to finalize your changes.

- Select your preferred method to submit your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your documentation management needs in just a few clicks from a device of your preference. Modify and eSign Hawaii L 80 Tracer Request For Net Income Tax State Legal Forms to guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the hawaii l 80 tracer request for net income tax state legal forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Hawaii L 80 Tracer Request For Net Income Tax and how can it help me?

The Hawaii L 80 Tracer Request For Net Income Tax is a state legal form used to request information regarding net income tax. This can help businesses and individuals track their tax liabilities and ensure compliance with state requirements. Using airSlate SignNow, you can easily complete and eSign this form online, streamlining the process.

-

How much does it cost to use airSlate SignNow for filling out the Hawaii L 80 Tracer Request For Net Income Tax?

The pricing for airSlate SignNow varies depending on the plan you choose. Generally, our services are cost-effective and designed to meet the needs of businesses while providing features like eSigning and form management. We recommend checking our pricing page to see which plan suits your needs best for applications like the Hawaii L 80 Tracer Request For Net Income Tax.

-

What features does airSlate SignNow offer for the Hawaii L 80 Tracer Request For Net Income Tax?

airSlate SignNow offers several features for the Hawaii L 80 Tracer Request For Net Income Tax, including customizable templates, easy eSigning, and secure document storage. These features ensure that your forms are completed accurately and efficiently while maintaining compliance with state regulations. You can also track the status of your forms in real-time.

-

Is airSlate SignNow compatible with other software for handling legal forms?

Yes, airSlate SignNow integrates seamlessly with a variety of software applications to enhance your workflow. Whether you are using CRM, cloud storage, or document management systems, you can easily import and export your Hawaii L 80 Tracer Request For Net Income Tax and other state legal forms without hassle. This compatibility ensures a smooth experience across platforms.

-

Can I save my progress when filling out the Hawaii L 80 Tracer Request For Net Income Tax?

Absolutely! With airSlate SignNow, you can save your progress while filling out the Hawaii L 80 Tracer Request For Net Income Tax. This allows you to return to the form later without losing any of your entered information, making it convenient and user-friendly for anyone working with state legal forms.

-

What are the benefits of using airSlate SignNow for the Hawaii L 80 Tracer Request For Net Income Tax?

Using airSlate SignNow for the Hawaii L 80 Tracer Request For Net Income Tax offers several benefits, such as increased efficiency, enhanced security, and easier compliance with state regulations. Our platform allows for quick eSigning, tracking, and storage of legal documents, which saves time and resources for individuals and businesses alike.

-

Is customer support available if I encounter issues with the Hawaii L 80 Tracer Request For Net Income Tax?

Yes, airSlate SignNow provides robust customer support to assist you with any issues related to the Hawaii L 80 Tracer Request For Net Income Tax. Our knowledgeable support team is available via chat, email, or phone to provide guidance and ensure your experience is seamless while using our platform for state legal forms.

Get more for Hawaii L 80 Tracer Request For Net Income Tax State Legal Forms

Find out other Hawaii L 80 Tracer Request For Net Income Tax State Legal Forms

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation