Dr 0172 Form

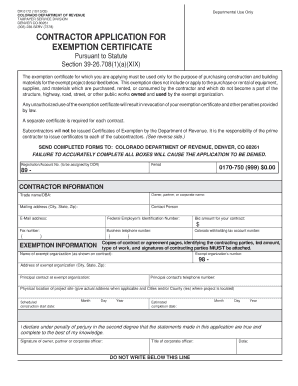

What is the DR 0172?

The DR 0172 is a Colorado Department of Revenue form specifically designed for contractors applying for an exemption certificate. This form allows eligible businesses to claim tax-exempt status for certain purchases related to their contracting work. Understanding the purpose of the DR 0172 is essential for businesses seeking to minimize their tax liabilities while ensuring compliance with state regulations.

How to Use the DR 0172

Using the DR 0172 involves several steps to ensure proper completion and submission. First, businesses must gather the necessary information, including their tax identification number and details about the purchases for which they are claiming exemption. Once the form is filled out accurately, it can be submitted to the appropriate state agency. It is important to keep a copy of the submitted form for your records, as this may be required for future reference or audits.

Steps to Complete the DR 0172

Completing the DR 0172 requires attention to detail. Follow these steps:

- Obtain the latest version of the form from the Colorado Department of Revenue website.

- Fill in your business information, including name, address, and tax identification number.

- Provide details about the specific purchases you are claiming as tax-exempt.

- Review the form for accuracy and completeness.

- Sign and date the form to certify that the information provided is true and correct.

Legal Use of the DR 0172

The DR 0172 is legally binding when completed correctly and submitted according to state guidelines. It is crucial for businesses to understand that improper use of this form can lead to penalties or audits. To ensure legal compliance, businesses should familiarize themselves with the relevant state tax laws and regulations concerning tax-exempt purchases.

Eligibility Criteria

To qualify for the tax exemption using the DR 0172, businesses must meet specific eligibility criteria. Generally, this includes being a registered contractor in Colorado and using the purchased items directly in their contracting work. It is advisable to review the Colorado Department of Revenue guidelines to confirm eligibility before submitting the form.

Form Submission Methods

The DR 0172 can be submitted through various methods, including online, by mail, or in person. For online submissions, businesses may need to create an account on the Colorado Department of Revenue's website. If submitting by mail, ensure that the form is sent to the correct address provided on the form itself. In-person submissions can be made at designated state offices, which may offer assistance with the process.

Quick guide on how to complete dr 0172

Complete Dr 0172 effortlessly on any gadget

Online document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can find the right template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Dr 0172 on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to alter and electronically sign Dr 0172 with ease

- Find Dr 0172 and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight essential sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your needs in document management in just a few clicks from any device of your choice. Modify and electronically sign Dr 0172 and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 0172

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is dr 0172 in relation to airSlate SignNow?

The term dr 0172 refers to an important feature within airSlate SignNow designed to enhance document signing security and efficiency. This feature streamlines the signing process, making it easier for businesses to manage their documents without compromising on security. Understanding dr 0172 will help you maximize your use of airSlate SignNow and improve your workflow.

-

How does airSlate SignNow pricing structure work for the dr 0172 feature?

airSlate SignNow offers a competitive pricing structure that includes access to the dr 0172 feature as part of its standard packages. This pricing is designed to be cost-effective for businesses of all sizes, ensuring that you get excellent value for the comprehensive eSignature capabilities, including dr 0172. For precise pricing details, it's advisable to check the airSlate SignNow pricing page.

-

What are the key features of dr 0172 in airSlate SignNow?

The dr 0172 feature in airSlate SignNow includes advanced security protocols and user-friendly interfaces. It enables seamless eSigning with tracking options, ensuring that your documents are both secure and easy to manage. By implementing dr 0172, users can benefit from enhanced visibility and control over their document workflows.

-

What benefits does dr 0172 offer for businesses using airSlate SignNow?

By using the dr 0172 feature, businesses can signNowly reduce the time spent on document processing and improve their overall efficiency. It allows for fast, legally binding eSignatures which streamline transactions. Consequently, adopting dr 0172 can lead to improved customer satisfaction and increased productivity.

-

Can dr 0172 integrate with other tools or software in airSlate SignNow?

Yes, dr 0172 is designed to seamlessly integrate with various tools and software you may already be using in conjunction with airSlate SignNow. This allows for a more flexible and efficient workflow, enabling users to connect their preferred applications with ease. You can leverage the power of dr 0172 to enhance your existing business processes.

-

Is dr 0172 suitable for all industries using airSlate SignNow?

Absolutely, the dr 0172 feature is versatile and caters to a wide range of industries, making it an ideal solution for any business looking to enhance its document management. Whether you're in finance, healthcare, or real estate, dr 0172 can help streamline your eSigning processes. It fits easily into various industry-specific needs.

-

How secure is the dr 0172 feature in airSlate SignNow?

Security is a top priority for airSlate SignNow, and the dr 0172 feature includes robust encryption and authentication measures to safeguard your documents. These protocols ensure that all signed documents remain confidential and tamper-proof. Consequently, businesses can trust dr 0172 to protect sensitive information throughout the signing process.

Get more for Dr 0172

- Fomatting of resume on brassring form

- Field trip t shirt order form

- Nevada ohv phone number form

- Ez paid enrollment form sign up for plymouth rock ez paid

- Injury screening form u s army me ngb army

- Residential pool inspection report template form

- Advantek benefit administrators claims address form

- Proof of expenditure form

Find out other Dr 0172

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template