Gtbank Domiciliary Account Form

What is the Gtbank Domiciliary Account Form

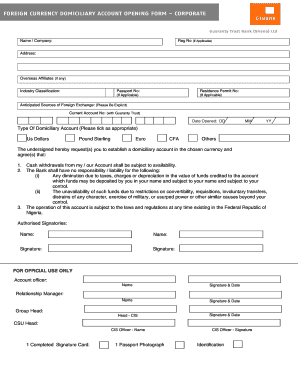

The Gtbank domiciliary account form is a crucial document required to open a domiciliary account with GTBank. This type of account allows customers to hold funds in foreign currencies, such as US dollars, British pounds, or euros. The form collects essential information about the account holder, including personal identification details, contact information, and the type of currency desired for the account. Understanding the purpose of this form is vital for anyone looking to manage foreign currency transactions effectively.

Steps to Complete the Gtbank Domiciliary Account Form

Completing the Gtbank domiciliary account form involves several key steps:

- Gather necessary personal documents, including a valid ID and proof of address.

- Fill out the form with accurate personal information, ensuring all fields are completed.

- Specify the currency you wish to hold in your domiciliary account.

- Review the form for any errors or omissions before submission.

- Submit the completed form along with required documentation to the bank.

Following these steps carefully ensures a smooth application process.

How to Obtain the Gtbank Domiciliary Account Form

The Gtbank domiciliary account form can be obtained through multiple channels. Customers can visit the official GTBank website to download the form in PDF format. Alternatively, individuals can visit a local GTBank branch to request a physical copy of the form. It is essential to ensure that the latest version of the form is used to avoid any processing delays.

Legal Use of the Gtbank Domiciliary Account Form

The legal use of the Gtbank domiciliary account form is governed by banking regulations and compliance standards. This form must be filled out accurately to ensure that the account holder meets the legal requirements for opening a domiciliary account. Compliance with anti-money laundering laws and customer identification regulations is critical. The information provided on the form may be subject to verification by the bank to ensure its authenticity.

Key Elements of the Gtbank Domiciliary Account Form

The Gtbank domiciliary account form includes several key elements that are essential for processing the account application:

- Personal identification information, including full name and date of birth.

- Contact details, such as phone number and email address.

- Residential address and proof of address documentation.

- Details regarding the type of account and currency preferences.

- Signature of the account holder, which is necessary for legal validation.

Each of these elements plays a vital role in the account opening process.

Required Documents

To successfully complete the Gtbank domiciliary account form, several documents are required. These typically include:

- A valid government-issued identification, such as a passport or driver's license.

- Proof of residence, which can be a utility bill or bank statement.

- Any additional documentation specified by the bank, which may vary based on individual circumstances.

Having these documents ready can expedite the account opening process.

Quick guide on how to complete gtbank domiciliary account form

Effortlessly prepare Gtbank Domiciliary Account Form on any device

Digital document handling has gained traction among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly and without delays. Manage Gtbank Domiciliary Account Form from any device utilizing the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to alter and eSign Gtbank Domiciliary Account Form without hassle

- Obtain Gtbank Domiciliary Account Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to record your changes.

- Select your preferred method of sharing your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Gtbank Domiciliary Account Form to maintain excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gtbank domiciliary account form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a gtb dom account?

A gtb dom account is a specialized account designed for businesses that need to manage and automate their document signing processes efficiently. With airSlate SignNow, your gtb dom account allows you to send, sign, and track documents seamlessly in a secure environment.

-

How much does a gtb dom account cost?

The pricing for a gtb dom account varies based on the features and the number of users. airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes, ensuring you get maximum value for your investment in document management and e-signature solutions.

-

What features does the gtb dom account offer?

A gtb dom account includes essential features like customizable templates, document tracking, and team collaboration tools. These features make it easy for businesses to automate their document workflows and enhance productivity while maintaining compliance.

-

How can a gtb dom account benefit my business?

By using a gtb dom account, your business can signNowly reduce the time spent on document management. This solution streamlines the signing process, reduces paperwork, and enhances operational efficiency, ultimately leading to cost savings.

-

Can I integrate my gtb dom account with other applications?

Absolutely! A gtb dom account is designed to integrate seamlessly with various applications, including CRM systems, project management tools, and cloud storage platforms. This integration enhances workflow efficiency and ensures that your document processes are well-connected.

-

Is it secure to use a gtb dom account for sending sensitive documents?

Yes, a gtb dom account provides top-notch security features, including encryption and secure storage, to protect your sensitive documents. airSlate SignNow prioritizes data security, ensuring that your information remains confidential throughout the signing process.

-

How do I get started with a gtb dom account?

Getting started with a gtb dom account is easy. Simply sign up on the airSlate SignNow website and choose the plan that best suits your business needs. Once set up, you can start sending and signing documents immediately.

Get more for Gtbank Domiciliary Account Form

- 07 form escrow instructions for escrow of employee stock

- Nvca documents table of contents name of document page form

- 122 subscription agreement form

- Form of employee stock option agreement secgov

- Section 1 s 4 form s 4 sampampp global sign in

- Section ddeo core contract myfloridacom form

- 082 form license agreement

- Start up ampampamp emerging companies planning financing and form

Find out other Gtbank Domiciliary Account Form

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe