Chase Credit Card Agreement Form

What is the Chase Credit Card Agreement

The Chase credit card agreement outlines the terms and conditions associated with using a Chase credit card. This document serves as a legally binding contract between the cardholder and Chase Bank, detailing the rights and responsibilities of both parties. Key components include interest rates, fees, payment terms, and rewards programs. Understanding this agreement is essential for responsible credit card usage and financial management.

How to use the Chase Credit Card Agreement

Utilizing the Chase credit card agreement involves familiarizing yourself with its terms to ensure compliance and optimal use of your card. Cardholders should review the agreement regularly to stay informed about any changes in fees or interest rates. When making purchases, consider how your spending aligns with the rewards structure outlined in the agreement. This knowledge can help maximize benefits while avoiding unnecessary fees.

Steps to complete the Chase Credit Card Agreement

Completing the Chase credit card agreement typically involves several key steps:

- Review the agreement thoroughly to understand all terms and conditions.

- Provide necessary personal information, including your name, address, and Social Security number.

- Sign the agreement electronically or physically, depending on the method of submission.

- Submit the completed agreement to Chase, either online or via mail, as instructed.

Key elements of the Chase Credit Card Agreement

The Chase credit card agreement contains several important elements that every cardholder should be aware of:

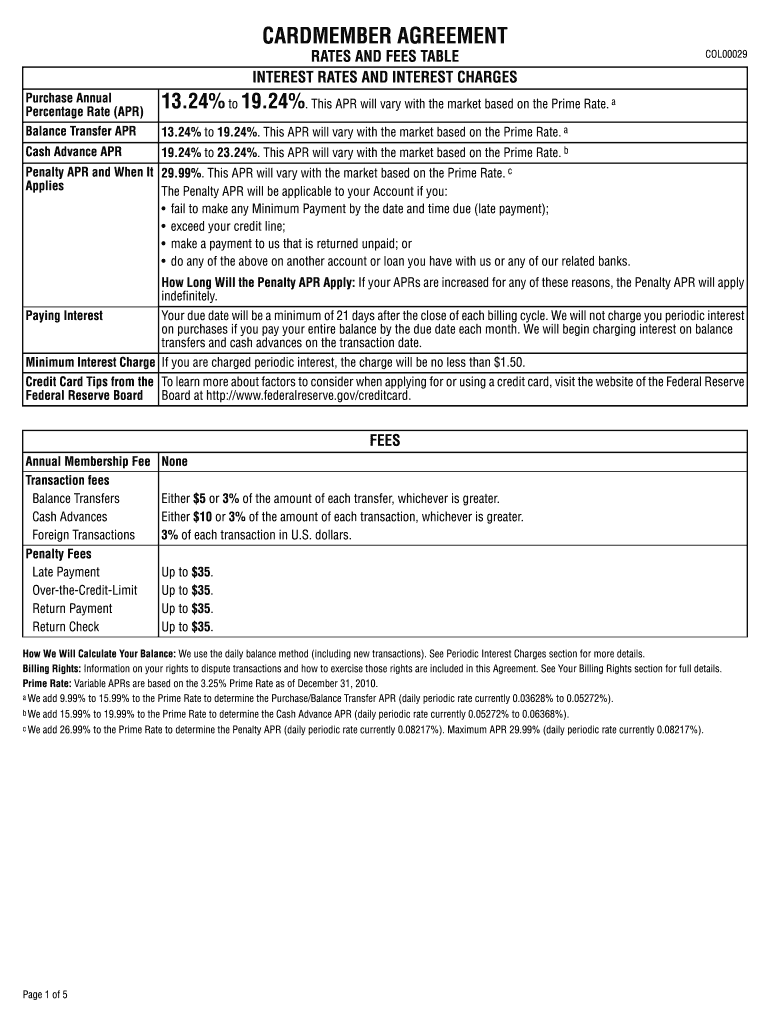

- Interest Rates: Information on annual percentage rates (APRs) for purchases, cash advances, and balance transfers.

