Vat103 Form

What is the VAT 103?

The VAT 103 is a specific form used primarily for tax purposes in the United States. It is essential for businesses and individuals who need to report value-added tax (VAT) transactions. This form serves as a declaration of VAT collected and paid, ensuring compliance with federal and state tax regulations. Understanding the VAT 103 is crucial for maintaining accurate financial records and meeting legal obligations.

How to Obtain the VAT 103

Obtaining the VAT 103 form is a straightforward process. Individuals and businesses can typically download the form from the official state tax authority website or request it directly from their local tax office. It is important to ensure that you are using the most current version of the form to avoid any compliance issues. Additionally, some tax software may include the VAT 103, making it easier to complete and submit electronically.

Steps to Complete the VAT 103

Completing the VAT 103 involves several key steps:

- Gather necessary documentation, including records of all VAT transactions.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate tax authority by the specified deadline.

Following these steps carefully will help ensure that your VAT 103 is processed smoothly.

Legal Use of the VAT 103

The VAT 103 form must be used in accordance with federal and state tax laws. It is considered a legal document, and any inaccuracies or omissions can lead to penalties or audits. To ensure legal compliance, it is advisable to consult with a tax professional or accountant when completing the form. This will help clarify any specific requirements that may apply to your situation.

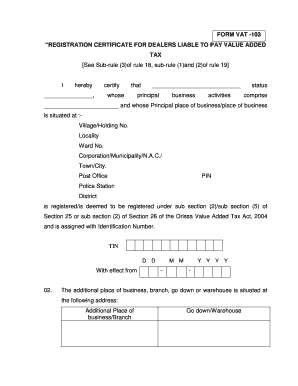

Key Elements of the VAT 103

Several key elements must be included when filling out the VAT 103:

- Taxpayer identification information, including name and address.

- Details of VAT collected and paid during the reporting period.

- Any applicable deductions or credits that may reduce the overall VAT liability.

- Signature and date to certify the accuracy of the information provided.

Ensuring these elements are accurately reported is vital for compliance and to avoid potential issues with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the VAT 103 may vary depending on state regulations. Typically, these forms must be submitted quarterly or annually, depending on the volume of VAT transactions. It is essential to stay informed about specific deadlines to avoid late fees or penalties. Regularly checking with your state tax authority can provide updates on any changes to filing requirements or deadlines.

Penalties for Non-Compliance

Failure to properly complete and submit the VAT 103 can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. Non-compliance can also lead to increased scrutiny from tax authorities, resulting in audits or additional requirements. It is crucial to prioritize accurate and timely submissions to mitigate these risks.

Quick guide on how to complete vat103

Complete Vat103 effortlessly on any device

The management of online documents has gained increasing popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can access the necessary form and securely archive it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents promptly without delays. Handle Vat103 on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The most efficient way to modify and eSign Vat103 with ease

- Locate Vat103 and click Get Form to begin.

- Utilize the tools at your disposal to complete your document.

- Emphasize key sections of your documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choosing. Modify and eSign Vat103 and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat103

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is VAT 103 and how does it relate to airSlate SignNow?

VAT 103 is a value-added tax form that businesses may need to deal with for reporting and compliance purposes. airSlate SignNow can simplify the process of signing and sending VAT 103 documents electronically, ensuring that all your tax obligations are met efficiently.

-

How does airSlate SignNow help with VAT 103 compliance?

airSlate SignNow offers features that streamline document management, including templates and secure electronic signatures. By using airSlate SignNow, it's easier to ensure that your VAT 103 forms are completed correctly and sent on time.

-

Is there a cost associated with using airSlate SignNow for VAT 103 forms?

Yes, airSlate SignNow offers competitive pricing plans that are designed to meet the needs of businesses handling VAT 103 documents. The pricing is based on features and functionality, making it a cost-effective solution for managing your electronic signatures and document workflows.

-

What are the key features of airSlate SignNow for handling VAT 103 documents?

Key features include customizable templates for easy document creation, multi-party signing, and real-time tracking of your VAT 103 forms. These features enhance the efficiency and accuracy of your document workflows, making VAT compliance a breeze.

-

Are there integrations available for airSlate SignNow to support VAT 103 processes?

Yes, airSlate SignNow integrates with various business applications such as CRM systems and cloud storage solutions. This enables seamless data transfer and management of your VAT 103 documents, allowing for an efficient workflow.

-

Can I store my VAT 103 forms securely using airSlate SignNow?

Absolutely! airSlate SignNow provides secure cloud storage for all your documents, including VAT 103 forms, ensuring that they are protected and easily accessible. You can maintain compliance while keeping your information safe.

-

How does airSlate SignNow improve the efficiency of processing VAT 103 forms?

By using airSlate SignNow, you can automate the signing process, reduce paper use, and eliminate the need for physical storage. This signNowly boosts efficiency when processing VAT 103 forms and reduces the chances of errors.

Get more for Vat103

- Revocation of statutory living will louisiana form

- Power of attorney forms package louisiana

- Anatomical gift form 497309344

- Employment hiring process package louisiana form

- Louisiana anatomical form

- Employment or job termination package louisiana form

- Newly widowed individuals package louisiana form

- Employment interview package louisiana form

Find out other Vat103

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple