North Carolina Sales Tax Exemption Form

What is the North Carolina Sales Tax Exemption Form

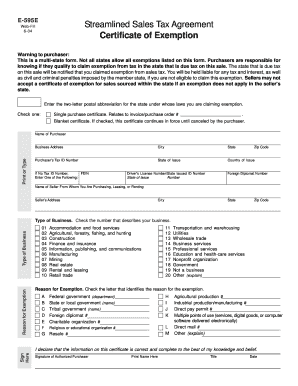

The North Carolina Sales Tax Exemption Form is a document used by businesses and individuals to claim exemption from sales tax on certain purchases. This form is essential for qualifying organizations, such as non-profits, government entities, and specific businesses, to avoid paying sales tax on eligible transactions. By completing this form, the purchaser certifies that the items being bought are exempt from sales tax under North Carolina law.

How to use the North Carolina Sales Tax Exemption Form

Using the North Carolina Sales Tax Exemption Form involves several steps. First, the buyer must complete the form accurately, providing necessary details such as the purchaser's name, address, and the reason for the exemption. Once filled out, the form should be presented to the seller at the time of purchase. The seller retains this form as proof of the tax-exempt sale for their records. It is crucial to ensure that the form is used only for eligible purchases to comply with state regulations.

Steps to complete the North Carolina Sales Tax Exemption Form

Completing the North Carolina Sales Tax Exemption Form requires careful attention to detail. Here are the steps to follow:

- Download the form from the North Carolina Department of Revenue website or obtain a physical copy.

- Fill in the purchaser's information, including name, address, and type of organization.

- Specify the reason for the exemption, referencing the appropriate statute if necessary.

- Sign and date the form to certify the accuracy of the information provided.

- Present the completed form to the seller during the transaction.

Legal use of the North Carolina Sales Tax Exemption Form

The legal use of the North Carolina Sales Tax Exemption Form is governed by state tax laws. The form must be completed truthfully and used solely for qualifying purchases. Misuse of the form, such as claiming exemptions for ineligible items, can lead to penalties, including back taxes owed and potential fines. It is important for users to understand the specific criteria that qualify for tax exemption to ensure compliance.

Eligibility Criteria

To qualify for using the North Carolina Sales Tax Exemption Form, purchasers must meet certain eligibility criteria. Commonly eligible entities include:

- Non-profit organizations recognized by the IRS

- Government agencies

- Educational institutions

- Religious organizations

Additionally, specific purchases such as items for resale or certain manufacturing equipment may also qualify for exemption. It is advisable to review the North Carolina Department of Revenue guidelines to confirm eligibility before submitting the form.

Form Submission Methods

The North Carolina Sales Tax Exemption Form can be submitted in various ways, depending on the seller's preferences. Typically, the form is presented in person at the point of sale. However, some sellers may allow submission via email or fax, especially for larger transactions. It is essential to verify with the seller regarding their accepted methods for receiving the exemption form to ensure proper processing.

Quick guide on how to complete north carolina sales tax exemption form

Effortlessly complete North Carolina Sales Tax Exemption Form on any device

Managing documents online has gained popularity among companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to find the appropriate form and secure it in the cloud. airSlate SignNow equips you with all the necessary tools to produce, alter, and electronically sign your documents quickly and without delays. Manage North Carolina Sales Tax Exemption Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-centric task today.

How to alter and electronically sign North Carolina Sales Tax Exemption Form with ease

- Obtain North Carolina Sales Tax Exemption Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select pertinent sections of the documents or redact sensitive information with the various tools that airSlate SignNow offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a handwritten signature.

- Review all details and click the Done button to finalize your changes.

- Choose how you wish to send your form—via email, SMS, invitation link, or download it to your computer.

No need to worry about lost files, tedious form searches, or mistakes that require new document prints. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and electronically sign North Carolina Sales Tax Exemption Form to ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the north carolina sales tax exemption form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nc tax exempt form and how can airSlate SignNow help?

The nc tax exempt form is crucial for businesses in North Carolina looking to make tax-exempt purchases. airSlate SignNow streamlines the process, making it easy to send, eSign, and store these forms securely. With our platform, businesses can ensure compliance and efficiency in managing their tax-exempt documentation.

-

How much does using airSlate SignNow to manage nc tax exempt forms cost?

airSlate SignNow offers flexible pricing options to accommodate various business needs, starting from affordable monthly subscriptions. This cost-effective solution allows you to manage your nc tax exempt forms without breaking the bank. You can even try our service with a free trial to evaluate its value for your business.

-

Can I integrate the nc tax exempt form into my existing workflows with airSlate SignNow?

Absolutely! airSlate SignNow allows seamless integration of the nc tax exempt form into your existing workflows. With our user-friendly interface, you can easily incorporate eSigning and document management into your business processes, enhancing overall efficiency.

-

What features does airSlate SignNow offer for nc tax exempt form management?

Our platform offers a variety of features for managing your nc tax exempt forms, including customizable templates, real-time tracking, and secure cloud storage. Additionally, advanced security measures ensure your sensitive data is protected, which is essential for maintaining compliance.

-

Is airSlate SignNow mobile-friendly for completing nc tax exempt forms?

Yes, airSlate SignNow is fully mobile-friendly, allowing you to complete nc tax exempt forms from any device. This flexibility ensures that your team can easily manage important documents on the go, streamlining the eSigning process across all platforms.

-

How do I get started with airSlate SignNow for my nc tax exempt forms?

Getting started with airSlate SignNow is simple! Sign up for an account, and you can begin creating, sending, and eSigning your nc tax exempt forms in minutes. Our intuitive interface guides you through the process, making it accessible even for those new to digital signing solutions.

-

What are the benefits of using airSlate SignNow for nc tax exempt forms?

Using airSlate SignNow for nc tax exempt forms signNowly increases efficiency and reduces the time spent on paperwork. Furthermore, the digital nature of our service helps minimize errors and ensures that all forms are stored securely for easy access and compliance verification when needed.

Get more for North Carolina Sales Tax Exemption Form

- Roofing contractor package iowa form

- Electrical contractor package iowa form

- Sheetrock drywall contractor package iowa form

- Flooring contractor package iowa form

- Trim carpentry contractor package iowa form

- Fencing contractor package iowa form

- Hvac contractor package iowa form

- Landscaping contractor package iowa form

Find out other North Carolina Sales Tax Exemption Form

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online