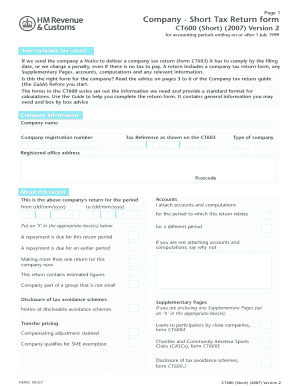

Short Tax Return Form

What is the Short Tax Return

The short tax return is a simplified tax form designed for individuals with straightforward financial situations. Typically, it is used by taxpayers who have a limited number of income sources, such as wages or retirement benefits, and who do not itemize deductions. This form allows for a more efficient filing process, making it easier for eligible taxpayers to fulfill their tax obligations.

How to use the Short Tax Return

Using the short tax return involves several key steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other relevant income statements. Next, select the appropriate short tax return form, such as the 1040-EZ or 1040-SR, depending on your eligibility. Complete the form by entering your personal information, income details, and any applicable credits or deductions. Finally, review the completed form for accuracy before submitting it electronically or via mail.

Steps to complete the Short Tax Return

Completing the short tax return can be done in a few straightforward steps:

- Gather all necessary documents, including income statements and previous tax returns.

- Choose the correct short tax return form based on your eligibility.

- Fill out personal information, including your name, address, and Social Security number.

- Report all income sources accurately, ensuring to include any taxable interest or dividends.

- Claim any eligible credits or deductions, such as the standard deduction.

- Review the form for any errors and ensure all calculations are correct.

- Sign and date the form before submitting it to the IRS.

Legal use of the Short Tax Return

The short tax return is legally binding when completed correctly and submitted to the IRS. It must be filled out truthfully, as providing false information can lead to penalties or legal repercussions. To ensure compliance, taxpayers should familiarize themselves with IRS guidelines and ensure that all necessary information is included. Utilizing a reliable electronic signature tool can also enhance the legal standing of the submitted document.

Filing Deadlines / Important Dates

Filing deadlines for the short tax return typically align with the general tax filing deadlines set by the IRS. For most taxpayers, the deadline is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to keep track of any changes to filing deadlines, as well as any extensions that may apply, to avoid penalties for late submission.

Required Documents

To successfully complete the short tax return, several documents are required:

- W-2 forms from employers detailing annual earnings.

- 1099 forms for any freelance or contract work.

- Records of any other income, such as interest or dividends.

- Documentation for any tax credits or deductions claimed, such as education credits.

Who Issues the Form

The short tax return forms are issued by the Internal Revenue Service (IRS). These forms are available on the IRS website and can also be obtained through various tax preparation software. It is essential to ensure that the most current version of the form is used to comply with any recent tax law changes.

Quick guide on how to complete short tax return

Effortlessly Prepare Short Tax Return on Any Device

The utilization of online document management has surged in popularity among enterprises and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents rapidly without any holdups. Manage Short Tax Return on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

The easiest way to modify and electronically sign Short Tax Return effortlessly

- Locate Short Tax Return and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and then click the Done button to store your updates.

- Select your preferred method to share your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, the hassle of searching for forms, or errors that necessitate printing new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from your device of choice. Modify and electronically sign Short Tax Return to ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the short tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a short tax return?

A short tax return is a simplified version of a tax form that eligible taxpayers can file to report their income and claim deductions. It is ideal for individuals with straightforward financial situations. Understanding how to file a short tax return can save time and reduce the complexity of tax season.

-

How does airSlate SignNow help with short tax returns?

airSlate SignNow simplifies the process of signing and sending documents related to short tax returns. Users can easily create, edit, and eSign tax documents without the hassle of printing or scanning. This streamlined process enhances productivity, ensuring that tax documents are sent and received promptly.

-

Is there a cost to use airSlate SignNow for short tax returns?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including those looking to manage short tax return documents efficiently. The pricing is competitive, providing a cost-effective solution for individuals and businesses alike. You can choose a plan that best suits your volume of documents and usage.

-

Can I integrate airSlate SignNow with my accounting software for short tax returns?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easy to manage documents related to short tax returns. These integrations help streamline workflows, ensuring that all financial documents are organized and accessible in one place.

-

What features does airSlate SignNow offer for handling short tax returns?

airSlate SignNow includes features such as template creation, document tracking, and secure eSigning, all of which are essential for efficiently managing short tax returns. Additionally, the platform offers compliance assurance, ensuring that your documents meet necessary legal requirements. Its user-friendly interface makes it easy for anyone to navigate the process.

-

Is my information secure when using airSlate SignNow for short tax returns?

Yes, airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to keep your information safe. When managing short tax returns or any sensitive documents, you can trust that your data is protected. Regular security audits ensure compliance with industry standards.

-

How quickly can I send and receive short tax returns using airSlate SignNow?

With airSlate SignNow, you can quickly send and receive short tax returns within minutes. The platform allows real-time notifications when documents are viewed or signed, enhancing communication and transparency. This rapid turnaround is crucial during tax season, where time sensitivity is paramount.

Get more for Short Tax Return

- Warranty deed from corporation to husband and wife connecticut form

- Petition for review connecticut form

- Quitclaim deed from corporation to individual connecticut form

- Warranty deed from corporation to individual connecticut form

- Rehabilitation request connecticut form

- Quitclaim deed from corporation to llc connecticut form

- Quitclaim deed from corporation to corporation connecticut form

- Warranty deed from corporation to corporation connecticut form

Find out other Short Tax Return

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free