Mortgage Servicing Transfer Letter Sample Form

Understanding the Mortgage Servicing Transfer Letter Sample

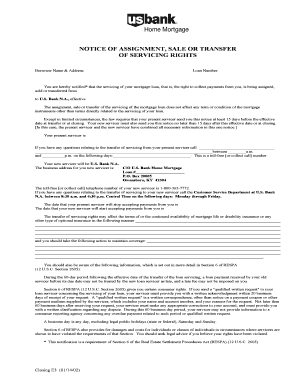

The mortgage servicing transfer letter is a formal document that notifies borrowers about the transfer of their loan servicing from one company to another. This letter serves as an important communication tool, ensuring that borrowers are aware of who will be managing their mortgage payments and customer service inquiries. It typically includes details such as the effective date of the transfer, the new servicer's contact information, and any changes in payment instructions. Understanding this letter is crucial for borrowers to ensure they continue to make timely payments and maintain their mortgage account in good standing.

Key Elements of the Mortgage Servicing Transfer Letter Sample

A well-structured mortgage servicing transfer letter includes several key elements to ensure clarity and compliance. These elements typically consist of:

- Sender Information: The name and address of the current servicer.

- Recipient Information: The name and address of the borrower.

- Transfer Date: The date when the servicing will officially transfer to the new servicer.

- New Servicer Details: The name, address, and contact information of the new servicer.

- Payment Instructions: Any changes in where and how payments should be made.

- Contact Information: A point of contact for any questions or concerns regarding the transfer.

Steps to Complete the Mortgage Servicing Transfer Letter Sample

Completing the mortgage servicing transfer letter involves several steps to ensure it is accurate and effective. Here’s a step-by-step guide:

- Gather Information: Collect all necessary details about the loan, current servicer, and new servicer.

- Draft the Letter: Use a clear and professional tone to draft the letter, incorporating all key elements.

- Review for Accuracy: Double-check all information for accuracy, including dates and contact details.

- Send the Letter: Deliver the letter to the borrower, ensuring it is sent via a reliable method to confirm receipt.

- Follow Up: After sending the letter, follow up with the borrower to address any questions or concerns.

Legal Use of the Mortgage Servicing Transfer Letter Sample

The mortgage servicing transfer letter is not only a courtesy but also a legal requirement under the Real Estate Settlement Procedures Act (RESPA). This law mandates that borrowers be informed of any changes in their loan servicing. The letter must be sent within a specified timeframe to ensure compliance. Failure to provide this notice can result in penalties for the servicer. Therefore, it is essential that the letter is prepared and sent correctly to protect both the borrower’s rights and the servicer’s legal obligations.

Examples of Using the Mortgage Servicing Transfer Letter Sample

Examples of the mortgage servicing transfer letter can vary based on the specific circumstances of the transfer. For instance, a letter might be used when a lender sells a mortgage portfolio to another company, or when a servicer changes due to a merger or acquisition. In each case, the letter should clearly communicate the necessary information to the borrower, maintaining transparency and trust. Providing a sample letter can help servicers ensure they include all required elements and maintain compliance with regulations.

Quick guide on how to complete mortgage servicing transfer letter sample

Complete Mortgage Servicing Transfer Letter Sample seamlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly and without holdups. Manage Mortgage Servicing Transfer Letter Sample on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

The simplest way to edit and eSign Mortgage Servicing Transfer Letter Sample with ease

- Find Mortgage Servicing Transfer Letter Sample and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize important sections of the documents or hide sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal significance as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, endless form searches, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Mortgage Servicing Transfer Letter Sample and ensure outstanding communication at any stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mortgage servicing transfer letter sample

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a notice of servicing transfer letter?

A notice of servicing transfer letter is an official document that informs a borrower about the transfer of their loan servicing to a different company. This letter typically outlines important details, including the new servicer's contact information and any changes in servicing terms. Understanding this letter is crucial for borrowers to ensure they receive correct payment instructions and service.

-

How can airSlate SignNow help with the notice of servicing transfer letter?

airSlate SignNow allows businesses to easily create, send, and eSign a notice of servicing transfer letter quickly. With its user-friendly interface, you can streamline your document workflows without the hassle of printing or mailing. This ensures your clients receive their letters promptly and securely.

-

Is there a cost associated with creating a notice of servicing transfer letter using airSlate SignNow?

Yes, there is a pricing structure associated with airSlate SignNow, which is designed to be cost-effective for businesses. The pricing varies depending on the features and number of users you need. Investing in airSlate SignNow can save your business time and resources when handling important documents like the notice of servicing transfer letter.

-

What features does airSlate SignNow offer for managing documents like the notice of servicing transfer letter?

airSlate SignNow offers features such as customizable templates, eSignature capabilities, and secure document storage to manage notices of servicing transfer letters efficiently. Additionally, it provides tracking options that allow you to see when your documents are viewed and signed, giving you peace of mind throughout the process.

-

Can I integrate airSlate SignNow with other applications for my notice of servicing transfer letter workflows?

Absolutely, airSlate SignNow integrates seamlessly with various applications that enhance your workflow for generating notice of servicing transfer letters. Whether you need to sync with CRM systems or other productivity tools, these integrations help streamline communication and document management efforts signNowly.

-

What are the benefits of using airSlate SignNow for sending a notice of servicing transfer letter?

Using airSlate SignNow to send a notice of servicing transfer letter ensures faster delivery, reduced administrative burden, and improved client satisfaction. Its eSigning feature allows recipients to sign documents from anywhere, fostering quick agreements. Plus, the document's security measures protect sensitive information during the transfer.

-

Is airSlate SignNow compliant with regulations for sending a notice of servicing transfer letter?

Yes, airSlate SignNow is built to comply with industry regulations, ensuring any notice of servicing transfer letter sent through the platform meets legal standards. The solution incorporates security features, such as strong encryption and audit trails, to maintain compliance and safeguard client information.

Get more for Mortgage Servicing Transfer Letter Sample

- Affidavit for service of process on the secretary form

- 801 329 service of process or notice service virginia form

- To any authorized officer you are hereby commanded to summon the defendants form

- Va certificate of eligibility online form

- Warrant in detinue civil claim for specific personal property form

- 801 114 when property to be taken by officer virginia law form

- In re form

- Final rent and damages form

Find out other Mortgage Servicing Transfer Letter Sample

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy