1336 Transfer on Death Deed Stevens Ness Law Publishing Form

What is the 1336 Transfer On Death Deed Stevens Ness Law Publishing

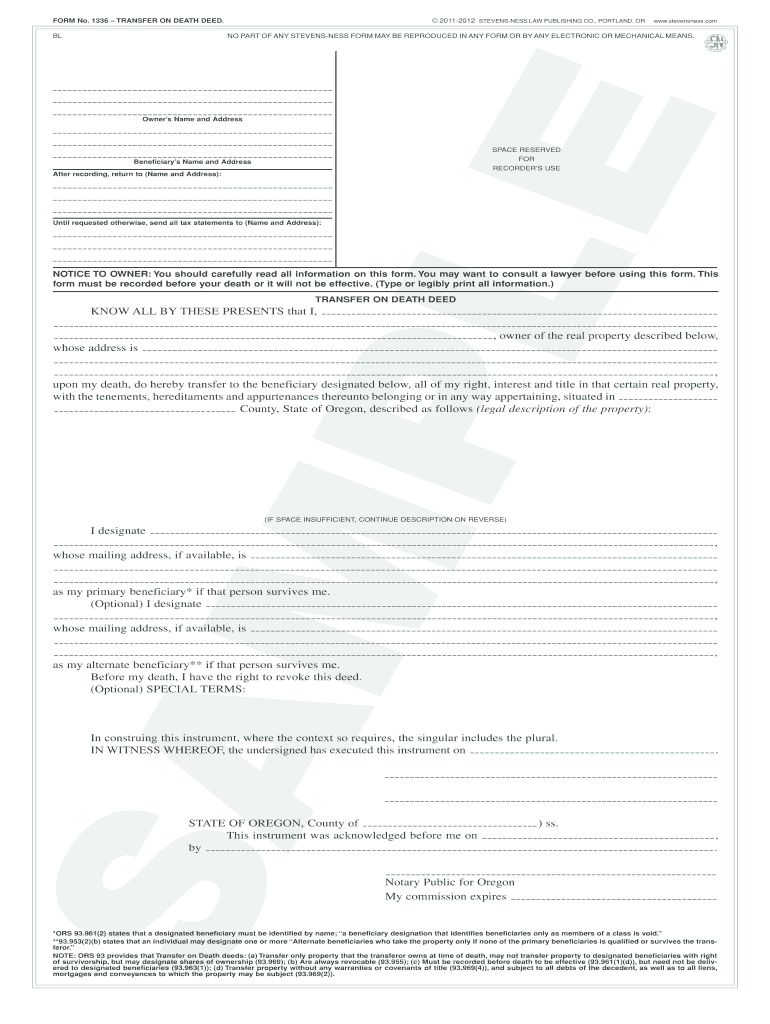

The 1336 Transfer On Death Deed is a legal document that allows property owners in the United States to designate beneficiaries who will inherit their real estate upon their death, bypassing the probate process. This deed is particularly valuable for individuals looking to simplify the transfer of their property to heirs without the complexities and delays associated with traditional wills. The form is published by Stevens Ness Law Publishing, ensuring it meets the necessary legal standards for use in various states.

How to use the 1336 Transfer On Death Deed Stevens Ness Law Publishing

To effectively use the 1336 Transfer On Death Deed, property owners must complete the form accurately, ensuring that all required information is provided. This includes the names of the property owners, the designated beneficiaries, and a legal description of the property. Once completed, the deed must be signed and notarized to be valid. It is essential to record the deed with the appropriate county office to ensure it is enforceable upon the owner's death.

Steps to complete the 1336 Transfer On Death Deed Stevens Ness Law Publishing

Completing the 1336 Transfer On Death Deed involves several key steps:

- Obtain the form from a reliable source, such as Stevens Ness Law Publishing.

- Fill in the property owner's details, including name and address.

- Identify the beneficiaries by providing their full names and relationship to the owner.

- Include a precise legal description of the property, which can typically be found on the property deed.

- Sign the document in the presence of a notary public.

- File the completed deed with the local county recorder's office to make it official.

Key elements of the 1336 Transfer On Death Deed Stevens Ness Law Publishing

Several key elements are crucial to the effectiveness of the 1336 Transfer On Death Deed:

- Property Description: A clear and accurate legal description of the property is essential.

- Beneficiary Designation: The form must specify who will inherit the property, which can include multiple beneficiaries.

- Signature and Notarization: The deed must be signed by the property owner and notarized to be legally binding.

- Recording: The deed should be recorded with the appropriate county office to ensure its validity.

Legal use of the 1336 Transfer On Death Deed Stevens Ness Law Publishing

The 1336 Transfer On Death Deed is legally recognized in many states, allowing property owners to transfer real estate outside of probate. However, its legality can vary based on state laws, and it is essential to ensure compliance with local regulations. By utilizing this deed, property owners can streamline the inheritance process for their beneficiaries, reducing the financial burden and emotional stress associated with probate proceedings.

State-specific rules for the 1336 Transfer On Death Deed Stevens Ness Law Publishing

Each state may have specific rules and regulations governing the use of the 1336 Transfer On Death Deed. It is important for property owners to familiarize themselves with their state's requirements, such as the need for witnesses or additional documentation. Some states may also have restrictions on the types of properties that can be transferred using this deed, making it crucial to consult local laws or seek legal advice to ensure compliance.

Quick guide on how to complete 1336 transfer on death deed stevens ness law publishing

Complete 1336 Transfer On Death Deed Stevens Ness Law Publishing effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, alter, and electronically sign your documents swiftly and without complications. Handle 1336 Transfer On Death Deed Stevens Ness Law Publishing on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign 1336 Transfer On Death Deed Stevens Ness Law Publishing seamlessly

- Locate 1336 Transfer On Death Deed Stevens Ness Law Publishing and click Get Form to initiate the process.

- Utilize the tools we offer to finalize your document.

- Emphasize key sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes just moments and carries the same legal significance as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Alter and eSign 1336 Transfer On Death Deed Stevens Ness Law Publishing and ensure excellent communication at any point during the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1336 transfer on death deed stevens ness law publishing

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1336 Transfer On Death Deed from Stevens Ness Law Publishing?

The 1336 Transfer On Death Deed from Stevens Ness Law Publishing allows property owners to transfer their real estate assets to beneficiaries upon their death without going through probate. This legal document simplifies the inheritance process and ensures a smooth transition of ownership.

-

How does airSlate SignNow support the use of the 1336 Transfer On Death Deed from Stevens Ness Law Publishing?

airSlate SignNow provides an easy-to-use platform that allows users to eSign and send the 1336 Transfer On Death Deed securely. With simple document management features, users can prepare and manage their estate planning documents efficiently, ensuring that everything is in order.

-

What are the benefits of using a Transfer On Death Deed?

Using the 1336 Transfer On Death Deed from Stevens Ness Law Publishing can save time and money by avoiding probate, which can be a lengthy process. Additionally, this deed allows the property owner to maintain control over their property during their lifetime, providing peace of mind for both the owner and their beneficiaries.

-

Is the 1336 Transfer On Death Deed valid in all states?

While the 1336 Transfer On Death Deed from Stevens Ness Law Publishing is recognized in many states, it’s essential to check state-specific rules regarding its validity. Some states may have different requirements or limitations, so consulting a legal professional is recommended.

-

What features does airSlate SignNow offer for eSigning the 1336 Transfer On Death Deed?

airSlate SignNow offers a user-friendly interface for eSigning documents, including the 1336 Transfer On Death Deed from Stevens Ness Law Publishing. Features include secure signatures, multi-party signing capabilities, and mobile access, making it convenient to handle essential documents on the go.

-

How much does it cost to use airSlate SignNow for the 1336 Transfer On Death Deed?

Pricing for airSlate SignNow varies based on the subscription plan and features you choose. However, it provides a cost-effective solution for managing documents, including the 1336 Transfer On Death Deed from Stevens Ness Law Publishing, allowing you to save time and resources.

-

Can I integrate airSlate SignNow with other applications to manage the 1336 Transfer On Death Deed?

Yes, airSlate SignNow offers various integrations with popular applications to streamline your document management process. This means you can easily use the 1336 Transfer On Death Deed from Stevens Ness Law Publishing in conjunction with software you are already using, enhancing your productivity.

Get more for 1336 Transfer On Death Deed Stevens Ness Law Publishing

- Louisiana marriage 497309130 form

- Louisiana partition property form

- Unanimous consent directors of form

- Consent members form

- Unanimous consent shareholders form

- Unanimous consent agreement by the shareholders and directors of corporation louisiana form

- Louisiana donation form 497309136

- Donation and declaration louisiana form

Find out other 1336 Transfer On Death Deed Stevens Ness Law Publishing

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation

- Can I Sign Pennsylvania Resignation Letter

- How To Sign Rhode Island Resignation Letter