- Fees: Details on annual fees, late payment fees, and foreign transaction fees.

- Payment Terms: Guidelines on minimum payments, due dates, and payment methods.

- Rewards Program: Explanation of how to earn and redeem rewards points or cash back.

Legal use of the Chase Credit Card Agreement

The legal validity of the Chase credit card agreement is established through compliance with federal and state regulations governing credit agreements. This includes adherence to the Truth in Lending Act, which requires transparency in disclosing terms and conditions. Cardholders should ensure they understand their rights under this agreement, including dispute resolution processes and consumer protections.

Digital vs. Paper Version

Both digital and paper versions of the Chase credit card agreement are available to cardholders. The digital version is often more convenient, allowing for quick access and easier storage. However, some individuals may prefer a physical copy for personal record-keeping. Regardless of the format, it is crucial to keep the agreement accessible for reference as needed.

Quick guide on how to complete chase credit card agreement

Effortlessly Prepare Chase Credit Card Agreement on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally-friendly substitute to conventional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without interruptions. Manage Chase Credit Card Agreement on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related task today.

The easiest method to modify and eSign Chase Credit Card Agreement effortlessly

- Find Chase Credit Card Agreement and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and hit the Done button to save your changes.

- Choose how you wish to submit your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to misplaced files, tedious form searching, or errors necessitating the printing of new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and eSign Chase Credit Card Agreement and guarantee seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the chase credit card agreement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a chase cardmember agreement?

The chase cardmember agreement is a legal document that outlines the terms and conditions of using your Chase credit card. It details important information about fees, interest rates, rewards, and your responsibilities as a cardholder. Understanding your chase cardmember agreement is essential for managing your credit card effectively.

-

How can I access my chase cardmember agreement?

You can access your chase cardmember agreement by logging into your Chase online account or mobile app. Alternatively, you can request a copy from customer service. Having your chase cardmember agreement on hand is useful for referring to terms and conditions before making decisions related to your credit card.

-

What are the benefits of understanding my chase cardmember agreement?

By understanding your chase cardmember agreement, you can better manage your credit card usage, avoid unexpected fees, and take full advantage of rewards programs. Knowledge of your agreement helps you make informed decisions regarding payments and upgrades. Overall, it empowers you to optimize your credit card experience.

-

Are there fees associated with the chase cardmember agreement?

Yes, the chase cardmember agreement outlines various fees you may encounter, such as annual fees, late payment penalties, and cash advance charges. It’s important to read this section carefully to avoid incurring unnecessary costs. By being aware of these fees, you can manage your card use more responsibly.

-

What features are included in the chase cardmember agreement?

The chase cardmember agreement includes features such as your credit limit, interest rate information, and specific benefits tied to your card. It also provides guidelines for rewards points, travel insurance, and purchase protection. Familiarizing yourself with these features is vital for making the most of your Chase credit card.

-

Can I update my chase cardmember agreement?

You cannot directly update your chase cardmember agreement, as it is dictated by Chase’s policies. However, you can apply for different card options that may come with new terms and benefits. Staying informed about updates or promotions can help you switch to a more favorable card if needed.

-

How does the chase cardmember agreement affect my credit score?

The chase cardmember agreement impacts your credit score through responsible management of your credit card. Timely payments and maintaining a low credit utilization ratio are vital aspects covered in the agreement that can help improve your score. Understanding these components can empower you to maximize your credit potential.

Get more for Chase Credit Card Agreement

- Washington state real estate exam flashcardsquizlet form

- Partial release of easement and agreement form

- Deed restriction stormwater management statenjus form

- Dormant no more fracking boom causes states to revist form

- Application packet ampamp checklist for consolidation boundary form

- Azlawhelporghousinglandlord and tenant rights and form

- Pipeline right of way option agreement day of 20 form

- Pipeline right of way easement form

Find out other Chase Credit Card Agreement

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online